Our best tips to deal with difficult customers who are trying to rip you off

JECCA Blake just wanted to be paid for her work. With Public Defender’s help that’s been achieved. But what can a small business do if they are owed money? And how is the problem avoided?

Public Defender

Don't miss out on the headlines from Public Defender. Followed categories will be added to My News.

THIS column’s bread and butter is helping consumers get what is rightfully theirs.

But what about small businesses? Thirty to 40 per cent say they haven’t been paid by at least one customer in the past year, according to the no. 1 credit information and debt management firm D & B.

So what can small businesses do if they are owed money? And how can the problem be avoided in the first place?

RING, RING

It’s best to begin by getting on the phone. This should be a friendly reminder. You want to maintain a positive relationship, if possible. It’s not the time for strongarm tactics.

INVOLVE A MEDIATOR

If a dispute arises, this may be the answer. State government-backed Community Justice Centres across NSW arranged more than 1500 free mediations in 2013-14. Seventy-nine per cent settled.

LETTER OF DEMAND

Instead of mediation, you could get mean by putting your demands in writing, setting out the amount owed, date it was due and what it was for, plus providing relevant evidence such as contracts, invoices or emails that show an agreement.

You should give seven to 14 days to pay. Send the letter registered post in case you later need to show a court that you made a written request for payment.

Such a letter could also be written for you by a lawyer. This may have more clout.

CLICK HERE FOR THE SMALL BUSINESS LETTER OF DEMAND

COURT ACTION

The template letter foreshadows court action.

For amounts under $10,000 you can go to the Local Court’s Small Claims Division. You don’t have to be represented by a lawyer.

You will need to complete a statement of claim form, file it with the court and serve it on the debtor. The fee to start a case is $93. The NSW Sheriff charges $62 to serve a document. However, you can seek to reclaim these outlays in your action.

If you use a lawyer, you can also seek to recoup up to $767 of this cost.

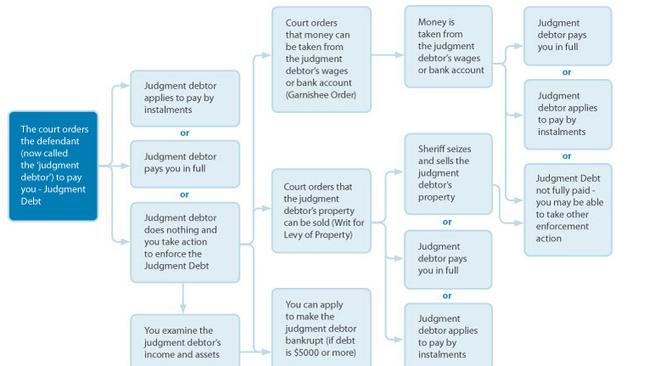

If your legal action succeeds you may still need to enforce the judgment to get paid. This involves more paperwork and getting the sheriff to seize property or money from the debtor.

USE A DEBT COLLECTOR

This is an alternative to the letter of demand/court action path. There can be a listing fee and a commission rate of 5 to 30 per cent, depending on the value of the debt.

There are online recovery services which can be quicker and cheaper. The cost of using a debt collector service can only be recovered if it was specified in the terms and conditions of your agreement with the customer.

A PROBLEM AVOIDED

There are simple ways to reduce the likelihood of not getting paid.

The first is to put contracts in writing. Be tight on your credit control and give clear payment conditions.

Specify a late fee or offer a discount of, say, 5 per cent for paying within 30 days.

And send out your invoices as soon as a job is done, in the form your customer requires.

LEGAL ISSUE? BLOG LIVE WITH BRYDENS LAWYERS AT 1PM TODAY

JECCA BLAKE WILL ALWAYS GET BILLS SETTLED WRITE ON TIME

ALL Jecca Blake wanted was to be paid for her work.

Over three months the freelance writer did six articles for a publication in the Southern Highlands, where she lives.

All the pieces were published. But she wasn’t paid the $1500 she was owed. The agreement wasn’t written down, making it harder to enforce.

“There wasn’t a formal contract,” Ms Blake said. “It was all just agreed over the phone.”

When she rang about the non-payment, the publisher made excuses and avoided her.

Before involving Public Defender, Ms Blake considered taking legal action or using a debt collector — and kneecapping she jokingly added.

Yesterday I was able to get the publication to pay. “I can’t thank you enough,” Ms Blake said. “This money will be very handy.”

Ms Blake’s experience underscores the importance of having written agreements and limiting the credit to new customers. She should have been paid for the first month’s work before the second was provided.