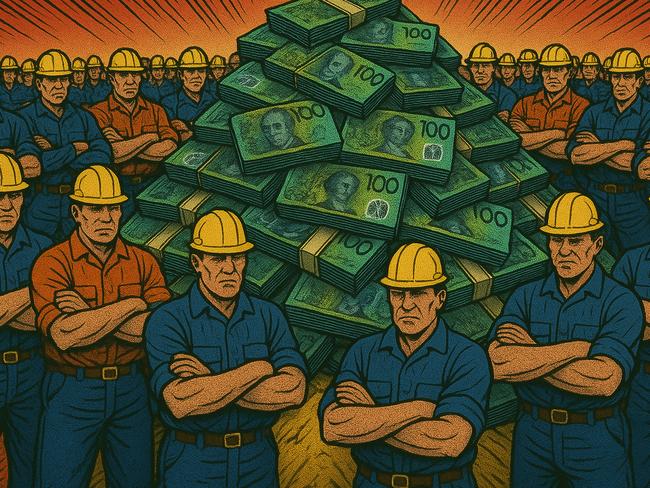

Minns takes on unions in huge compo cash battle

Treasurer Daniel Mookhey’s crackdown on questionable and costly workers’ comp mental health claims has sparked a full-frontal assault, which NSW Premier Chris Minns will bear the brunt of, writes James O’Doherty.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

Premier Chris Minns is bracing for his most bruising battle yet with the government’s real opposition: The union movement.

Treasurer Daniel Mookhey’s bid to crack down on questionable and costly workers’ comp mental health claims has already sparked a full frontal assault from UnionsNSW, and the fight has only just begun.

What the Minns government is trying to stop are scams that would be familiar in almost any workplace.

In one example, a tech specialist who lodged a compo claim after feeling “micromanaged” and “targeted” has not worked since September 2021. That claim, I’m told, has cost the state insurer $922,000.

In another case, a worker presented a “workplace stress” diagnosis on the same day they learned about being investigated over bullying allegations. The compo claim was accepted, costing more than $200,000 so far.

Proposed reforms would make it harder for these claims to be made. They would cut off psychological injury payments two and a half years earlier unless an injured worker can prove they will be significantly impaired for life, and enshrine “reasonable management practices” to protect bosses from blowback when performance managing staff.

Mookhey has the business lobby on board: 90 per cent of BusinessNSW members called for “urgent reform” in a recent survey.

Half the lobby group’s members said that once a person goes on compo for a psychological injury, they never return.

But UnionsNSW Mark Morey says Minns risks letting down the very people he was elected to help.

“You’ve got shop assistants who are being abused constantly and attacked in their shops,” he says.

Morey, the state’s opposition leader in all but name, cites health workers who are “continually seeing people dying,” or young female teachers early in their career being “surrounded” by high school boys spouting “Andrew Tate rubbish”.

He argues these workers will lose deserved compensation.

UnionsNSW’s $400,000 advertising blitz, launched across TV, radio and online platforms this week, is part of the biggest policy fight between the Labor government and the labour movement since Minns was elected.

What both sides do agree on is that the current system is broken. The nominal insurer continues to run at a loss, holding only 82 cents for every dollar that it expects to pay out.

This means almost 20 per cent of compensation liabilities are unfunded. Businesses are facing massive hikes in the premiums they pay, just to ensure there is enough cash to cover insurance claims that keep piling up.

The Treasury Managed Fund, which covers 400,000 public sector workers, is losing capital hand over fist. Since 2018, it has needed $6.1 billion in top-up payments.

Without reform, Mookhey warns, this debacle will make the budget’s bottom line $2.6 billion worse. “You can have the best workers compensation scheme in the world on paper (but) if it has no money – it helps no one,” Mookhey says.

Morey agrees that the current system is “unsustainable,” “broken,” and “not returning people to work”.

He also concedes that people are “ripping off the system,” and agrees that “reasonable management” practices should be defined to stop businesses being left in the lurch.

At one family-owned manufacturing business, for example, premiums have increased by 149 per cent over three years after employees lodged psychological injury claims.

One employee sought damages the day after being put on a performance management plan for, the business says, “repeated unacceptable behaviour”.

The boss claims the employee was liable for the sack, but said his business could not defend itself from the worker’s allegations. The worker was paid more than 30 months’ wages, getting a payout of more than $500,000.

“We are completely powerless and at the whims of the system, and the system believes everything the employee says,” the boss says.

At another business, a 29-year-old was employed for a marketing role for about four months before being made redundant. “The day after the redundancy occurred, she put in for a psychological bullying and harassment claim,” says a source familiar with the case.

The claim, in turn, increased the business’s premium costs. “We just had to cop it sweet,” the source said.

At another company, a not-for-profit disability provider, premium costs have increased 400 per cent in the past four years due to claims being made against them.

In parliament, the government expects opposition from both the Coalition and the Greens.

And the UnionsNSW campaign is only ramping up.

It is almost enough for the Treasurer to lodge a workplace stress claim of his own.