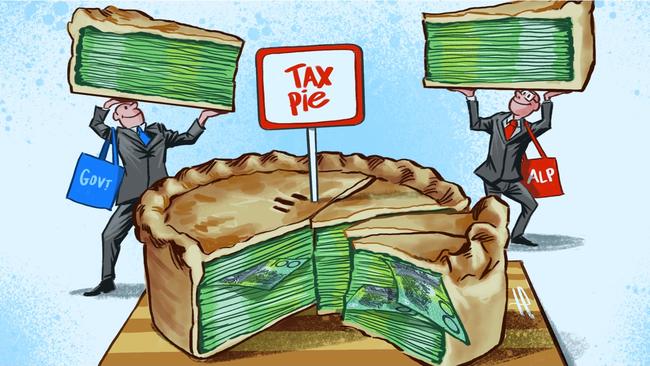

Labor’s plan to target the ‘top end of town’ is a risky business

Bill Shorten’s Budget reply speech was red meat for Labor voters — but his top-end-of-town rhetoric could backfire if he turns off aspirational middle-income voters.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

Bill Shorten needed to sound prime ministerial as he delivered the most important Budget reply speech of his life last night.

With a methodical beating of the drum he turned to the classic Labor playbook — a Shorten government would lead the way on tax cuts for low-income earners, better healthcare and education.

It was heartland stuff that would stir the base in a week where he has gone to war with the government over low-earning workers.

But there’s a risk here.

Listening to Labor’s rhetoric this week, you’d believe Australia was riven with class warfare, deeply and irrevocably divided between the haves and the have nots.

While Shorten is working hard to paint his vision for the future, his focus on cutting taxes for our lowest earners while hiking taxes on investors, self-funded retirees and high-income earners risks something very dangerous: a war on aspiration.

It was Tanya Plibersek who yesterday uttered the classic Labor line — one that was tried and failed in the hands of Michael Daley and co in the state election — that “this is a government focused on the top end of town”.

Labor believes that going into bat for the little man wins it votes and that’s precisely why Shorten is on this crusade to cut the taxes of our lowest paid.

Despite making no major overhaul to his tax offering, which Labor rightly says is more generous at the lower end than the government’s, Shorten is casting himself as the everyman’s tax cut champion.

But hold on. Just how believable is this when the government has just announced billions of dollars in tax cuts which are largely targeted at people earning between $48,000 and $90,000?

Labor tried to undercut this last night, declaring that $48,000 would get bigger tax cuts with Shorten at the helm. It was, on any read, a predictable evocation of class warfare. But it’s hard to see how many votes Shorten will win with this approach.

Most of the people in this low-income bracket are voting for Shorten anyway. ABS statistics show the top three electorates in NSW where people earning under $40,000 live are all Labor-held.

Nonetheless, Shorten will be hoping his promise can convince those electorates that sit closer to the middle of the pack — places like Lindsay that he needs to hold and seats like Banks and Reid he’d like to win.

While cost of living is a real voter issue, the fact is that most people earning less than $40,000 are net beneficiaries of Australia’s tax system, rather than contributors to it.

ABS data from 2016 found that households with the primary income earner in the 19 per cent tax bracket received more in government benefits than they pay in taxes.

These households received $8 of government income support for every $1 they paid in income tax. They got $11 of other government assistance for every dollar in income tax — a total of $19 in government benefits for every dollar paid in income tax.

In the same analysis, people earning between $37,001 and $80,000 got on average $2 in government benefits for every dollar paid. Those in the $80,001 to $180,000 tax bracket got on average $1, although this would taper out at the top of the bracket.

This is the underlying flaw in Shorten’s class war.

But don’t expect to hear Scott Morrison shout it from the rooftops because he wants these low-income earners to vote for him just as badly as Labor does.

And that’s precisely why the government backflipped late on Tuesday night to allow dole recipients to receive the brand new energy assistance payments.

This is an election where neither side can afford to alienate a demographic. And that’s why Shorten’s push for poor workers at the expense of what he calls the “top end of town” is so risky.

Make no mistake, Shorten’s greatest hurdle will be gaining trust on the economy. Voters believe intuitively that Labor governments tax more heavily and are less likely to deliver budget surpluses.

The government knows this and believes that when the conversation is about the economy it can win. Liberal MPs have already been happily tallying up just how many people in their electorates will get Treasurer Josh Frydenberg’s tax cuts as they prepare to hit the hustings doorknocking this weekend.

They want economic record to be this election’s key battleground.

The Liberal campaign machine launched a campaign website called “Labor’s Tax Bill”, warning that “when Labor runs out of money they come after yours”.

The site lists taxes on retirees, housing, incomes, investments, family business, electricity and more under a Labor government.

Shorten’s focus on low-income earners won’t help him slap this attack away.

The site, which is a vehicle for Liberal donations, warns that “Bill Shorten poses the greatest risk to Australia’s economy in a generation” and declares the party would slug Australians more than $200 billion over a decade.

Mr Frydenberg gave us a clue as to the kind of lines we’ll hear from the government ad nauseam this election, as they reinforce their narrative that Labor cannot be trusted not to tax Australians into oblivion.

“Every time Bill Shorten opens his wallet you need to check yours because he’s coming after your money,” Frydenberg said, as if he was starring in a slickly produced TV commercial.

“Every time he makes a promise ask yourselves what taxes he will levy to pay for it.”

The government will stoke this fear that Shorten will tax you to the hilt every day until you go to the polls.

Shorten tried last night to paint his own vision — better health care, education and a better way of life for our poorest workers.

As Morrison prepares to visit the Governor-General, the contest of ideas is only just beginning.