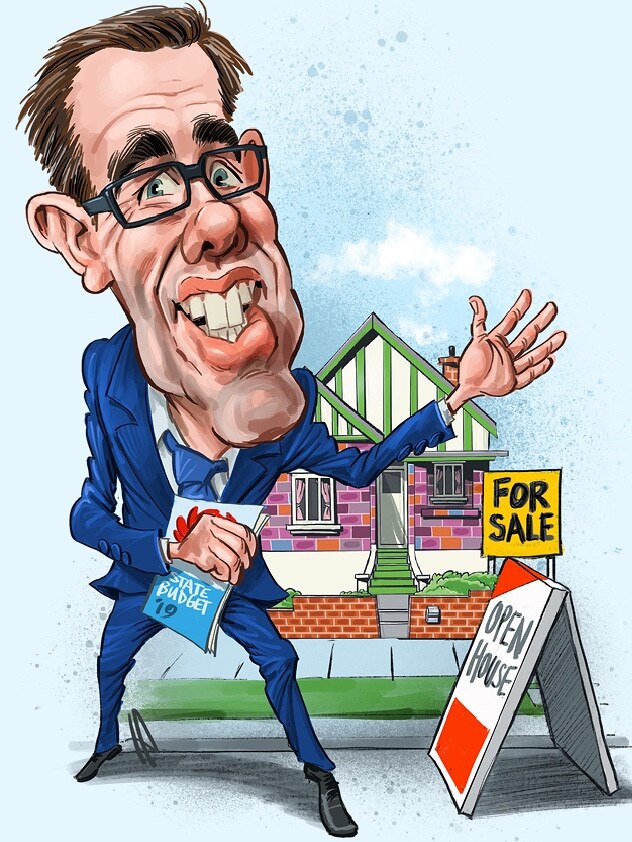

Jonathan Chancellor: State’s budget hinges on property prices bouncing back

NSW Treasurer Dominic Perrottet’s third budget’s likely success — at being both big spending and still in surplus — would be even more assuring if there was also a house price recovery, writes Jonathan Chancellor.

Like many of his optimistic predecessors, the NSW Treasurer, Dominic Perrottet would be helped by a Sydney housing recovery.

Or at the very least more sales activity by nervous property owners who’ve understandably pulled back from the weakened market.

His third budget’s likely success — at being both big spending and still in surplus — would be even more assuring if there was also a house price recovery.

The budget comes against the revised backdrop of already seeing $10 billion in stamp duty revenue foregone given we’ve slowed down our desire to sell and buy.

The housing downturn and hibernation in the city, and drought in the bush, have conspired to create a potentially nasty fork in the road for the softening NSW economy.

But Perrottet pushes ahead with the now-largest infrastructure construction spend in our state’s history.

Close to $100 billion on roads, rail, schools, stadiums, hospitals and museums. It was the defining centrepiece of the state budget.

He’s also proud of the one million children who’ve participated in the $100 Active Kids and Creative Kids voucher program announced in his second budget last June.

There are the rooftop solar energy and battery storage subsidies announced in the election campaign; along with the capped cost of weekly Opal card usage; teeth checks for primary school children; and the seniors’ regional travel incentive.

The state’s record low unemployment will remain steady, the budget papers advised, although he’s set to trim the 330,000-strong NSW public service with around 3000 backroom jobs to go.

But he’s also overseeing the appointment of more frontline nurses, teachers and police, in his desire to deliver “a new golden century for NSW”.

He even signalled on Tuesday he wants sweeping changes to Australia’s federation system of government saying our three tier financial relations are a mess.

Ambitious for a politician only in the parliament since 2011 in Barry O’Farrell’s victory, and into the ministry in 2014 under Premier Mike Baird. He headed into parliament to represent an aspirational heartland community which he said was defined by “the principles of honesty, hard work and generosity”.

“Great communities are built on these qualities — and great states as well,” he said in his maiden speech in 2011.

The embrace of these objectives saw him affirm his desire of a four-year term “of delivery” by the Berejiklian government after their narrow March re-election.

Adding vision, passion and determination to his mission statement, he encouragingly started his budget from the perspective that there be no new taxes.

“We have taken windfall revenues and lazy assets and are transforming them into bricks, mortar, concrete and steel,” he said.

Our man of steel had better hope national and global economies strengthen, along with coal mining royalties to assist his cause.

He’s personally sensed over recent weeks that confidence was coming back into the housing market — “it’s the coalition confidence” effect post-election, he suggests. His more sombre Treasury department boffins think this month’s RBA cut to the cash rate, and market expectations for a further cut, will provide support to the NSW economy, particularly in the consumer and housing sectors.

They pointedly noted Sydney house prices have “fallen dramatically” from their mid-2017 peak, down 14 per cent in the largest decline since the early 1980s.

The decline across NSW had also been “negatively shocked by 10 per cent,” while the rest of Australia experienced a fall of 7 per cent.

The department, of course, has seen plenty of prior housing downturns impact on budget revenues, and surmise lower interest rates will support “a stabilisation” in housing market conditions from late this year.

However, the current weakness in household consumption was not expected to abate until mid-next year, aided by those promised federal government income tax cuts and possibly stronger wages growth.

Dwelling price growth, however, is expected to be restrained, just keeping pace with inflation.

The budget papers acknowledged reduced investor and owner occupier sentiment, and barely mentioned the first home buyers who’ve partially filled the void.

The Treasury rightly inserted the risk scenario that house prices continue to decline into the budget papers.

“The weakness in housing finance commitments and rental price growth provide the strongest basis for this risk,” they advised, adding that affordability also remains an issue.

“Despite the recent fall, house prices are still around 60 per cent higher than in late-2011, leaving house price to income ratios still stretched, suggesting further downside risk.”

Payroll tax remains the largest source of state government taxation revenue, accounting for 30 per cent in 2019-20, followed by stamp duty on house and apartment sales that make up about 21 per cent of revenue.

Meanwhile, economic growth in NSW is forecast to decline to 2.25 per cent this financial year and will remain at well below the 3 per cent average for a some time still.

Perrottet can still, however, boast the state is “strongly in the black, back-to-back.”

Perrottet and his wife Helen, who reside in Beecroft, could always make personal contribution to assist the surplus, upgrading homes especially as they welcomed their fifth child in late 2017.