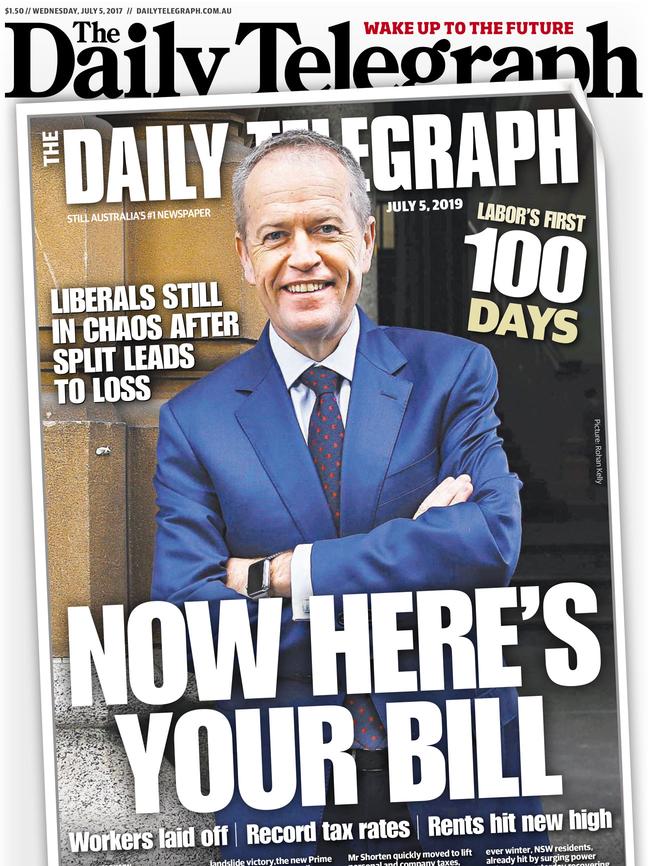

Welcome to Bill Shorten’s Australia: As divided Liberals set up Labor for a win, business warns economy at risk

WITH polls and perceptions saying Bill Shorten will be Prime Minister by 2019, we’ve examined a Labor government’s emerging agenda. Here’s what Australia would look like.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

BILL Shorten has begun outlining an aggressive agenda for reform in his first 100 days as prime minister, which will dramatically reshape the country, but has prompted warnings of significant ramifications for the economy.

The sharp focus on what Labor in power would look like comes as the ALP grows in poll dominance and key conservatives continue to gnaw at each other.

As The Daily Telegraph examined a Shorten government’s emerging agenda, top business leaders warned “populist” policies are a grave risk to jobs and would strip away workers’ reward for effort.

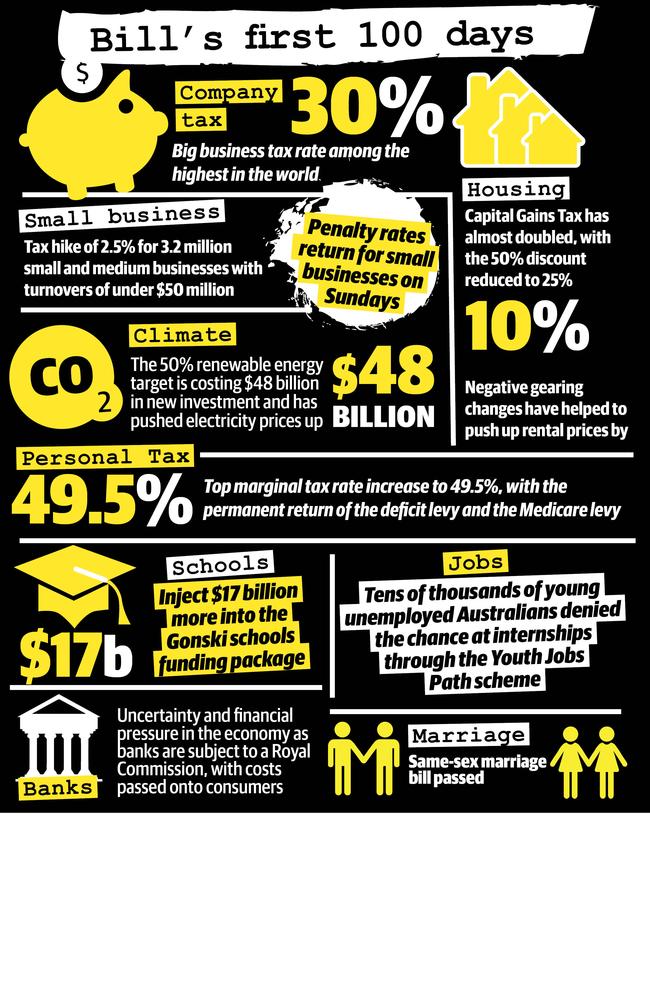

Mr Shorten has pledged in his first 100 days to overturn the Sunday penalty rate cut, hike the top marginal tax rate, scrap negative gearing and potentially withdraw the company tax cuts.

Business Council of Australia chief executive Jennifer Westacott said Australia cannot create jobs and compete globally if it is “hamstrung by backwards thinking and frankly populist policies”, warning against Labor’s moves to overturn the independent determination on penalty rates, and lift the income tax rate.

“The opposition talks a lot about progressive politics but in truth there is nothing progressive about returning to tax and industrial relations policies that belong in the 1950s,” she said.

“Higher taxes strip away people’s reward for effort, and remove the incentive for businesses to take the risk of investing in new jobs.”

EDITORIAL: Future shock for Australia under Labor

Mr Shorten has pledged to permanently increase the top marginal tax rate by 2 per cent, which takes it to 49.5 per cent.

This would give Australians among the highest marginal tax rate in the world.

The top marginal tax rate in New Zealand is 33 per cent, in the UK it’s 45 per cent and in the US it’s 45 per cent.

Australia’s company tax rate of 30 per cent for big business is also among the highest in the world. In the UK and Singapore, it is 17 per cent while in France and China it’s 25 per cent with the United States aiming to cut theirs to 15 per cent.

Labor has repeatedly failed to support Turnbull Government’s move to lower the company tax rate to 25 per cent — a reform already on track for small to medium sized businesses.

Australian Chamber of Commerce and Industry chief executive James Pearson said: “A country cannot tax its way to prosperity and Australia is already too reliant on personal income tax for government funding.

READ MORE

Editorial: The penalties of ‘playing politics’

“The problem is that uncertainty over the Labor’s position on the company tax cuts, that have already been passed into law by the parliament, can weaken business confidence and have a negative impact on decisions to invest and employ.

“Should Mr Shorten move to reverse this tax cut, 3.2 million small and medium businesses that employ 6.5 million Australians will be hit with a 2.5 per cent tax, affecting their ability to hire more staff and offer pay rises.

“Raising the company tax rate would also affect investment into Australia, push major headquarters overseas, dry up infrastructure spending and cause the unemployment rate to rise.”

Business leader Gerry Harvey said companies were, in greater frequency, moving their headquarters offshore, to operate more efficiently and for a quarter of the price.

“Company tax here is 30 per cent, we are uncompetitive in that respect. If you go to the personal tax rate, it’s only 33 per cent in New Zealand. When you start raising those taxes here, you’re encouraging businesses to go somewhere else,” he said.

“The Singaporean government has always talked to us about bringing your head office to Singapore, (saying) we’ll give you no tax the first two years, 5 per cent and then 10 per cent after that.”

On the property front, Labor will end negative gearing and halve the capital gains tax concessions from 50 per cent to 25 per cent.

This would drive up the cost of holding an investment property and result in rents rising. BIS Shrapnel modelling of Labor policy has shown rents would increase by 10 per cent per year, 4 per cent fewer new homes would be built and 70,000 families would be pushed into housing rental stress.

Labor’s 50 per cent renewable energy target is expected to lead to unreliability in the sector, while pushing up the price of household electricity bills along with the energy cost to big business.

In other social policy, tens of thousands of young unemployed Australians will be denied the chance at employment through the Youth Jobs PATH scheme, which Labor opposes.

Labor will also pour an additional $17 billion into the so-called Gonski 2.0 needs-based schools funding package, which is already funded to the tune of $23 billion.

Mr Shorten’s vow to overturn the Fair Work Commission’s penalty rate reduction “will definitely lead to higher unemployment,” Council of Small Business chief executive Peter Strong said. “Why is he targeting small business? We have Labor concentrating on punishing small businesses. The cafes, retail shops, that were thinking of opening on Sundays, aren’t going to.”

Treasurer Scott Morrison said Mr Shorten would be an “outright disaster” for the economy. “Australia would be saddled with some of the highest rates of business and personal tax in the world,” he said.

“Labor remains a danger to Australia’s economic growth story; a potential saboteur that would put us at risk of becoming a stagnant, backwards economy, and leave future generations lumped with ever-increasing debt.

“Labor reckless decision to abolish negative gearing will not only bring on a hard landing for Australia’s housing market, threatening jobs and economic growth, but will put even more stress on Australia’s renters as mum and dad investors, who provide around a quarter of the country’s rental stock, are forced to walk away.”

Ms Westacott also warned against politicians dismissing “evidence-based, considered advice of trusted institutions in favour of ‘one-off’ policy decisions based on little more than a whim and a poll.”