Water torture: Farmers fleeced by wealthy investors

Wealthy investors in water are revelling in returns three times better than the best super fund, but farmers say those gains are pricing them out of the market and destroying manufacturing jobs.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Wealthy investors in water are revelling in returns three times better than the best super fund, but farmers say those gains are pricing them out of the market and destroying manufacturing jobs.

The Daily Telegraph can reveal Australia’s largest water fund, run by Argyle Capital Partners, delivered an 11 per cent gain in 2019-20. And that was a lean year.

Since starting in 2012, the $300 million fund has averaged annual returns of 17.7 per cent for clients, who are all certified as “sophisticated investors”, meaning they earn at least $250,000 or have net assets of $2.5 million-plus.

Meanwhile rival manager Duxton Water, which has been accused of hoarding water, reaped a return of 7.7 per cent in 2019-20.

By comparison the top super fund made its members 3.8 per cent in the year to June 30 – half of what Duxton achieved and a third of Argyle’s gain.

Duxton recently told investors its growth was driven by the price increase of water entitlements it leases for thirsty permanent crops such as almonds.

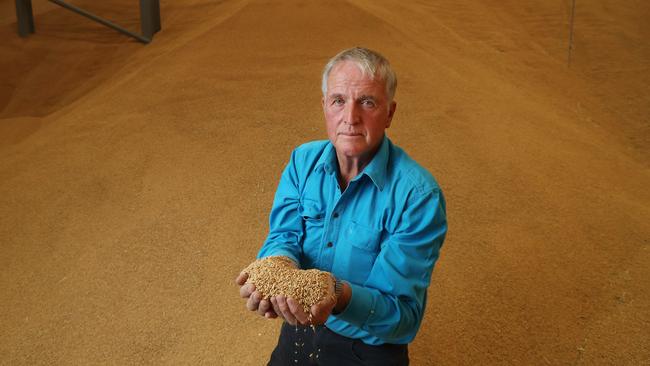

That rise in water prices has meant some rice farmers have been better off selling their allocation, said NSW farmer Laurie Arthur.

“They can grow a crop or do nothing and make the same money,” said Mr Arthur, who is also chairman of SunRice. “And when you sell they mightn’t even use the water.

“There is a lot of water being held in dams. It never gets used, even in our most extreme droughts. It just gets traded.

“That’s what absolutely amazes us.”

For the past two years rice production was five per cent of normal levels, Mr Arthur said, adding drought was a major factor, but the increasingly sophisticated water trade was another.

SunRice has been forced to lay off 230 workers, many of them at its Leeton and Deniliquin production plants.

“We are facing a situation where we are having to seriously look at our future in Australia,” Mr Arthur said, with more and more of its operations forced offshore to countries such as Vietnam, PNG and the US.

One of the biggest users of water in the Murray Darling Basin said the trade was “like the wild west”.

Rob McGavin, executive chairman of Cobram Estate olive oil maker Boundary Bend, which spent about $20 million buying water last financial year, said only irrigators and farmers should be able to buy “temporary water”. He said as things stood, speculators could outbid them in drought.

“It’s like buying all the food in a famine,” Mr McGavin said. “It’s that bad.”

He has accused Duxton of “hoarding” water during the recent Big Dry.

But Duxton’s water assets director Alister Walsh said the claim was “absolutely false.”

He said Duxton helped farmers manage water risk and only represented a tiny fraction of the trade. “Rob doesn’t have to buy from us,” Mr Walsh said. “He can buy from the rice farmer. He can buy from the cotton grower.”

Mr McGavin said he hoped an Australian Competition and Consumer Commission inquiry into water trading would highlight “the risks to our rural communities and effectively the food supply of allowing anyone to buy”.

He said the price of the temporary water allocations he needed had risen from $25/ML in 2017 to more than $900/ML in October last year, before dropping to $795/ML in early December. He said he believed the fall was triggered by the ACCC probe.

ACCC chairman Rod Sims said “it would not be the first time mention of an ACCC inquiry has seen prices fall,” although he wasn’t sure it was the reason.

There have also been allegations of insider trading directed at unspecified traders.

Argyle boss Kim Morison said he believed the ACCC wouldn’t find any “malfeasance”.

He dismissed Mr McGavin as a “whinger” who had sold his permanent water entitlement a decade ago and now regretted having done so.

Unlike Duxton, Argyle only buys permanent entitlements, whose price has risen by about 270 per cent since 2014, data shows.

Mr Morison acknowledged that the increase was a bad trend for producers of the least profitable outputs such as dairy and rice. “But we are only two per cent of the trade,” Mr Morison said. “Most of the trade is between farmers.”

The government is likely to make the ACCC’s interim report public within weeks.