NSW budget 2020: Perrottet reveals stamp duty changes

Stamp duty breaks for first-home buyers could be replaced by grants of up to $25,000 under what would be the biggest shake-up in property taxes in a generation.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Stamp duty breaks for first-home buyers could be replaced by grants of up to $25,000 under what would be the biggest shake-up in property taxes in a generation.

NSW Treasurer Dominic Perrottet has used the State Budget to outline reforms he claimed would make it easier for those trying to get into the market as well as families looking to upgrade or empty-nesters wanting to downsize.

In building the case, Mr Perrottet said since 1990 average stamp duty on dwellings had increased more than seven times compared to three times for average earnings.

He also said it now takes 2.5 years to save the money needed to pay for stamp duty on the average home, compared to one year when MC Hammer was top of the charts.

Removing the upfront cost of stamp duty would take tens of thousands of dollars off the cost of homes, the Treasurer said as he opened a public consultation process on his reform plan.

By removing barriers to purchase, the government believes there would be an $11 billion benefit to the state economy over four years.

Under the changes, buyers would have a choice between the status quo or an annual tax on land value.

It would only apply to future purchases, meaning if you are not buying a property there is no change.

“This is a substantial change to the system,” Mr Perrottet said.

“We’ve got a model we believe works.

“I think choice is crucial going forward.”

Mr Perrottet said the proposed model would be revenue neutral in the “short term.”

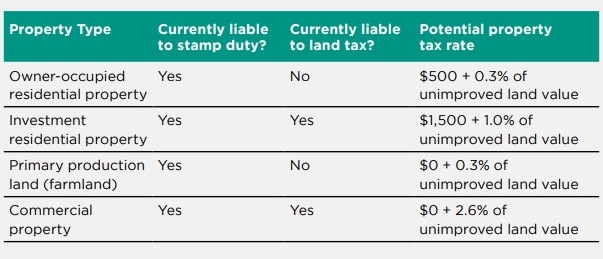

A consultation paper published by NSW Treasury this afternoon reveals the different proposed rates for the property tax.

The paper says “it is proposed that the annual property tax would be based on unimproved land values, which is how council rates are determined.

“The property tax would apply to each individual property, unlike land tax which is based on an owner’s aggregate value of landholdings.”

The consultation paper fleshes out the idea of cash grants for initial purchases in place of stamp duty concessions.

It says $25,000 could be offered to “people buying their first homes at values of up to $1 million (or up to $650,000 for vacant land), for a period of, say, three years from the start of reform” and provide a “choice to pay either stamp duty or property tax.

“Under this model, a first homebuyer of an $800,000 property could receive a $25,000 grant and opt-in to the property tax to avoid $31,000 in stamp duty.”

They would then be liable for an annual property tax.

“Compared to a non-first homebuyer who chooses to pay stamp duty, a first homebuyer who chooses the property tax would save $56,000 at the time of purchase.”