‘The Wolf of Castlereagh Street’: Chinese luxury developer leaves trail of debt

Known as the ‘Wolf of Castlereagh Street’, ambitious Michael Guo’s dream of bringing high-class apartments to Sydney came crashing down this week among sixty businesses that went belly-up leaving behind a trail of fat bills and worried creditors. SEARCH THE COMPANIES

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Concrete Kings of Sydney leaving their footprints across the suburbs

- A quarter of Colette stores to close

From cost blowouts to mounting debt, The Daily Telegraph reveals the Sydney businesses that have gone bust in the past week with some leaving behind eye-watering debts and unpaid creditors.

Some had dreams of selling opulent, resort-style apartments in Sydney, others were starry-eyed start-ups once backed by renowned venture capitalists - but they all have one thing in common - the risk of a costly business failure.

These are the Sydney companies that have this week gone into administration, been liquidated or are being wound up.

‘The Wolf of Castlereagh Street’ leaves trail of debt

The subsidiaries of a Chinese-backed Sydney luxury apartment and hotel developer owned by a man dubbed the ‘Wolf of Castlereagh Street’ have gone belly-up this week with hundreds of thousands in unpaid bills. Now the company is desperately trying to save nine of its subsidiaries from troubled waters.

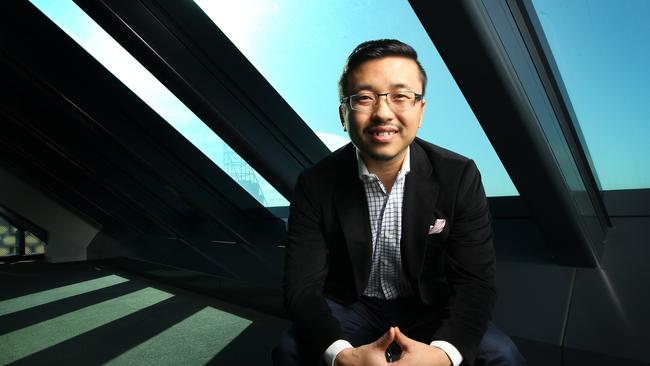

Chinese-born Michael Guo hit Australian shores more than 10 years ago with ambitious plans to bring opulent ‘east meets west’ hotel-style apartments to Sydney.

Backed by Chinese investors, it took just a few years for Visionary Investment Group to take hold of Sydney’s golden streets - but it would take just months for nine of the empire’s companies to come crashing down into voluntary administration.

Just two years after arriving from the US, Guo purchased most of the buildings on Castlereagh Street - one of the most lucrative business strips in Sydney. Years later, he became the mastermind behind Silkari Suites in Chatswood, Pagewood and Sydney CBD.

The Chinese-backed developer has also been planning a “resort-led development providing residences, three five-star resorts and spas and a Greg-Norman-designed golf course” in the Southern Highlands. In December, the company added Oaks Lagoons in Port Douglas to their property portfolio.

But the ambitious developer’s dream of bringing high-class apartments to Sydney this week came crashing down as nine of Visionary’s subsidiaries - mostly related to property sales and marketing - appointed an administrator, leaving behind a trail of fat bills in the hundreds of thousands and worried creditors.

While it’s early days, administrator Mackay Goodwin says it’s hopeful creditors will be able to claw back a fair share of their money.

“The board have expressed to the administrators a willingness to formulate a proposal in order to provide a return to creditors and we will be happy to provide further information in due course,” the firm said.

Michael Guo, director of Visionary said none of the company’s properties - like Silkari - are impacted by the news.

“We are not saying things aren’t difficult,” he told The Telegraph.

“It’s tough market conditions that are to blame for the collapse.

“The property, hospitality and tourism industries have continually endured some of the toughest times in recent memory. And things have just taken a turn for the worse in the past few months.

“Our businesses, likely many others, unfortunately cannot escape the impact. The right thing to do is to put our affected subsidiary businesses into voluntary administration.”

Despite the difficult market conditions, Guo is hopeful the company will be able to move forward without liquidation.

“It is a very difficult situation, we are trying everything we can to move forward and if there are any opportunities we won’t give up,” he said.

Sydney companies declared insolvent this week

CLIPPED WINGS: DOMAIN NAME FIRM COLLAPSES

A domain-name start-up with dreams of scaling globally once backed by a renowned venture capitalist is in administration almost a decade after it was founded.

Winged Media, an Erina-based firm specialising in domain training, debuted on the prestigious BRW Fast Starter List almost a decade ago.

The company was backed by Mark Carnegie’s venture capital firm in 2011 who handed the company a $ 3 million funding injection after it was valued at $30 million.

The founder, Troy Rushton, had big dreams for the company, telling Smart Company “there’s an overwhelming need for this new program.”

But the company came crashing down last year as creditors prepare to meet this week after administrators were appointed.

A deed of company arrangement is now in place for the company, with hopes it may be able to continue operating.

Efforts were made to contact Winged Media and Mark Carnegie.

For more information about the companies listed above visit the ASIC website here and contact the administrators.

Are you owed money or have you got an experience you want to share? Email the writer at Georgia.Clark@news.com.au