Shorten prioritises taxpayers ‘over multinationals, banks and big business’

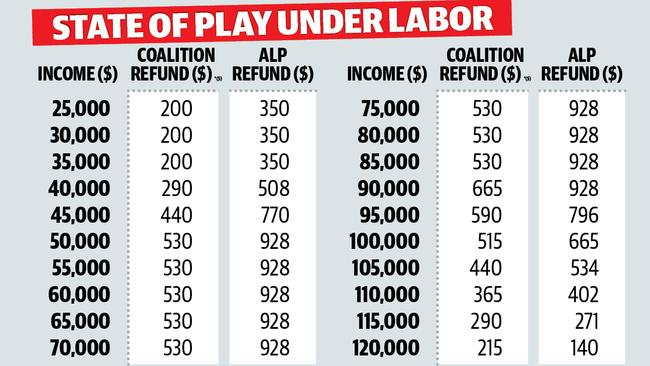

LABOR Leader Bill Shorten has set up a tax cut election showdown promising to top the Turnbull government’s cash hand back to 10 million taxpayers. Here is the comparison between Labor and Liberal depending on your income.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

BILL Shorten has set up a tax cut election showdown promising to top the Turnbull government’s cash hand back to 10 million taxpayers by $400 a year.

Making an election pitch directly to middle class voters, Mr Shorten yesterday said Labor would dole out bigger personal tax relief “because I think you are more important than multinationals, banks and big business”.

Having banked billions in savings through changes to negative gearing and superannuation benefits enjoyed by property investors and retirees, Labor will give taxpayers with incomes of between $50,000 and $90,000 an extra $398 in refunds every year.

Labor is likely to face criticism over class warfare, with Treasurer Scott Morrison already taking aim at Mr Shorten for being stuck “in a rut of envy and bitterness”.

But Labor will not oppose the first part of Prime Minister Malcolm Turnbull’s tax changes, although it will not support a plan to put all taxpayers earning between $41,000 and $200,000 on one tax bracket of 32.5 per cent.

BILL SHORTEN’S BUDGET REPLY: AS IT HAPPENED

“In our first term of government, a teacher on $65,000 will be $2780 better off under Labor — an extra $928 a year,” Mr Shorten said

“After years of flat wages, rising power bills and increasing health costs: it’s time for a fair-dinkum tax cut for middle-class and working-class Australians.

“I’ve already said Labor will support the government’s modest tax cuts starting 1 July this year.

“And tonight, I announce a Labor government will go further and do better on tax cuts for working and middle income Australians.”

SHARRI MARKSON: BUDGET A BLOW TO SHORTEN ENDGAME

SHORTEN’S CREDIBILITY HIT BY DUAL CITIZENSHIP DEBACLE

SHARRI MARKSON: BILL SHORTEN HAS COME A-CROPPER ON TRUST

Mr Shorten’s budget reply came as Labor attacked the government’s over its $140 billion income tax cut plan, with new analysis from the Grattan Institute showing 60 per cent of the lost revenue would go to those with the top 20 per cent of incomes by 2028.

While the largest tax cuts would benefit low and middle income earners until 2025, changes to tax arrangements putting more high earners in lower tax brackets would eventually favour the wealthy, the analysis said.

But the government is expected to release its own analysis which shows the largest proportion of the reduction in tax bills would favour low and middle income earners.

Mr Turnbull said his tax relief would give workers an incentive to take on more work and get paid more.

“The tax system remains thoroughly progressive in the sense that the bulk of the tax is paid by people on higher incomes,” he said

“But what it will ensure (workers) who want to earn more, who want to get ahead, who want to do some more hours, who want to take on another promotion or start a business, will know that they will not be put off that or disincentivised by higher and higher marginal tax rates.”

Labor will use the same mechanism as the government, a tax offset, to deliver the refunds at the end of the financial year.

But without permanent tax bracket changes, taxpayers remain at risk of being caught by bracket creep — which economists have cautioned would cost them billions every year due to inflation.