Property developers ‘driving up’ house prices by refusing to build

Sydney’s property developers have approval to build 140,000 new dwellings but academics claim they won’t begin construction because companies have an interest in keeping house prices high and maximising their own profits.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Exclusive look inside Sydney’s ‘suburb of the future’

- Lamborghini-loving developer’s high rise headache

Sydney’s house prices could be lowered “significantly” if property developers were punished for going slow on building new homes.

That’s the finding of a landmark study from the University of Sydney that claims to have busted the “myth” that loosening planning controls will bring down property prices and increase housing supply.

But developers claim excessive development conditions and government levies cause the delays.

Sydney’s property developers have approval to build 140,000 new dwellings, enough to create the equivalent of a new Sydney CBD.

But academics claim developers won’t do this because companies have an interest in keeping house prices high and maximising profits.

MORE FROM BEN PIKE:

Liverpool Council refers itself to ICAC

Former mayor slams Salim Mehajer

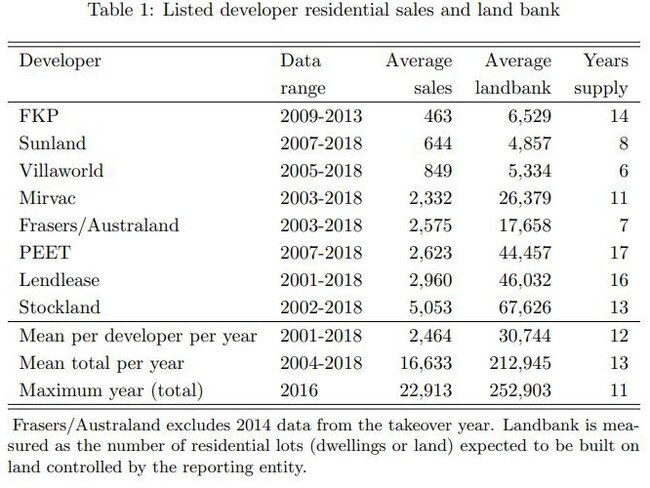

Dr Cameron Murray put the annual reports of the top eight publicly-listed residential property developers under the microscope and found they have an average of 11 years’ worth of housing supply “in the bank”.

These developers, who construct one in every 10 homes built in Australia, are sitting on 252,903 residential lots that are zoned or approved, yet they only sell around 16,000 lots per year.

Building on this land would combat what developer lobby the UDIA calls our “housing affordability crisis”, Dr Murray said.

“The last thing developers want is cheaper houses,” Dr Murray said.

“If they doubled, or even tripled, the rate they sold these lots they could depress home prices significantly in all the key growth areas of the country where they own land banks.

“People pretend that they want cheaper house prices but the housing industry and the 70 per cent of households who own their own homes don’t want that.”

Sydney property prices ballooned 74 per cent from 2012-2017 with a median house price of $910,000 and a median apartment price of $691,000, according to CoreLogic.

Yet the proportion of second or empty dwellings in Australia has gone from 2.4 per cent to 8.6 per cent between 2002 and 2015, according to the ABS.

Stockland’s Elara near Liverpool was acquired in 2012 but only 66 per cent settled.

Mirvac and PEET’s development Googong near Queanbeyan, was acquired in 2011 and is less than one-third released.

Dr Cameron has called on the state government to accelerate housing supply by penalising developers who go slow.

He has also called on governments to increase competition by directly building housing and not having to turn a profit, thus putting downward pressure on prices.

Planning Minister Rob Stokes dodged questions on implementing any reforms, instead saying the government has a target to deliver 725,000 new homes in Sydney by 2036 “to meet the needs of our growing population”.

In its national pre-budget submission January 2019, the UDIA said “there is a housing affordability crisis which needs to be addressed through increasing housing supply, planning reform and stamp duty taxation reform. Falling house prices are not correcting the pent-up demand and years of lack of supply”.

Developer lobby Urban Taskforce spokesman Chris Johnson said projects are delayed because of “excessive” levies and planning conditions imposed by councils.

“In Sydney the NSW Government is removing the cap on local contributions from July 2020 and this will add significant extra costs that could stop projects,” he said.

“I am aware of major housing projects by Urban Taskforce members that are stuck in the planning system for years.”

UDIA national executive director Connie Kirk said it can take “up to 10 years” to run the gauntlet of regulatory approvals needed to convert raw land into new housing.

“Red and green tape costs — combined with excessive taxes and charges on new housing — add up to 40 per cent to the cost of new housing,” she said.

“We are pleased to see the Commonwealth Government invest in new analysis of housing supply, demand and affordability and hope it leads to reforms that eliminate the barriers to new housing construction.”

A Stockland spokeswoman said “residential land is released in line with planning approvals; the delivery of infrastructure such as roads and transport, services such as water, electricity, sewer facilities and community services; and agreements with government and authorities”.

“We seek to bring all projects to market as quickly as possible, and where land is zoned and services are connected, we release lots as quickly as possible to meet market demand,” she said.