NSW suburbs where first home buyers will win big

Wannabe homeowners tossing up where to buy their first property could cash in big time across NSW, exclusive heatmaps show. See where you could afford a property.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Around 84 per cent of all homes will be eligible for the NSW government’s scheme to ditch upfront stamp duty costs.

The scheme, which was announced in the state budget, allows buyers entering the market to avoid paying stamp duty in favour of a yearly property fee at $400 plus 0.3 per cent land value.

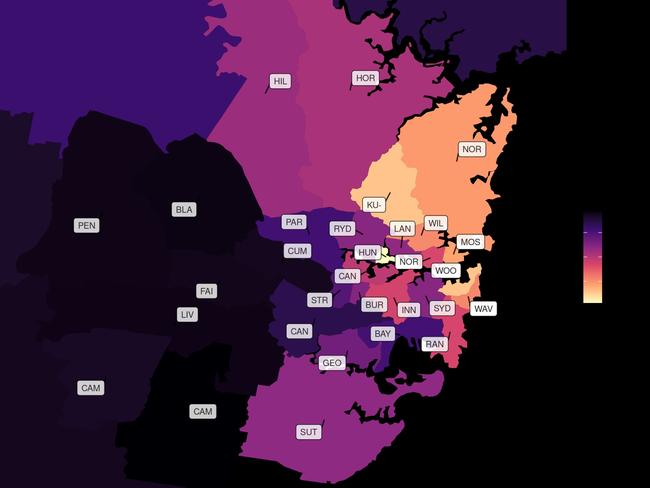

Exclusive heatmaps show rural and regional NSW will be the big beneficiaries with almost all properties eligible under the scheme.

These heatmaps show the areas where this scheme will benefit most, with the highest percentage of eligible homes.

The areas least to benefit are Hunters Hill, Kuring-gai, the eastern suburbs north shore where property values outstrip the $1.5 million cap.

Revenue NSW data shows 214,528 property transactions per year with 180,789 eligible for the First Home Buyer Choice scheme.

With the median home price in Sydney $1,342,000 for houses and $781,000 for units, the choice to dump stamp duty for a yearly payment will help the majority of Sydneysiders.

The scheme applies to all properties under $1.5 million in value, and data from Revenue NSW has shown Campbelltown is the best area to take advantage of the scheme with 98 per cent of properties under that cap.

96.5 per cent of properties in Blacktown are eligible, 96.2 per cent in Liverpool and 96 per cent in Penrith.

Fairfield, Cumberland, Camden and the Blue Mountains also have more than 90 per cent of properties under that $1.5 million cap.

Central Coast and Canterbury-Bankstown round out the top ten.

25-year-old recruitment consultant Kellie-Ann Glassock is on the hunt for her first property, and said she’d seriously consider swapping upfront stamp duty for a yearly tax.

“I think initiatives that help people pay less upfront and get them to enter the property market are great it’s definitely something I’d consider,” she said.

“Upfront costs are a huge barrier and speaking to mortgage brokers, I think people think you just have to save the 20 per cent deposit but all those additional fees are a major barrier.”

Treasurer Matt Kean said the scheme will allow more young people to engage with the property market.

“The majority of homes in NSW are under $1.5 million enabling first home buyers to soon make a choice between upfront stamp duty and a smaller annual property fee,” he said.

“First Home Buyer Choice is all about helping people achieve their dream of home ownership sooner by providing an alternative to stamp duty which can be a huge barrier to entering the market.”