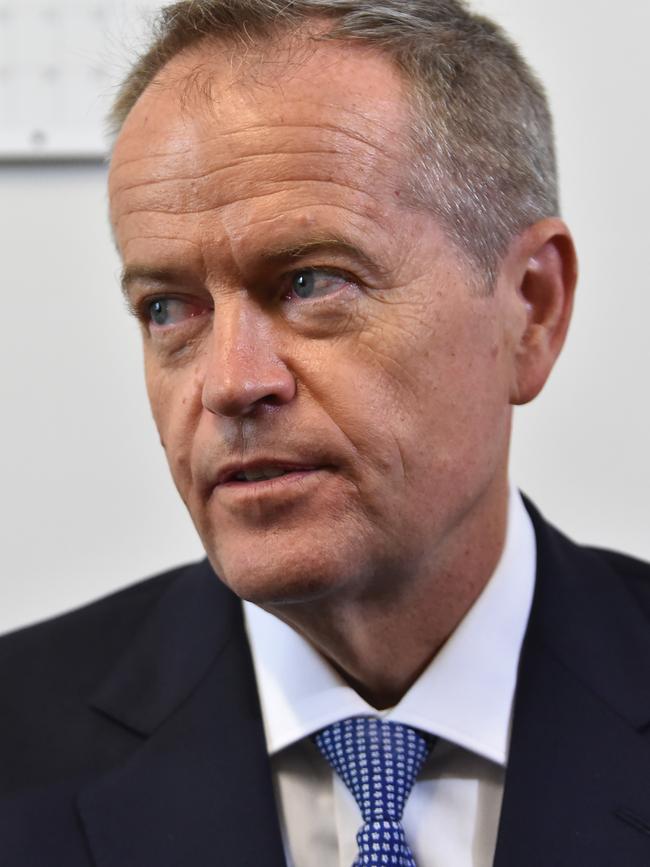

NSW seniors to be hit hardest under Bill Shorten’s retiree tax

More than 300,000 retirees across the state stand to lose thousands of dollars a year under Bill Shorten’s retiree tax, damning new analysis shows. But a Sydney suburb will be hit the hardest in the country, losing on average nearly $5000 a year. SEE HOW YOU’LL BE AFFECTED.

More than 300,000 retirees across the state stand to lose an average of $1900 a year under Bill Shorten’s retiree tax, damning new analysis shows.

In a boost to the Liberals’ pitch to win back the once-safe seat of Wentworth, 8250 retirees in Malcolm Turnbull’s former eastern Sydney seat will be the hardest hit in the country, losing $4690 on average every year if Labor is elected.

Former PM Tony Abbott will be able to make Mr Shorten’s plan to end cash refunds for share tax central to his campaign in Warringah where more than 10,000 retirees would be $3315 worse off.

MORE NEWS

Former Test bowler backs Abbott for re-election campaign

’It’s just too quiet’: Foster mum’s frantic search for William

Tech giant execs to face jail over extreme online content

The analysis, based on yet to be released Australian Taxation Office data, finds more retirees in NSW will be hit by Labor’s retiree tax than anywhere else in the country.

In further proof that Labor’s plan to target retiree shareholders is an electoral risk, it can be revealed that tens of thousands of voters in marginal seats across the country will be financially worse off.

The Coalition has set its sights on snaring Lindsay in Western Sydney and Dobell on the Central Coast from Labor where almost 10,000 retirees who receive the cash refunds live.

Thousands of voters in the marginal Liberal seats of Gilmore (8690), Robertson (7323) and Reid (6614) accessed refunds under the current scheme according to the ATO in 2016/17.

Treasurer Josh Frydenberg said the people who will suffer the most hurt under Labor’s plan were those with a taxable income of less than $37,000.

“This is another shameless tax grab by Labor from those who have done the right thing, grown their nest egg and planned to provide for their own retirement,” Mr Frydenberg said.

“In recent months, hundreds of retirees have voiced their deep-seated anger and worry about the impact that Labor’s tax would have on their quality of life in retirement.

“Yet Shadow Treasurer Chris Bowen has arrogantly dismissed these concerns, telling retirees that if they don’t like the policy then they should vote against Labor.”

Former prime minister John Howard introduced the scheme where individuals and some superannuation funds could receive a cash refund from the ATO if their dividend imputation credits — where tax paid by a company may be used by its shareholders to reduce their income tax — exceeds the tax they owed.

Labor want to axe refunds other than for existing pensioners. Imputation credits could still be used to reduce tax but not for cash refunds.

Labor estimates its plan would save the budget $11.4 billion over the forward estimates. However, this figure has been disputed by critics of the plan who say shutting down the refunds will likely change investor behaviour.