NDIS Commission launches $400k case against Aurora after client in their care killed

An intellectually disabled man who required two-on-one care around the clock died after escaping from his home and being hit by a car. His is the latest case in a growing list of vulnerable NDIS clients who died while in care.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The operator of a supported living facility for people with disabilities is facing a $400,000 fine over the tragic death of a man with intellectual disabilities who was in their care.

A year ago the 38-year-old slipped out of the facility, operated by community health conglomerate Aurora Community Care, in the early hours and wandered onto a busy motorway, where he was struck by a vehicle and killed.

His departure went unnoticed, despite the fact that he was supposed to be receiving around-the-clock care by a team of workers.

The NDIS watchdog launched a $400,000 civil penalty case against Aurora Community Care in the Federal Court in December, claiming their allegedly catastrophic failures to care for the man resulted in his death.

It’s one of half a dozen cases where the NDIS Commission has taken legal action over death or serious injury.

The Sunday Telegraph can reveal the man hit by a car on March 17 last year left his supported independent living residence alone around 2am.

He was required to receive two-on-one care, 24 hours a day, seven days a week.

“The overnight supports provided by Aurora pursuant to the agreement were active overnight shifts, where both support workers were required to be awake rather than ‘sleepovers’ where support workers can sleep during normal sleeping hours,” a statement tendered to court said.

“It was known to Aurora that the man would leave or attempt to leave his residence from time to time.”

According to the statement, Aurora and its staff knew that the resident was not subject to any “environmental restraint” that permitted Aurora to lock doors, therefore workers needed to always watch him.

On this occasion one of the carers had allegedly fallen asleep in the living room while the other was in the study and heard the resident open the back sliding door but considered this behaviour to be normal and did not investigate it.

NDIS Minister Bill Shorten said the NDIS Commission, now with gun law enforcer Mike Phelan at the helm, would prosecute any providers who were negligent or responsible for the deaths of vulnerable Australians.

In another case, the NDIS Commission has commenced civil penalty proceedings in the Federal Court of Australia against Valmar Support Services Limited.

An NDIS participant died on May 17, 2020, from choking on food at a residential group home at Hemmings Crescent, ACT, while under the care of Valmar.

It is alleged that other NDIS participants were also put at serious risk of harm by Valmar from September 11, 2018, to May 14, 2020.

Sydney-based provider Australian Foundation for Disability (Afford) has been fined $400,000 and ordered to pay court costs over the death of Merna Aprem, who drowned in a bathtub.

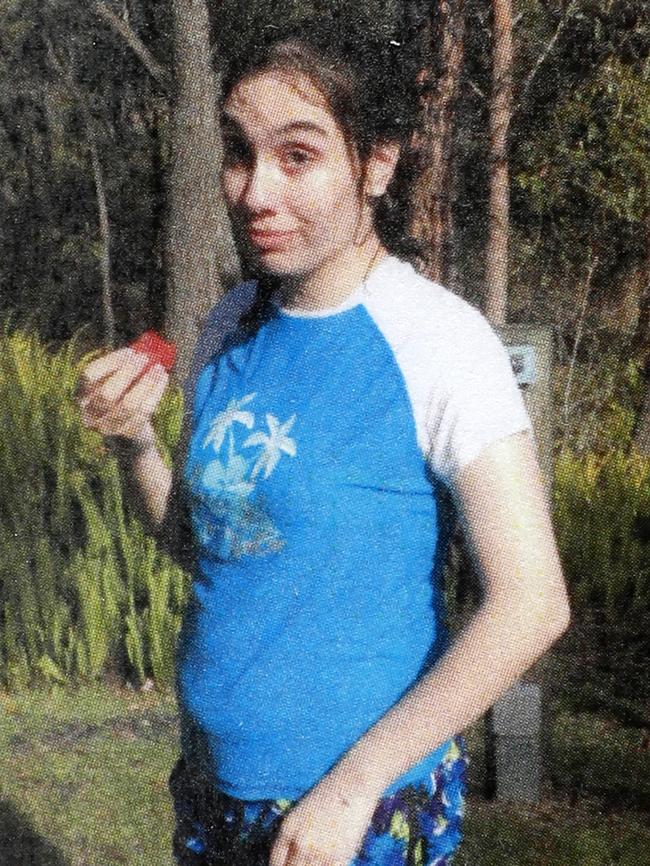

Meanwhile court proceedings are continuing over the death of Kyah Lucas, who died from complications associated with the burns she sustained after being placed in a bathtub of hot water while receiving personal care support in her Orange home.

The Commission has also taken action on the death of Ann-Marie Smith, who died in hospital, after a period of neglect, having lived in squalid and appalling circumstances.

SHORTEN’S GRIM WARNING

Businesses that hike up prices just because their customers are NDIS participants can expect the wrath of a new task force now operating across the country.

NDIS Minister Bill Shorten vowed he would wipe out the so-called “wedding tax phenomenon” and prosecute people robbing vulnerable Australians.

“We are writing to hundreds of thousands of people to show them what action they can take to stop being ripped off,” the Minister exclusively told the Sunday Telegraph.

“There are penalties for people breaching the law. The NDIS is not a honeypott.”

From this week, every NDIS participant, their carers, guardians, and nominees, will receive a letter in their mail box showing them how to fight back against the NDIS “wedding tax”.

NDIS Minister Bill Shorten, who has worked with Assistant Minister for Competition, Charities and Treasury Andrew Leigh, said the new taskforce is part of a broader plan to close loopholes and defend the NDIS.

The NDIS Commission will tackle illegal overcharging of NDIS participants. The ACCC

will focus on investigating and clamping down on misleading conduct, unfair contract

terms and anti-competitive agreements that might impact NDIS participants, while

supporting the task force’s work.

“The era of ripping off disabled people on the NDIS is over,” Minister Shorten said.

“Charging you more just because you are simply an NDIS participant is wrong and it is a

breach of federal law. We have upgraded the NDIS rules to make it clear overcharging

is prohibited and we have further legal changes coming to more strongly prohibit and

punish such practices.”

Those found in breach of this federal law could face severe action imposed by the NDIS

Commission. Penalties include permanent banning, infringement and compliance

notices, civil financial penalties and/or injunctions imposed and, where fraud is

suspected, urgent referral to the fraud fusion taskforce for criminal sanctions against the

provider found guilty of rip-offs.

“Participants, the disability sector, and I have all known about this problem for years.

We finally have the legal powers to fix it with this taskforce and make changes to the

NDIS Code of Conduct,” Mr Shorten said.

“I know most service providers are doing the right thing, but there is a small minority of swindlers who are giving everyone a bad name”.

Mr Leigh said the work the ACCC will undertake with the NDIS

Commission and the NDIA will be monumental to people with disability.

“The ACCC will also remain a tough cop on the beat, with additional resourcing to take

action against providers who breach the existing consumer protection laws,” Mr

Leigh said.

Got a news tip? Email weekendtele@news.com.au