Mystery of Sydney’s vanishing $1bn fruit growing company

A Sydney-based fruit growing company that was worth almost $1bn has vanished, triggering calls by investors and several former insiders for an official investigation.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Alerts, personalised news feeds are key features of our app

- Revenue booms for Chinese agricultural producer

A Sydney-based company that was worth almost $1bn has vanished, triggering calls by investors and several former insiders for an official investigation.

The Australian Securities Exchange-listed Dongfang Modern Agriculture — whose main business is growing fruit in China — last released financial results in March 2019.

Two months later, four of its five directors resigned, leaving behind chairman and majority shareholder Hongwei Cai.

According to company documents, Mr Cai either lives in China, Australia or Tonga.

The resignations prompted the ASX to send a “please explain” letter to Dongfang.

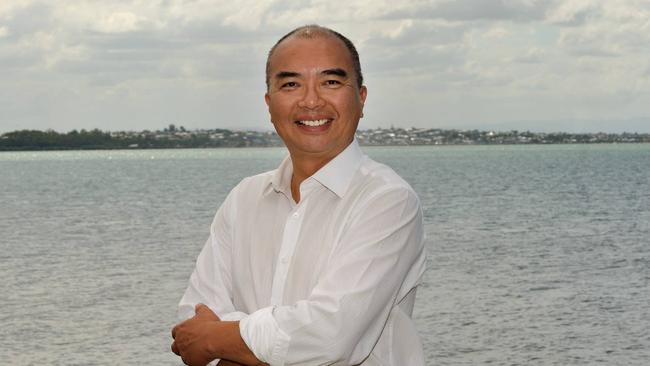

The company responded five weeks later to say its two Australian-based board members — former Queensland state Labor MP Michael Choi and Sydney woman Dan Lin — had quit due to their concerns about speculation Ganzhou City government officials were interviewing plantation staff and “investigating criminal connections”.

The Daily Telegraph understands Dongfang was rumoured to be using high-pressure tactics to get local farmers to sell their land.

The company said the talk was not true but because Mr Choi and Ms Lin had been unable to visit the plantations to check, they resigned “due to the seriousness of the rumours”.

Dongfang said the pair’s departure was the catalyst for the resignation of the other directors, as well as CEO Charles So.

There was never any suggestion the directors, Mr So or the company secretary were involved in any wrongdoing in China.

Dongfang’s Sydney-based auditors PKF wrote to the Australian Securities and Investments Commission immediately after the four directors quit. But it is unclear if ASIC is investigating. It won’t say.

Based on the last trading price, 700 investors who own the 32 per cent of Dongfang that is not controlled by Mr Cai face losing $112m.

One person who was involved with Dongfang said the corporate regulator must step in.

“Shareholders are entitled to know what went wrong,” the source said.

Another who worked closely with Dongfang said: “There’s a story here. But I don’t know what it is. It’s a real mystery.”

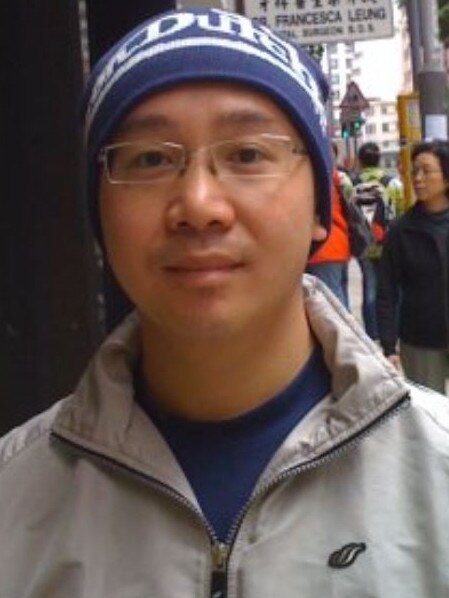

Sydney businessman Tong Liu, who outlaid about $230,000 on Dongfang shares starting in 2017, wrote to ASIC alleging there were problems with thecompany’s finances.

He said ASIC “absolutely” should investigate.

Dongfang listed on the ASX in October 2015, valued at nearly $400 million. It gave its headquarters as an office in Chatswood.

When The Telegraph visited that office, none of the neighbouring tenants knew of the company. It is now occupied by a mining business.

By basing itself in Sydney, Dongfang aimed to leverage Australia’s clean, green image — despite not producing any fruit here.

In February 2016 it reported a better-than-expected profit of $90 million and a bumper harvest of 240,000 tonnes of tangerines, oranges and pomelos.

Nonetheless, there were doubts.

A third person with inside knowledge of Dongfang said: “We had a lot of scepticism at the start about whether the orchards really existed.”

Photographs showing a director at the plantations were sourced to ease these anxieties.

By April that year, the company’s shares — sold for $1 each in the float — had soared to nearly $2.50, increasing its market worth to almost $1 billion.

But questions re-emerged in 2018 after Dongfang’s decision to borrow $50 million at 10 per cent from a state-owned bank in Hong Kong when it had $30 million in the bank and no debt.

The loan was used to buy a 70 per cent stake in Silverwater’s Bio Health Pharmaceuticals, for $18 million.

While Dongfang Modern has made no announcements to the ASX since November last year, the Telegraph has learnt a British Virgin Islands-based subsidiary of the company was at that time pursuing legal action against Bio Health in the Federal Court, seeking to inspect Bio Health’s books and minutes of directors’ meetings.

A hearing was set for February this year. But four days before, Hilly Woodland discontinued its action.

Dongfang’s last three announcements were filed by its lawyer, Piper Alderman’s Alan Jessup.

He told The Telegraph he no longer had a current phone number for Dongfang.

In stock trading forums such as HotCopper, investors are canvassing whether Dongfang was what it seemed and whether a class action should be pursued.

However, a former insider said: “My understanding is it continues to operate, but there’s no communication to the ASX from China.”

If financial statements are not released by the end of this month, Dongfang will be delisted from the exchange.

Its shares last traded at 83 cents. Mr Cai was a buyer at this price in the weeks before all his fellow directors quit.

When The Telegraph visited the Hurstville address for Ms Lin, a person who identified herself as a family friend said Ms Lin was in China.

Mr Choi told The Telegraph: “Notwithstanding my resignation I remain bound by continuing obligations of confidence and owing to the possibilities that some form of investigation or litigation may take place, I am unable at this time to respond to your further questions.”

Know more? Contact john.rolfe@news.com.au