Middle-income Aussies will be more than $12,000 better off under tax plan

MIDDLE-INCOME earners will pocket more than $12,000 over the next 10 years under the Government’s proposed tax plan while high-income earners will still carry most of the tax burden.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

MIDDLE-INCOME earners will pay nearly $300,000 in tax over the next decade if nothing is done to change the rates — but will be nearly $13,000 better off under Malcolm Turnbull’s plan, a new Treasury analysis has revealed.

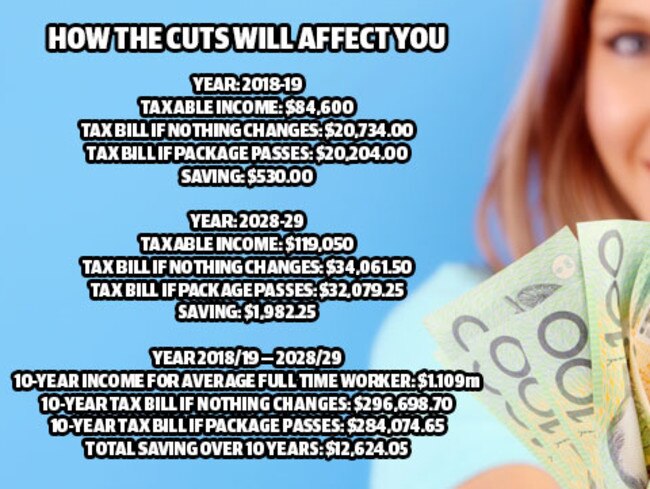

The latest figures, seen by The Sunday Telegraph, show the average full-time worker earning $84,600 will pay about $296,698 in income tax over the next decade if nothing is done to income tax rates.

But Treasury estimates that same worker will pay $284,074 in income tax if the government gets to pass its long-awaited reforms.

That would deliver a collective tax saving of $12,624 over the next decade.

With the debate set to dominate the next sitting fortnight of Parliament, Treasurer Scott Morrison is insisting that the Senate pass all three stages of the $144 billion tax cut plan when Parliament resumes on June 18.

With Labor and the Greens opposing the full package, the Coalition needs the votes of eight of the 10 crossbench senators to pass the legislation before the winter break.

The Sunday Telegraph understands the government has locked in support from five senators — Derryn Hinch, David Leyonhjelm, Fraser Anning, Cory Bernardi and marginalised One Nation senator Brian Burston.

Centre Alliance’s Rex Patrick and Stirling Griff are also close to backing the full plan.

But the three others, independent Tim Storer and One Nation’s Pauline Hanson and Peter Georgiou, want it to be split so they can support the first stages that mostly benefit low and middle-income earners.

Treasurer Scott Morrison said the full tax package wasn’t a “quick fix” but was a plan to deal with problems such as bracket creep, which penalise working Australians.