Local businesses in Mosman being forced to close as cost of living starts to bite

You might think it would be the last place in Sydney to feel the pinch of a tough economic climate, but local businesses in Mosman are closing down rapidly.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

If you want proof that small business across the state is doing it tough, just take a walk through Mosman.

This leafy north shore suburb has a median house price of $5 million and its well-heeled residents pocket an average weekly income of a touch under $3000 after tax.

So you would expect discretionary income would not be as much of a problem as, say, in Western Sydney.

But more than half a dozen small businesses have been forced to close recently, with others teetering on the edge.

And if Mosman can’t sustain small business, what chance has the rest of the state got?

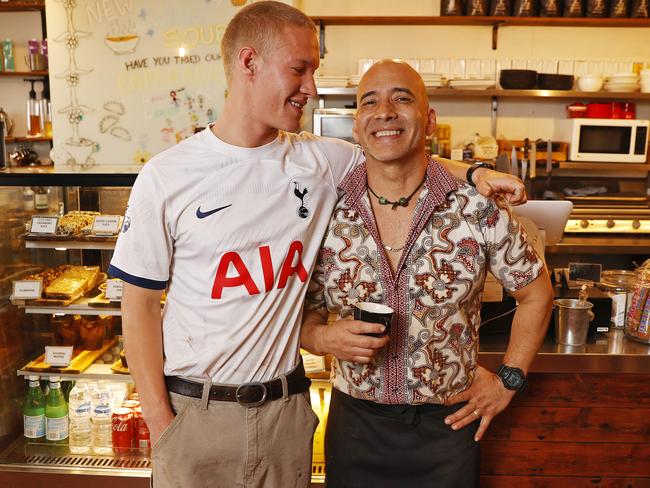

Gerard Barrios and his wife Sharron have been running cafes in Mosman for 27 years.

The Barrios family – including 20-year-old Gerard Junior, who also works in his parent’s cafes – was forced to close their Clifford St Don Adan eatery, one of three Mosman locations, which they had operated for 23 years. They join the suburb’s Brunskills Pharmacy, which is in liquidation after more than 40 years, Oracle Books, which will soon close after 32 years, Shane’s Butchery, which has shut down after 20 years, Curve Boutique, which was open for 35 years and women’s clothing store Savoir Faire, which was also part of the community or three decades.

Mr Barrios blames a combination of factors that will sound familiar to any small business owner – a difficult landlord, rising costs and a drop in consumer spending.

“This time, we just couldn’t keep on going,” he said.

“Last year, we had to increase our prices by 10 per cent in March, just to keep up with inflation of some of the expenses that were much higher.

“And then, if I compare my numbers this year to last year, it’s still down 20 per cent – so in simple terms, I’m down by 30 per cent – but everything else has increased.

“So not taking into consideration the price increases of everything, including wages and superannuation, my takings, retail, are down by 30 per cent. So as a business, if I was to put the price increases through everything – inflation and wages – I will be probably 40 to 45 per cent worse off than last year.”

“If you look at any development of any type, either done by state government, by council, or by any developer, and they showed the beautiful building with all the umbrellas and the cafe, and people walking by, it looks so inviting – but how many of these places can we have in a sustainable way?

“Mosman is a very special place and having been a coffee supplier for years, there are not many villages around, and Mosman is still a village … and people are very supportive, but parking is an issue – so you go to the mall, it’s a lot easier.”

He said for small business to survive, they had to be patient and believe in what they can do. But some of his suggestions may be impossible for others.

“Their vision has to be stronger than reality,” he said.

“At times, it’s almost delusional. But if you’re careful and basically reduce your expenses, when you can just speak honestly with your suppliers about where you are, the capability of paying – rather than paying every month, you might be paying every six weeks.

“You’d shop around for a better option if there is, or you’ll increase your workload. So if I was working 50 hours a week before, now I’m working 65.

“As a business owner, you have very few levers to pull – but your presence is always important. People want to see me or they want to see my wife in the cafe – they want to see my son, they want to see my daughter – it is a family-run business that is really run by the family.”

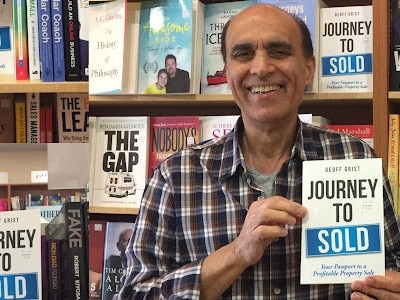

Mansour Ardestani opened Oracle Books at Spit Junction in 1991, but a 30 per cent decline post Covid due to people going online has sent him into a devastating early retirement.

“Since Covid when people were at home and they started ordering things online which turned into habits since then, and it’s not sustainable anymore,” he said.

“It is difficult and it’s very sad. We were very happy to work here, it was a peaceful, nice environment and we’re a very unique bookshop.

“We had a lot of good stock and exceptional things … that’s why we were the last standing one in Mosman, which is devastating for the area.”

Mosman real estate agent from O’Gorman and Partners, Anthony O’Gorman, said for as long as he could remember, Mosman Village shops had been an eclectic mix of locally owned businesses.

“Fast forward to 2023 and there’s no denying the last few years have been tough on small and local businesses … it’s also been tough for mortgage holders, renters and life in general has just become more expensive,” he said.

“But as locals, our priorities are all wrong when the first thing we do when we’re told to ‘tighten our belts’ is cancel our membership at the local fitness studio and cut back on buying coffees from the local cafe. To abandon the local businesses who’ve supported our community for so long in the pursuit of a cheaper price or to save a few dollars.

“I get it, you gotta do what you gotta do but here’s the thing … if you’re looking to cut back or cut out, you’re looking in the wrong place.”

XTEND Mosman owner and small business expert Liz Nable said with the Commonwealth Bank posting a 5 per cent rise in profits this year, NAB reporting profit growth of 25.5 per cent and Visa making an $8.123 billion profit – it was no secret that big businesses are booming.

“Large chain stores or online retailers backed by billionaires like Amazon have the bandwidth to withstand fluctuating profit margins – small businesses don’t,” she said.

“Small business is quite literally the backbone of the Australian economy.

“Small businesses are run by local families whose kids go to the local schools. They employ local people in local jobs.

“They sponsor the local footy and netball clubs, donate to the school fundraisers and know their customers by heart and by name. Yet, when push comes to shove – hello, cost-of-living crisis – local businesses seem to be the first to feel the blow.”

Mosman Chamber of Commerce President Tamara Keniry, wrote to federal Warringah MP Zali Steggall and North Shore MP Felicity Wilson in August, asking for help on the “dire” situation.

“All costs of doing business have increased – stock, supplies, utilities, freight, fuel … incentivise landlords to install solar, insulation and other energy efficient modifications so tenants benefit in reduced energy costs,” she wrote, adding consumer spending was massively down.

“Foot traffic is reduced, streets are quiet,” she said.

“Interest rate rises affect consumers, but also small business owners. Many took out additional debt to assist them in surviving Covid, and they now face significant pressure in debt repayments for their businesses, as well as their homes.

“They have been under sustained stress since 2020 with no relief in sight.

“Small business does not seem to be adequately recognised … these business owners are people who have worked hard, often for many years, to build their businesses, service their customers and create the atmosphere which is the essence of their local area.

“Small business owners have families and their own personal cost of living issues, like all households – however, unlike other households that are employed by big businesses or Government, on safe and steady income, small business owners have the additional pressure – financial and emotional – from the horrific combination of increasing expenses and falling revenue. They are in the perfect storm.”

Both MPs did raise these issues but things have not changed – in fact they have become worse for many.