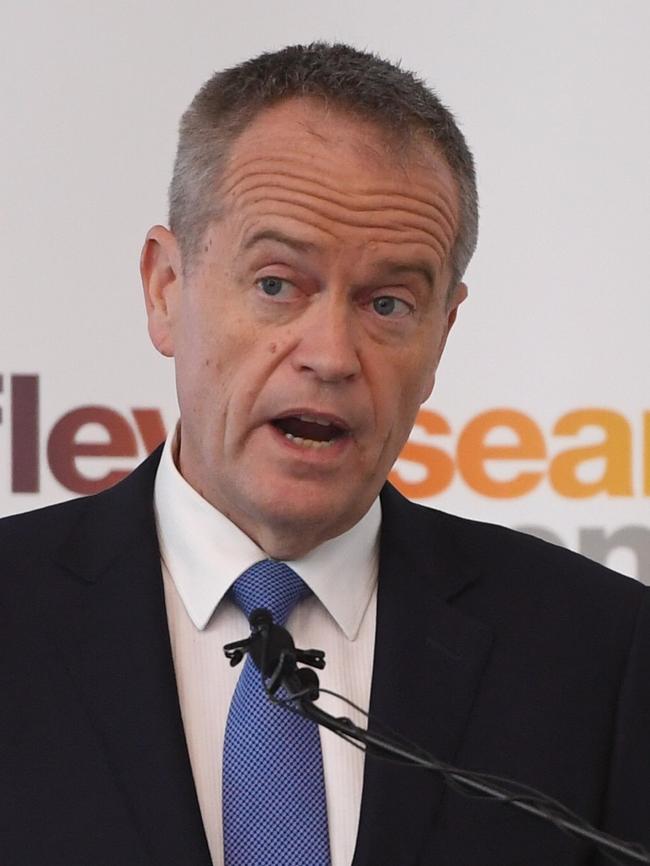

Labor leader Bill Shorten’s tax plan would ’cripple millions of retirees and pensioners’

BILL Shorten has accused Malcolm Turnbull of using pensioners as a “human shield” as the major parties battle it out over a tax loophole for investors.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

BILL Shorten has accused Malcolm Turnbull of using pensioners as a “human shield” as the major parties battle it out over a tax loophole for investors.

The Opposition Leader is staring down a fierce backlash to his plan to boost the federal budget bottom line by $11.4 billion by removing imputation dividend refunds.

“We’ll fight the scare campaign of the government — I’m going to choose the battler over the top end of town,” Mr Shorten told the Nine Network’s The Today Show this morning.

Mr Turnbull is using a few pensioners as human shields to justify featherbedding the very rich who are getting a tax loophole which is unsustainable.”

His comments came after former Treasurer Peter Costello warned millions of retirees and pensioners will be hit by Bill Shorten’s plan to axe tax refunds on share investments which has opened up a new political battlefield with the Coalition.

More than 230,000 pensioners will be impacted by Mr Shorten’s move to abolish dividend imputation refunds — cash for tax credits — received by shareholders and super funds, with internal government figures showing more than half of those who receive a credit refund have a taxable income below the tax-free threshold of $18,200.

Its modelling also shows about 97 per cent of Australians who will be affected by the move have a taxable income of below $87,000.

Mr Costello, who as treasurer introduced refunds for surplus tax paid on dividends in 1999, said even a low-income earner with a small investment income would be “worse off”. “If Mr Shorten’s proposal goes through, their tax refund will be taken by the government,” he told The Daily Telegraph.

“They will be worse off. This will affect millions of retirees, age pensioners and part pensioners.”

The dividend imputation policy will form a crucial battleground between Prime Minister Malcolm Turnbull and Mr Shorten.

READ MORE

EDITORIAL: RETIREES IN BILL SHORTEN’S SIGHTS

WHAT LABOR’S DIVIDEND CHANGES WOULD MEAN FOR YOU

The Turnbull government will claim Labor is asking grandmas and grandpas to bail them out of a budget blackhole, arguing the policy is in effect a double-taxation of self-funded retirees and pensioners.

The ALP leader says he is embarking on the most significant tax reform since the Hawke-Keating era.

Mr Shorten described dividend tax credits as “unsustainable tax subsidies that disproportionately favour a fortunate few” and are “unfair and unaffordable”.

“Tipping billions into exemptions and deductions for the lucky few is the same as ripping billions out of our schools and our hospitals,” he said.

“Every dollar our opponents spend on preserving exemptions for the top end of town is a dollar they cut from Medicare or education, or extract from Middle Australia in higher taxes, or indeed, they’ll just force taxpayers to pay more interest on the nation’s debt.”

Treasurer Scott Morrison rejected Mr Shorten’s suggestion the changes would only affect typically wealthier retirees and said it would “completely extinguish a vital income stream for low income earners”.

“This is a tax smack on more than a million Australians including 230,000 pensioners,” he said.

“If Labor were serious about preventing the distribution of refundable imputation credits on the basis that entities haven’t paid tax, why does their policy still allow ... franking credits to be refunded to income tax exempt organisations like trade unions?”

And despite Mr Shorten’s suggestions, shadow treasurer Chris Bowen last night told the ABC the new policy would affect 14,000 full pensioners and 200,000 part-pensioners and admitted implementing the changes would be “difficult”.

However, Mr Bowen and Mr Shorten yesterday received the backing of the man they consulted on the changes, former prime minister Paul Keating, who welcomed Labor’s return to the original system he designed in 1987.

“This did not include cashbacks for people whose average tax rate was below the corporation tax rate of 30 per cent,” Mr Keating reportedly said yesterday.

“The key thing is to make certain that company income is not taxed twice.”

Brian Penhall, 85, from Newport, estimates he will lose $6000 a year under Labor’s plan.

“I spend all that I earn, so I would have to start drawing down on my capital,” he said. “I would be typical and I would lose 30 per cent of income made from my managed funds. This continual revisiting of the rules has to stop.”

- with additional reporting by Christopher Harris