Interest rate hikes will put more than one million Aussies in mortgage stress by Christmas

MORE than one million Australian households will be in mortgage stress by Christmas as they struggle to deal with banks hiking interest rates, rising living costs and low wage growth. Data released reveals eight of the ten postcodes suffering are in Sydney. See if you will be affected.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

MORE than one million Australian households will be in mortgage stress by Christmas as they struggle with banks hiking interest rates, rising living costs and low wage growth.

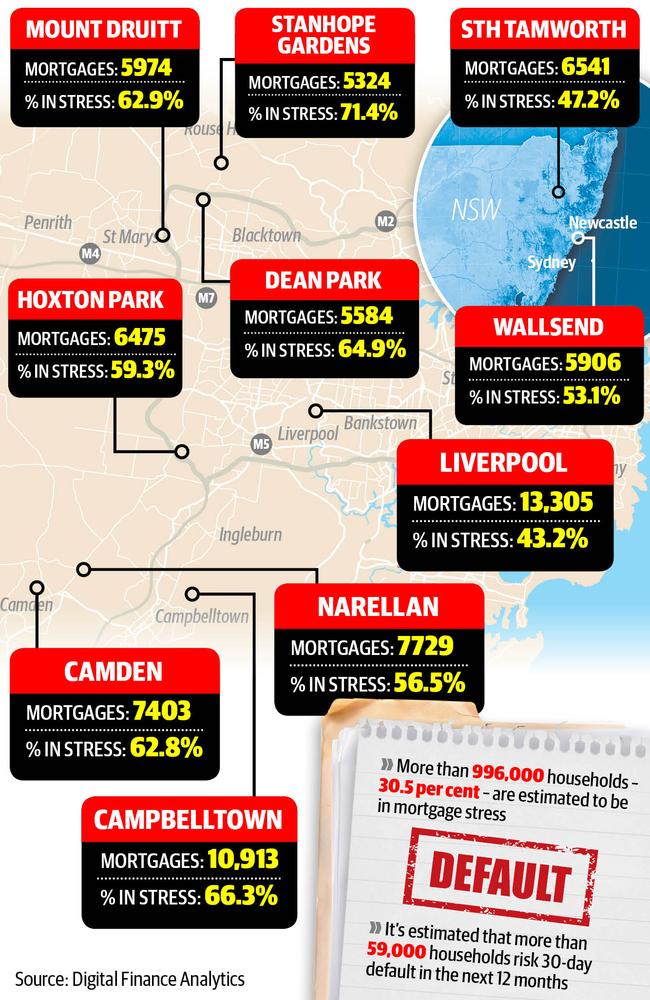

The number of households in stress — defined as when net income does not cover ongoing costs — is currently sitting at 996,000, or roughly 30.5 per cent of all owner-occupied houses in Australia.

And the principal of research group Digital Finance Analytics (DFA) Martin North is predicting mortgage stress rates will continue to rise this year, and may even increase at a faster rate once three of the Big Four banks increase their mortgage rates later this month.

MORE

How to get a better interest rate on your home loan

No home loan by 40? You may never get one

“My feeling is that this side of Christmas we are going to be hitting the one million (households suffering mortgage stress) mark,” Mr North said.

“Frankly the only get out of jail card is income growth, and I just can’t see where income growth is going to come from.”

Data from DFA has found eight out of the top 10 postcodes in NSW suffering from mortgage stress are in Sydney, with Campbelltown leading the way with 7234 households (66.3 per cent) with home loans under stress.

Mr North said continual rising living costs — including child care, school fees and fuel — were all adding pressure to homeowners in the “mortgage belt” located in the outer suburbs of Sydney. “There has been quite a spike in mortgage stress in NSW,” Mr North said.

“There is little wiggle room insofar as the only way they can solve this problem is to hunker down, pull money out of deposits … or put bills onto credit cards.”

Stanhope Gardens is the most stressed suburb in NSW, with 71.4 per cent of its 5324 households with home loans under duress. Campbelltown is a close second and Dean Park is third with 64.9 per cent of mortgage holders under stress.

During August 270,612 households in NSW were classified as in stress, with 15,768 at risk of mortgage default.

Mr North said the softening Sydney housing market, which CoreLogic said had fallen 5.9 per cent in the past year, was an additional worry. “As home prices are falling in some postcodes, the threat of negative equity is now rearing its ugly head,” he said.

Newly engaged Matt Hespe and Melissa Taylor recently purchased a duplex in Revesby after saving for nearly three years. They chose the area as it was cheaper than the coastal pockets of the Sutherland Shire, where they originally intended to buy.

“We were able to buy something a little bit bigger and much newer for a lot less,” Ms Taylor said.