On Tuesday when Bill Shorten proposed his changes to the dividend imputation system, hundreds of thousands of Australians began to wonder if the Labor leader’s plans would affect them.

Rival politicians and media commentators quickly branded the proposed policy a “tax hike” and a “$59 billion slug” on pensioners, retirees and low-income earners.

Many people were worried the announcement would make them worse off, but plenty more were unaware of what dividend imputation was and how it actually worked.

Retired Menai couple Ken and Jan Howell, aged 71 and 70 respectively, were fully aware of the changes and quickly calculated they stood to lose $8000 in franking credit refunds between them each year.

“We put a bit aside, and went without for years, thinking we had secured a better retirement - now the rules could be changed and it’s not fair, because we stand to lose $8000 a year

Mr Howell says Labor is committing “career suicide” by suggesting the changes, which would have a real impact on their quality of life.

“We put a bit aside, and went without for years, thinking that we had secured a better retirement, but now the rules could be changed and it’s not fair, because we now stand to lose $8000 (a year),” Mr Howell tells Saturday Extra.

The retired teacher met his wife Jan when she was a secretary at a school where he was working. Mr Howell says the proposed changes would force both of them to cut back on a lot of the luxuries in their lives.

“We will miss out on going to nice restaurants, holidays, and we can’t visit our grandchildren once a year in America,” he says.

“$8000 might not sound like very much but it is to people like us. It makes a considerable difference.”

Shorten’s proposed changes to franking credits stand to affect 1.2 million taxpayers across the country, along with about 200,000 people with self-managed super funds.

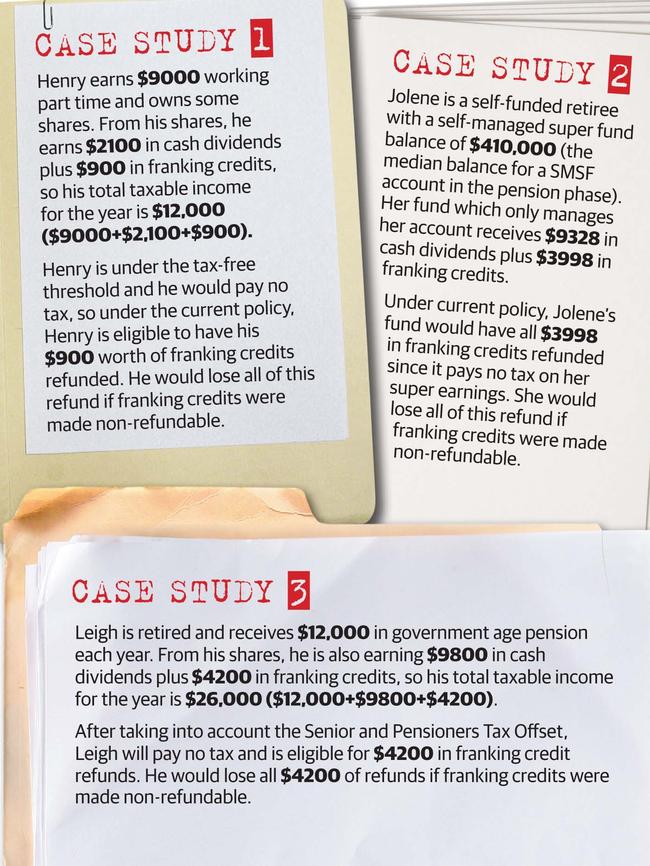

Paul Keating’s original form of the imputation system was to give a franking credit to a shareholder for tax paid at the company level, which would offset their tax liabilities. This was tweaked by John Howard in 2000, where certain taxpayers with a tax rate below 30 per cent could use franking credits to access a tax refund from the government.

Over the past 18 years the tweaked scheme has been a widely accepted part of the Australian financial system and has resulted in the number of self-managed super funds increasing to about 600,000 today.

Self-managed super funds are attracted to the tweaked policy because funds in the pension phase are tax-free, which usually means the total value of any imputation credits received can be claimed as cash refunds.

One-third of these self-managed super funds are now expected to be affected by the proposed changes, which if put into place would prevent them from receiving these franking credit cash rebates.

Labor’s modelling claims 50 per cent of these cash benefits paid to self-managed super funds are received by the wealthiest 10 per cent of these funds. Additionally, Labor says the top 1 per cent of funds received an average cash refund of $83,000.

This week’s announcement is consequently alarming and will create concerns for many retirees

Clime Investment Management managing director John Abernethy tells Saturday Extra that Labor’s proposed changes are “predictable” and “alarming”.

“This week’s announcement is consequently alarming and will create concerns for many retirees,” he says. “The proposed sledgehammer adjustment to the franking rebates will affect all pension fund returns (not just self-managed super funds).”

Independent economist Clifford Bennett agrees.

“It’s not a good idea to reduce the incentive and rewards for investing in Australia’s future,” he says.

“Share investment actually generates jobs. I thought he was with the Labor Party. The nation’s biggest long-term challenge is funding retirees. Why on Earth would you want to reduce people’s ability to look after themselves?”

Retirees such as the Howells, with a share portfolio that pays fully franked dividends, will lose out on their imputation cash rebates if the changes become law.

KPMG senior tax partner Grant Wardell-Johnson says making changes to franking refunds is a step in the right direction, but the money should be put towards other purposes, such as reducing the company tax rate.

Additional reporting by Danielle Gusmaroli, Chris Harris and Henry Lynch

Former council CEO stayed silent on job cut rumours: Inquiry

A former southwest Sydney council boss conceded he failed to de-escalate a rumour about mass job losses which led to a volatile protest where anti-Islamic chants against the mayor were made.

Parking pain: Business leader warns paid city meters ‘inevitable’

Paid parking is a “bad idea” that will hit workers and those struggling financially the hardest, warns a Port Macquarie business leader after council listed it as an option in a public survey.