RBA lowers official interest rate

THE decision by the Reserve Bank to cut the cash rate by 25 basis points to 3.25% on Tuesday has been described as “madness” by one independent economist.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

UPDATE: THE decision by the Reserve Bank to cut the cash rate by 25 basis points to 3.25% on Tuesday has been described as "madness" by one independent economist.

The RBA announced the cut on Tuesday on the back of slowing growth in China and continued economic weakness in Europe.

But economist Adam Carr tweeted the RBA's decision was madness, writing there was "no indication of where they will stop either".

Mr Carr said the possibility of further cuts later this year were difficult to forecast.

He wrote that the continued pressure to cut interest rates was regarded as terrible economic policy five years ago, but was now being embraced by monetary policy makers.

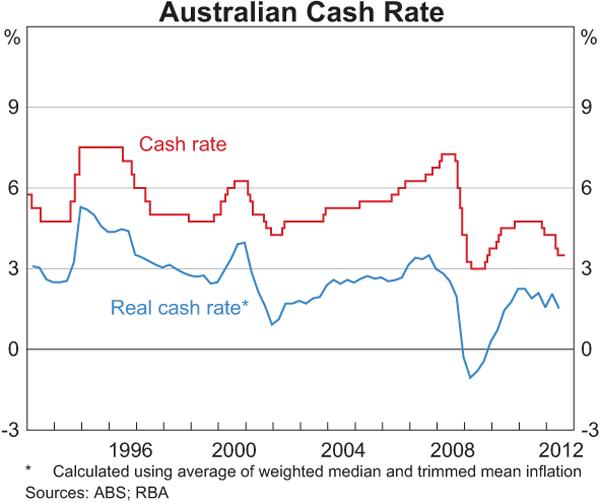

The cut was the fifth cut since October 2011, down a full 1.5% in the past year, and comes after a four-month hold on the cash rate.

But while global uncertainty was a consideration, the board wrote "Australian banks have had no difficulty accessing funding" - placing more pressure on the banks to lower variable interest rates.

Treasurer Wayne Swan said working Australians and small business owners deserved a cut to the cost of living, citing the government's "responsible budget management" as part of the reason for the RBA cut.

Mr Swan said the 3.25% cash rate was lower than any time during the last Liberal government, and it meant a family with a standard $300,000 variable mortgage were paying $4500 less each year than when Labor won government.

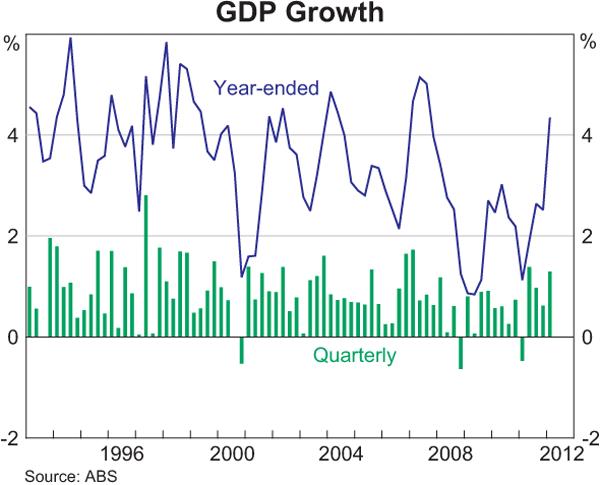

The board noted Australian growth was currently running close to trend, driven by "large increases in capital spending in the resources sector".

"Investment in dwellings has remained subdued, though there have been some tentative signs of improvement, while non-residential building investment has also remained weak," the board notes read.

"Looking ahead, the peak in resource investment is likely to occur next year, and may be at a lower level than earlier expected.

"As this peak approaches it will be important that the forecast strengthening in some other components of demand starts to occur."

The first bank to partially pass on the new rate was the Bank of Queensland, cutting its standard variable home and business loan rates by 20 basis points, effective October 19.

No cuts were recorded by deadline from any of the big four banks, Westpac, Commonwealth Bank, ANZ, or NAB.

The cut was welcomed by numerous industry groups including the Real Estate Institute of Australia.

WHAT YOU'LL SAVE:

How much people on a standard variable rate of 6.8% will save per month if the RBA cut is passed on in full:

- $250,000: $40 (new monthly repayments $1695)

- $300,000: $47 ($2035)

- $350,000: $55 ($2374)

- $400,000: $63 ($2713)

- $450,000: $71 ($3052)

- $500,000: $79 ($3391)

SOURCE: APN Newsdesk analysis.

2:34PM: INTEREST rates were cut by 25 basis points to 3.25% at the Reserve Bank of Australia meeting in Sydney today.

Despite some economists predicting the small cut, most were confident the bank would hold the cash rate at the October meeting.

In its decision notes, the board saw a softened outlook for the world economy, lower commodity prices and falls in the terms of trade.

The pressure on interest rates now moves to the big four banks to cut rates after the RBA announcement.

Originally published as RBA lowers official interest rate