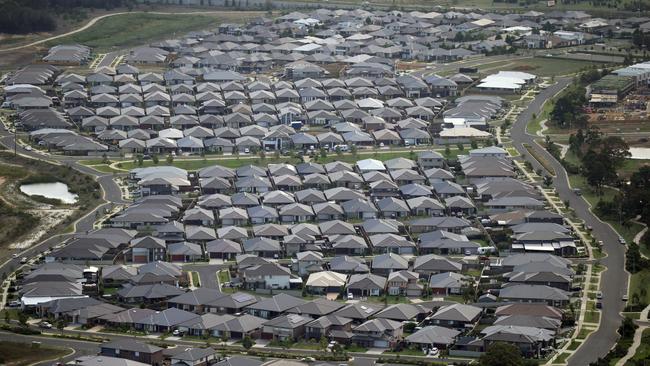

Foreign property buyers are pricing locals out of the market

EXCLUSIVE: Cashed-up foreigners are snapping up a staggering one in every 10 homes on the market in NSW — in an extraordinary raid on the great Australian dream.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Ban on foreigners buying entire apartment blocks

- Young househunters: Forget Sydney and ‘try Tamworth’

MORE than one in 10 residential properties sold in NSW are being snapped up by foreigners, according to new figures released under freedom of information laws, with a third of them bought by Chinese nationals.

The figures cover the period from July to September last year, after tough federal rules were introduced ensuring that foreign nationals declare purchases correctly.

They show that 11 per cent of all houses and units sold in that period across NSW were bought by foreigners.

With the vast majority of overseas buyers targeting the red-hot Sydney property market, the figure for Greater Sydney would be much higher but was not made available.

And it comes despite NSW introducing a 4 per cent foreign investor stamp duty surcharge in June last year.

Sources said last night that NSW Treasurer Dominic Perrottet was aware of the problem and would lift the surcharge in the June budget.

Opposition Leader Luke Foley will today promise that if Labor is elected it will lift the foreign investor stamp duty surcharge to 7 per cent — the same as Victoria — and double the new land tax on foreign investors from 0.75 per cent to 1.5 per cent.

“The great Australian dream is to own your own home,” Mr Perrottet said last night. “While foreign investment brings an important flow of capital into NSW, my priority is to ensure Australians have that opportunity first.”

The Chinese are by far the biggest group of foreign nationals snapping up our homes, on 33 per cent of the total, followed by the UK and New Zealand at 11 per cent and India at 10 per cent.

The next highest figures were Nepal and Malaysia (at 3 per cent) followed by purchasers from Korea, Vietnam, the US and Indonesia (2 per cent).

Over the three-month period last year, 2995 properties were sold to foreign buyers, raising $115 million in stamp duty. By comparison, $766 million in stamp duty was paid by Australian nationals in the same period.

The data also shows that 4.54 per cent of the purchasers had a different country as a tax residence.

NSW Federation of Housing Associations CEO Wendy Hayhurst said there was anecdotal evidence some investors were buying apartments as investments and then leaving them empty — a move which is obviously driving up prices.

This has recently prompted the Victorian government to introduce a vacant property tax, whereby anyone owning a property that lies vacant for six months or more will have to pay an annual tax of 1 per cent of the capital value.

Ms Hayhurst said research in Victoria had shown that as many as 20 per cent of homes are thought to be empty.

“The motivation I assume will be they don’t need the income [from rent] but this is an alternative investment for the spare cash they have, rather than putting in the bank or investing in the stockmarket,” Ms Hayhurst said.

Investors could buy properties, leave them “spanking new” and sell three to four years later for a tidy profit.

Related

Another reason foreigners might be buying property and leaving them empty is that although foreign people are normally given approval to buy vacant land for development and new dwellings such as house and land packages, home units and townhouses, there are restrictions on buying established properties.

Only foreign nationals who hold a visa that permits them to reside in Australia continuously for at least the next 12 months are given approval to purchase established residential real estate, but they are restricted from renting it out.

“(The demand) is focused on Sydney and Melbourne and city apartments,” Ms Hayhurst said. “The demand from Chinese ... investors is definitely increasing, but it is also increasing from people investing from the UK, US and New Zealand as well.”

Mr Foley said he wanted to create more of a level playing field.

“This is the next stage of what will be a comprehensive and smart approach to housing affordability,” the Labor leader said.

“Evidence suggests a surcharge on foreign investors will take some pressure off house prices and go a way towards levelling the playing field for first-home buyers.”

The figures reflect the start of the National Register of Foreign Ownership of Land Titles on July 1 last year.

In one transaction, buyers from New Zealand, Namibia and Malaysia paid $328,990 in stamp duty on one purchase worth about $3.5 million.

Under the foreign duty surcharge at present, a buyer paying stamp duty on a property worth $2 million would have to pay $95,490 plus 4 per cent on the $2 million, which would be an extra $80,000.

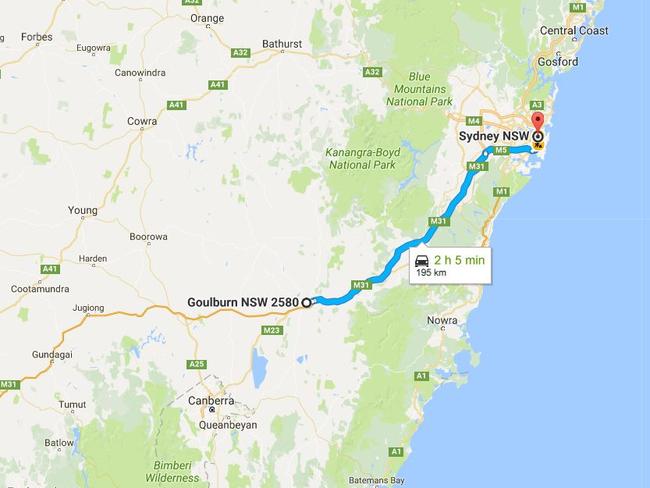

Work in Sydney ... Live in Goulburn

EXCLUSIVE

Miles Godfrey

THE NSW Business Chamber has accused the state government of being addicted to its whopping $9 billion a year stamp duty revenue, and says first-time home buyers may have to move to Wollongong or Goulburn just to get on the property ladder.

The shocking warning comes as Treasurer Scott Morrison told young couples to look more than 400km away — in Tamworth — if they want to buy a home.

“For young people who are thinking ‘can I buy a house in Sydney?’… there is an option if people want to take it in places like Tamworth,” the Treasurer said.

Business Chamber CEO Stephen Cartwright called on the state government to build fast transport to Wollongong, Goulburn and the Central Coast to ease Sydney’s housing affordability crisis.

There is no end to the pain in sight for first-time buyers, with Sydney property prices continuing to surge during the first months of 2017.

“The long-term solution is rapid transport. If you could get rapid transport from Goulburn, Central Coast, Wollongong to Sydney you would change the game,” he told The Daily Telegraph.

Mr Cartwright will tell a business lunch today, attended by Premier Gladys Berejiklian, that her government is “over-reliant” on stamp duty.

Meanwhile, the Sydney Business Chamber says proposed housing projects tangled in red tape must be progressed to help ease prices.

The Chamber’s Western Sydney director, David Borger, said there were major rezoning proposals caught in a backlog that could help the government’s push to improve housing affordability.

It’s not fair on us Aussies

FOR single mum Melissa Caruana, buying a home in Sydney is close to becoming a pipe dream.

The Western Sydney fitness instructor has dreamt of buying a house for her and her eight-year-old son Lucas for years, but is on the verge of giving up due to Sydney’s unrealistic prices.

“For me getting the kind of deposit I would need is pretty much impossible,” Ms Caruana, who runs her own fitness business, said.

Ms Caruana, who rents in Campbelltown, said more needed to be done to stop foreign investment.

“The people living in Sydney and Australia should be the priority,” she said.

“It’s not fair homes get bought by foreign buyers when people who actually live here can’t afford to buy.”