Federal Court issues record fine to three companies for costing clients $30m

Three dodgy companies have been fined a total of $75 million in the Federal Court, after more than 10,000 Australians collectively lost more than $30 million. ASIC described the companies’ business model as ‘exploiting vulnerable customers’.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The Federal Court has imposed a record $75 million fine on three dodgy companies for deceiving more than 10,000 Australians who traded complex contracts for difference (CFDs).

In a judgment that described clients as speculators seeking “heroin hits” from CFD trading and quoted senior managers as instructing underlings to “kill” their customers’ funds, Justice Jonathan Beach slapped derivatives issuer AGM Markets with a penalty of $35 million and related companies OTM and Ozifin were stung with fines of $20 million each.

It is the largest penalty in action brought by the Australian Securities and Investments Commission (ASIC), which had successfully argued the companies had broken corporate laws, including engaging in unconscionable conduct and providing unlicensed financial advice.

“This is really egregious,” ASIC head of markets enforcement Molly Choucair told The Saturday Telegraph. “The entire business model was directed at exploiting vulnerable customers.”

MORE NEWS

Court shuts down Sydney’s ‘Messiah’

Sports journalist’s life saved by speedy CPR

Fashion Week is back! Aussie designers given a lifeline

Justice Beach said the theoretical maximum penalty from the volume of contraventions was “enormous” — for AGM it was $27 billion, and it was $13 billion each for the other companies.

However, he said that because the companies were in liquidation, it was unlikely the fines would be paid to the federal government.

“Given that each of the defendants are being wound up, and in all likelihood are insolvent, any penalty fixed by me cannot be proved in the liquidation of those companies,” he said.

But that wasn’t really the point.

“The fixing of a pecuniary penalty in such cases can be justified in circumstances where to do so will serve the purpose of general deterrence.”

He also ordered clients be refunded, while noting that they were unlikely to receive 100 cents in the dollar.

Australians lost about $30 million trading with the companies.

“They were unsophisticated and ill-informed speculators,” Justice Beach said.

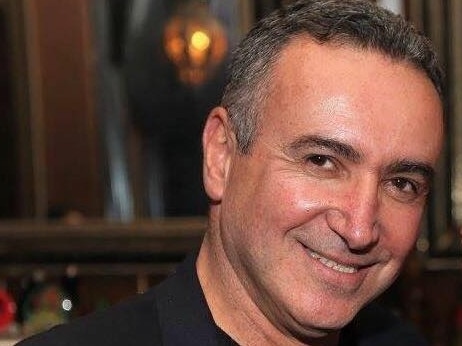

The judge condemned the behaviour of AGM’s sole director, Yossi Ashkenazi.

“There was a failure by Mr Ashkenazi, as the person charged with responsibility for AGM’s compliance with the financial services laws, to understand what was required of AGM and its representatives to discharge its obligations as the providers of financial advice to retail clients,” he said.

Mr Ashkenazi did not respond to a request for comment.

The “controlling minds” behind OTM and Ozifin were overseas, Justice Beach said.

He noted Australian derivatives issuers were now holding more than $2 billion of retail client funds and that ASIC has flagged moves to significantly curtail CFD trading using its product intervention powers.

“If I may say so, there is considerable merit in ASIC’s proposal,” the judge said.