Families on an average wage of $86,000 can afford to buy a home in cheapest suburbs

Falling prices have made homes across much of Sydney affordable again for middle-income families. It comes after prices dipped below the middle-income mortgage-stress threshold over the past year. SEE HOW MUCH YOU’LL NEED TO BUY A HOME.

Falling prices have made homes across much of Sydney affordable again for middle-income families.

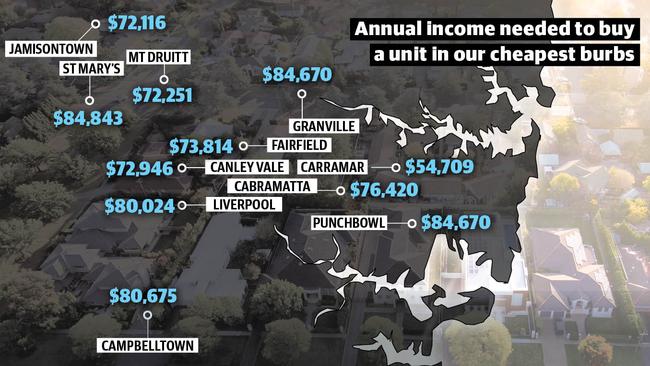

Homes in western suburbs like Kingswood, St Marys, Liverpool, Granville, Punchbowl and Harris Park are back in reach for families on Sydney’s average wage of about $86,000 a year.

Typical properties in those areas went beyond the budgets of average wage earners when prices hit a peak in mid-2017 — and the required mortgage repayments on a median-priced house would have eaten up more than a third of the buyer’s income.

Such a situation, known as “mortgage stress”, generally precludes banks from issuing a loan.

But prices have dipped below the middle-income mortgage-stress threshold over the past year.

MORE NEWS

Paramedics ‘scarred’ by music festival call-outs

Animals Australia knew live export worker was ‘motivated by money’

Opal Tower fix may reduce floor space in some units

For instance, a couple on as little as $27,354.50 each or $526 per week — a combined income of $54,709 — could buy a property in Carramar.

Demographer Bernard Salt said the improved affordability was a welcome change, particularly for Millennials who had lost hope of buying when the market was booming.

“Prices were rising faster than they could save and faster than their wages were increasing,” Mr Salt said. “It’s now moving in reverse … more young Aussies can get into the market if they have the willpower to save.”

Granville had one of the most notable improvements for buyers, analysis of mortgage data and CoreLogic median prices shows.

A typical Granville apartment which cost about $542,000 in 2015 now costs $487,500.

A buyer using a loan with a 4.8 per cent interest rate, with a 20 per cent deposit, would pay just over $2000 a month in mortgage repayments — which would be considered affordable on an $86,000 a year salary.

The median price of a Punchbowl unit fell from $531,000 in mid-2017 to $487,500 now, while the Liverpool median unit price has come down from $505,000 to $460,750.

Suburbs in Sydney’s inner west recorded even bigger price drops and, while they remain largely out of reach for average earners, look set become to more affordable soon.

The median apartment price in Newtown fell 18.4 per cent from $817,250 to $666,500.

First-home buyers have capitalised on the lower prices, with ABS mortgage data showing first-time buyer participation in the market hit a six-year high at the end of 2018.

Thomas Latty, 21, was surprised to find he could afford a deposit. He recently returned from a European holiday with some leftover cash and, after checking prices for units in Penrith development East Side Quarter, realised he could afford to buy right away.

“I’d thought it would take me a few more years,” Mr Latty said.

Reinald Struwig and Natalie Byrne recently bought their first home in Marsden Park after consulting with Smartline broker Michelle Schaafsma and realising their dream of home ownership was more within reach than they realised.

“The market wasn’t overly competitive,” Mr Struwig said. “It felt like we were in a good position as first-home buyers.”

Urbis economist Alex Stuart said buyers were benefiting from a drop investor activity, which was the primary driver of the boom in prices from 2014-17.

Investors have been struggling to get financing due to a clampdown on investment lending.

“First-home buyers are not up against as many other buyers anymore,” Mr Stuart said.

“First-home buyers are also getting a lot of help from (government stamp duty) incentives and that’s made a huge difference.”