Cowper candidates reveal their thoughts on taxation

The people chasing your vote on the Coffs Coast have their views on how your hard earned tax dollars should be spent. See what’s cooking.

Coffs Harbour

Don't miss out on the headlines from Coffs Harbour. Followed categories will be added to My News.

With so many retirees - pensioners and self-funded - on the Coffs Coast, it was no surprise that many were rattled at the last federal election by policies to clamp down on negative gearing and franking credits.

In the wake of defeat at the ballot box, Labor pulled them from the table, yet taxation issues remain front-of-mind for local residents.

In the final week of the campaign, money matters have emerged - with prime minister Scott Morrison outlining plans that would allow some to dive into their superannuation nest egg to stump up for a first home house deposit.

That will be attractive to many in Coffs Harbour where housing affordability has nosedived, driven in part by an influx of Covid refugees from the metropolitan centres.

But it’s argued that any scheme which stokes housing demand will see only further increased property prices.

This week we put a taxation question to the candidates chasing your vote in the local seat of Cowper.

Q: At the last federal election, negative gearing and franking credits were front of mind. There’s a luxury vehicle tax threshold which affects country people who need a decent 4WD. Do we need government incentives for electric vehicles? What’s your view on taxation and what needs to change?

Keith McMullen, Labor

Labor has no plans going into this election to change negative gearing or franking credits.

An exciting plan that Labor does have however is to introduce an electric car discount which will make electric vehicles cheaper by removing certain taxes from low emission vehicles.

The aim is to see 90 per cent of all new vehicles to be EVs by 2030.

My own personal view, which I‘ll be taking to the party room if elected, is that there are grounds for examining the tax evasion loopholes that some of the bigger corporations and businesses use to avoid paying their fair proportional amount of taxes.

I would also examine the tax rate that many of these large corporations pay to see if their contribution to Australia’s public finances fully benefit the country.

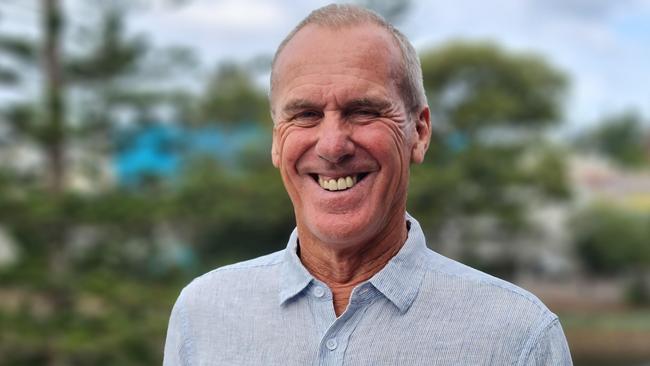

Caz Heise, independent

As a true community independent not aligned with any political party, my focus will not be on developing taxation policy.

It is not an area of expertise for me, but I am lucky in that within my core team are people who are working at the highest levels of taxation practice.

My role will be to ensure that all legislation presented about taxation policy is forensically and methodically analysed and its implications are fully considered before any vote is taken.

My focus will be on fully understanding how any changes to taxation policy will impact on people and businesses in Cowper.

Naturally I will support any changes which make taxation systems clearer and easier to understand.

Something we all need to understand is that taxation is the principal way by which the government raises the funds it needs to keep the country running.

Therefore any cut to personal or business tax has potentially huge implications on how much money any government has available to deliver necessary services and infrastructure.

Given the staggering deficit, I would seek expert advice and consult with the Cowper community about whether the legislated Stage 3 tax cuts should proceed.

They will cost the incoming government more than $22 billion in the first year, which is as much as what is spent on the Pharmaceutical Benefits Scheme and 50 per cent more than spending on higher education.

The rapidly changing nature of the national and global economies dictates there are no simple answers to questions about taxation.

Tim Nott, Greens

The Greens focus is ensuring each person and entity pays their fair share of tax. Starting with the largest corporations and billionaires.

A flat rate of tax will stop avoidance of tax using loopholes. This is to ensure users pay for the functioning of our country they advantage from.

It’s also designed to ensure a mining and agriculture boom will advantage Australians and be capitalised on.

Negative gearing is not the only policy artificially increasing housing prices. I prefer a staged approach for tax changes, eventually removing the ability to negative gear two properties or more.

I support most recommendations from the Royal Commission into Banking being implemented.

My aim is provide growth and stability over the long term, encouraging planning and investment.

The recession low business investment in Australia over the past 10 years requires attention.

I will focus on growing small business by giving certainty in direction of our economy.

My focus is on the cheapest form of electricity, solar, wind and batteries.

I support incentives to increase the speed and number of electric cars in Australia. Our complete dependency on other countries for movement is a large risk to our economy and the cost of living.

About 70 per cent of oil comes through between China and Japan. We need to change this dependence to protect our economy, national security and way of life.

I do not support the current policy to lower high income tax. Giving a benefit to high income people is not my priority at this time.

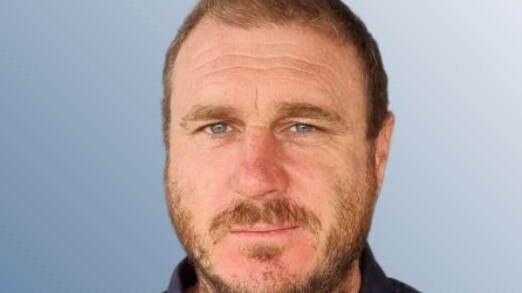

Simon Chaseling, Liberal Democrats

The Liberal Democrats have a policy of introducing a flat tax rate of 20 per cent on all income over $40,000, for both corporate and personal tax.

This would coincide with a simplification of the taxation system that would remove taxation loopholes used by large income earners to avoid taxation.

This policy would create a huge incentive for both individuals and companies to increase productivity, invest, employ, and would revitalise Australian manufacturing and industry, ending in a nett increase in tax revenue over the long term.

We need to think long term, and develop strategies to place Australia as an enterprising, producing and prosperous nation into the future.

A simple business and personal income friendly tax system is the best way to ensure this is the path Australia takes, and that our tax system receives the revenue needed to provide strong government services whilst not penalising hard work and industry.

* The other three candidates for Cowper were invited to participate.