Cashless society would cut off thousands of Australians from their finances, advocates warn

With bank branches and ATMs shutting down at an alarming rate, experts reveal elderly Australians wouldn’t be the only ones to suffer from a cashless society.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

A cashless society would leave thousands of Australians cut off from their finances and heap anxiety on older generations who still rely on hard currency, amid warnings the shutdown of ATMs and bank branches could increase financial abuse of the elderly.

Cuts to physical banking services risked alienating people who still relied on them daily, NSW Council on the Ageing chief executive Meagan Lawson said.

“There are groups of people who would be able to manage within a cashless society but there’s a group of older people who are digitally disadvantaged and who don’t have the skills to use particular technologies,” she said.

“It does make it easier for elder abuse to happen because you are handing over the control of your money to someone else. It takes one extra level of control away from the older person.”

She said the problem wasn’t just limited to the bush, although regional Aussies were hit harder by closures of their local bank branches.

“It’s not just regional and rural communities that struggle with this, but it is harder for them. For example, if you live in Kings Cross, you can just pop over to Darlinghurst if your bank closes to do your banking. You can’t do that in the regions,” she said.

Mayor Phyllis Miller of Forbes Shire Council, in the state’s central west, said the bush still struggled with basic internet accessibility, making physical services crucial.

“A cashless society would be fine, but we haven’t even got good digital connectivity in Forbes. Let’s put that on the table. They need to fix that up before they do that,” she told The Telegraph.

“Seniors are struggling. They’ve grown up with going into the bank and getting large amounts of money out for the week and not living the digital life.”

National Seniors Australia chief advocate Ian Henschke warned that banks “shouldn’t neglect the needs of older Australians”, with hundreds of thousands of Aussies still using bank books in some capacity.

“Half a million Australians are still using bank accounts not connected to debit cards, and these are not just seniors. There’s the 10-year-old who receives $50 each birthday from grandma and grandpa for their bank book as an example,” Mr Henschke said.

“You have to recognise that there are Australians still out there with bank books. How do you explain to an 88-year-old, who has never worked with a computer, who has always gone to the bank to get cash out (that they need to go digital).”

A spokesman for the Commonwealth Bank, which has the most branches in Australia, said “a lot of investment is still going into physical banking”, including a partnership with Australia Post to provide banking at post offices at 3500 sites.

“We recognise that we need to maintain physical banking services,” he said.

Harry Peadon, 82, and wife Helen, 79, said they relied heavily on their local bank branch in Bombala in the state’s south for cash and services.

“We prefer to do our banking face-to-face,” the couple said. “It is annoying, especially when you have to drive 80km to find a bank.”

Randwick’s Penny Nelson, 79, said: “I certainly do not want to have to do my banking on my mobile phone.

“I’d be upset if my local branch closed. It’s ruined some local and regional towns,” she said. “A decision to be cashless would leave out people who can’t afford an internet connection or device.”

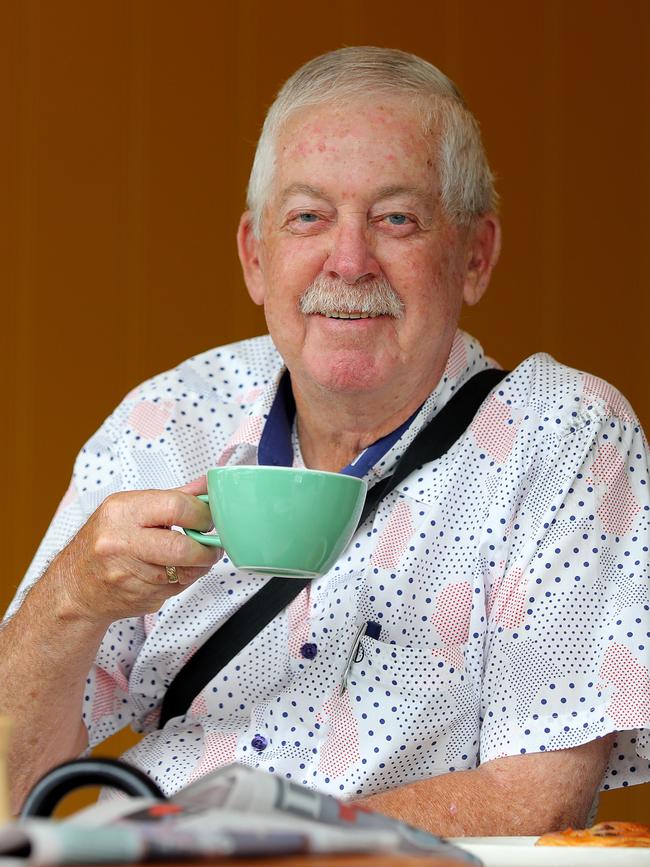

Peter Greenwood, 78, uses cash for everything except his groceries, but was confident he’d “get through” if physical services were further reduced.

“I have one lot of friends who only use cash and wouldn’t use anything else,” he said.

The Australian Banking Association said they are focussed on combating and preventing elder financial abuse.

“Our elderly Australians have worked hard over many years and deserve to live out their later years with dignity, respect and financial independence,” ABA chief executive Anna Bligh said.

“Banks have put in place a number of initiatives to assist with the prevention of elder abuse including the development of an industry guideline preventing and responding to financial abuse (including elder financial abuse), training staff to recognise red flags on transactions and providing digital tools and systems to help customers manage accounts, such as ‘two to sign’ arrangements, pre-set digital and card limits and transaction notifications.”