Budget 2020: Sydney roads, NSW regional highways upgraded

The federal government will pour millions of dollars into major NSW roads over the next four years, under a plan to boost employment in the wake of the pandemic. SEE THE PROJECTS HERE

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

NSW will chart a course out of the coronavirus recession with a $2.7 billion spend on shovel-ready road and infrastructure projects tipped to create more than 8,000 jobs across the state.

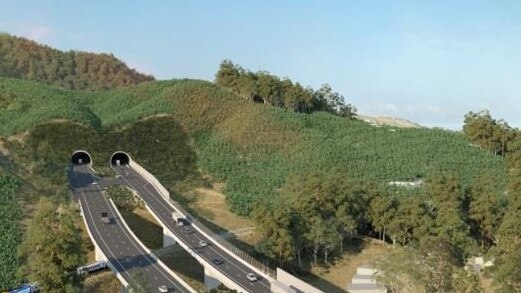

The federal government will pour millions of dollars into major NSW roads over the next four years, including $560m for the Singleton Bypass on the New England Highway, $360m for the Newcastle Inner City Bypass and $120m for the Prospect Highway upgrade, under its plan to boost employment in the wake of the pandemic.

The huge infrastructure spend will underpin a locally lead recovery strategy, in the hopes driving down unemployment will fuel consumer confidence and boost demand in service sectors hit hard by restrictions including tourism, hospitality and retail.

MORE NEWS

Government COVID-19 advice to aged care homes ‘insufficient’

Call to bring personal tax cuts forward in budget

Conservation and tourism to get big boost in federal budget

In Sydney commuters will benefit from a $60m upgrade to the M1 North Smart Motorway between ANZAC Bridge and Warringah and $94m for the Heathcote Rd upgrade between Hammondville and Voyager Point.

Regional NSW has also received a boost, with $4.6m to upgrade Pooncarie Rd in the state’s far south west, $7.8m for the Northern NSW Inland Port at Narrabri and $3m to improve Coffs Harbour Airport freight access on Hogbin Dr.

Various sections of the Newell Highway have been green-lit for new funding, with $149.7m for the Parkes Bypass, $176.2m for the Dubbo Bridge, $205.7m to go toward heavy duty pavement upgrades along the highway and $60m for more overtaking lanes.

The government has also earmarked $15m for “planning” of faster rail between Sydney and Newcastle.

In addition to the new projects, about $732.3m will be provided to ongoing builds, including $490.6m for the Coffs Harbour Bypass.

Funding top ups for other road projects include $43m for Bolivia Hill on the New England Hwy, $46.4m for Mulgoa Rd, $63.5m for Dunheved Rd at Penrith and $16.7m for the Central Coast Roads Package.

The federal government will also tip $13.8m into a commuter car park upgrade at St Marys along on the T1 North Shore, Northern and Western Line, as well as $7.1m at Campbelltown, $3m at Revesby and $1m at Riverwood on the T8 East Hills Line.

Prime Minister Scott Morrison said the 2020-21 Budget, to be unveiled tomorrow would deliver infrastructure funding that supports the federal government’s “JobMaker” plan and help NSW recover from COVID-19.

“We have been working closely with state and territory governments to invest in the infrastructure that is ready to go and can help rebuild our economy and create more jobs,” he said.

“These projects will keep commuters safe on the road, get people home to their loved ones sooner and provide better transport links for urban and regional communities.”

Mr Morrison said the government’s investment in infrastructure in NSW since the pandemic hit had now totalled $5bn.

“This latest investment will provide another boost to the local economy and is part of our plan to support an estimated 8,000 direct and indirect jobs across the state,” he said.

Economists have predicted the government will deliver a budget deficit of about $240bn tomorrow – an unimaginable figure prior to the pandemic when a $5bn surplus was forecast.

But despite the eye-watering figure, the government last month signalled it would not be focusing on any budget repair measures until unemployment, which is now expected to peak just below 10 per cent at the end of the year, is “comfortably” below six per cent.

Large-scale infrastructure projects will be key to the government’s job creating goal, with major road projects among the most likely to be able to start construction in the coming months and years.

Deputy Prime Minister and Infrastructure, Transport and Regional Development Minister Michael McCormack said the $2.7bn spend in NSW was focused on boosting jobs across all communities.

“We will draw on local businesses to stimulate local economies through these projects,” he said.

“Infrastructure means jobs, it means livelihoods, it means stronger local communities and it means building a better and more secure future for our nation.”

Population, Cities and Urban Infrastructure Minister Alan Tudge said the cash injection would give businesses the “certainty” needed to ensure long term recovery.

“We will continue our commitment to NSW in the coming years, through projects such as the Western Sydney International (Nancy-Bird Walton) Airport and new congestion-busting upgrades,” he said.

The federal government on Sunday unveiled a $1.2bn wage subsidy scheme that means, from Monday it will cover half the cost of any apprentice or trainee a business takes on for the next year.

It has also announced more than $60m in funding to spruce up national parks and heritage sites in a bid to attract tourists to domestic locations while international borders remain firmly shut.

The government is also banking on domestic border restrictions easing in the coming months, with the resumption of interstate travel expected to further boost the tourist-reliant regions and industries.

The budget is widely expected to include some form of personal income tax relief, with the door left open for cuts slated for 2022 and 2024 to be brought forward.

Labor’s treasury spokesman Jim Chalmers said the budget needed to deal with the harsh realities of Australia’s economy currently.

“We need to see a budget which deals with weakness in the labour market in particular, but also makes sure that we‘re building something that lasts, and that we’re actually getting bang for buck for these trillions of dollars that the government is borrowing,” he said.

“We measure that effectiveness by what it means for jobs.”

NSW WILL LEAD NATION THROUGH COVID-19 RECESSION

THE return of public servants and office workers to Sydney CBD will revive the once-bustling city blocks as the rest of the nation looks to NSW to lead jobs creation in the economic fallout of the coronavirus crisis, Treasurer Josh Frydenberg says.

Speaking to The Daily Telegraph, Mr Frydenberg said NSW had been an “outstanding performer” during the pandemic and was better placed than the rest of the country to drive its recovery.

“As the biggest economy, as the biggest state economy the expectation and hope for NSW is that it will create thousands of new jobs,” he said.

“And this is particularly important because Victoria, the second largest economy, has been hit so hard by the second wave.”

Mr Frydenberg said he was confident jobs would return to the decimated Sydney CBD.

“The jobs in the CBD will come back as more people turn up at work, and we’ve seen that with the public servants starting to return to their offices,” he said.

But he foreshadowed there would be permanent changes post-coronavirus to the way Australians do business.

“I think there will be some structural changes in how people work across the economy, I think a rapid uptake of the digital economy, and e-commerce will impact on retail,” he said.

“The best businesses were the ones that combined the online offering and the bricks and mortar shopfront.”

CAPITAL GAINS FIX FOR GRANNY FLATS

FAMILIES who add a granny flat to their home for an elderly parent, relative or friend will be exempt from capital gains taxes if they formalise the living arrangement.

The Daily Telegraph can reveal the federal government will waive the tax for granny flats built for someone of pension age who has a family or personal connection to the homeowner, saving money for mum and dad investors, as well as providing the elderly greater security.

Many homeowners avoid creating a legally enforceable agreement with a grandparent or parent to live in a separate room or unit on their property due to the tax, which can leave the elderly vulnerable to financial abuse or exploitation.

Under the changes, if a couple built a $125,000 granny flat they would no longer potentially be liable for up to a $62,500 capital gain each.

Treasurer Josh Frydenberg said removing capital gains tax for granny flats would benefit seniors and boost the economy.

“In addition to the government’s other housing initiatives, removing capital gains tax on granny flat arrangements will support the industry and create jobs at a time when the economy and the sector needs it most,” he said.

About 672,000 elderly Australians already live with extended family, with the changes expected to be eligible to more than 3.9 million people of pension age as well as more than 4 million Australians with a disability.

The change is due to kick in on July 1 next year, subject to the passing of legislation.

National Age Discrimination Commissioner Kay Patterson said with more families creating formal granny flat agreements, the elderly would be better protected in the event of a marriage breakdown, death or other unexpected disaster.

“There are a lot of people who have actually lost their homes in the fallout of an event like that,” she said.

“When you’re 80 and you lose your house, it’s a major impact on your life.

“This reform a fairly simply thing that removes the disincentive of having a written agreement with your family about your living arrangements,” she said.

Lawyer Rebecca Tetlow, who is an accredited specialist in wills and estates law, said Centrelink actively encourages families to formalise granny flat agreements so the money an elderly person hands over isn’t considered a “gift” as part of the pension assets test.

“But then when families try to do the right thing, I have to advise them it may actually be a capital gains tax event ... so this will address that,” she said.

BUDGET DEFICIT AMOUNT DEPENDS ON VACCINE

Spending, debt and deficit forecasts in the federal budget will be based on the assumption a COVID-19 vaccine is found and rolled out around the world as soon as possible.

Treasurer Josh Frydenberg has confirmed “vaccine issues” have been factored into the assumptions underpinning the budget.

“We have factored in those issues, related to the vaccine, and again that will be available on budget night,” he told Sky News.

“The budget takes into account the possibility (finding a vaccine) is the case.”

It is widely assumed Australia will not be able to fully reopen its borders and resume normal life pre-coronavirus until a vaccine has been developed and distributed.

If the vaccine is slow to arrive or does not eventuate, the delay would impact the amount of revenue the government expects in tax receipts, as well as the cost of support measures to businesses struggling due to restrictions.

In the government’s economic update in July, the budget papers made several key assumptions about how the virus would continue to impact Australia and the speed at which it would recover.

Treasury officials assumed some form of international travel would resume by January 1 next year, and wrongfully hoped Melbourne would not end up in Stage 4 lockdowns at the peak of its second wave.

Mr Frydenberg last week signalled the extremely low overseas migration figures used in the July update would in fact be dropped even further for the full budget.

It comes as Deputy Prime Minister Michael McCormack pointed to the distribution of a vaccine as being integral to a broader “travel bubble” with Pacific nations, followed by the permanent reopening of all international borders.

“Let’s hope that a vaccine is available soon,” he said.

“Then every Australian that’ll be freely available to them and our Pacific friends as well.”