Budget 2019: How it will affect the economy

The Morrison Government has pulled the nation’s books out of the red and into the black, delivering the first Budget surplus in 12 years thanks to the soaring iron ore price and a healthier tax take.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The Morrison government has pulled the nation’s books out of the red and into the black, delivering the first Budget surplus in 12 years thanks to the soaring iron ore price and a healthier tax take.

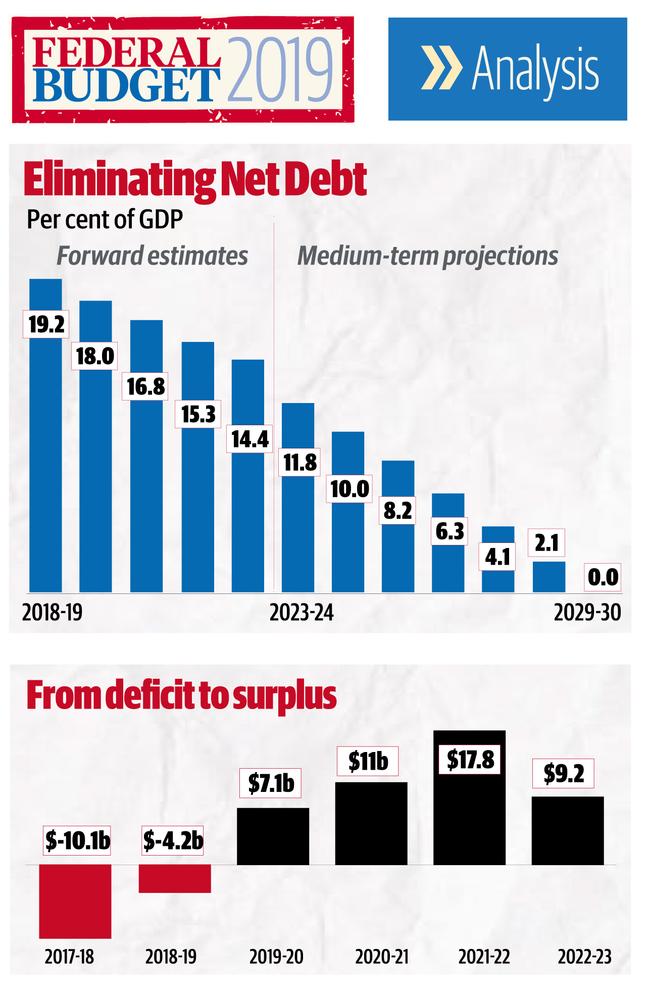

The leap into the black is almost double what Treasurer Josh Frydenberg estimated it would be just three months ago, coming in at $7.1 billion — significantly more than the $2.2 billion forecast last Budget.

“For the first time in 12 years, our nation is again paying its own way,” Mr Frydenberg told parliament last night in his first Budget speech.

“We have made real progress, but we know the job is not done. Australia is stronger than it was when we came to government six years ago.”

The unexpectedly positive outlook comes on the back of a healthier business climate, with more companies in profit and paying more tax and a surging iron ore price driving up royalties. Since Mr Frydenberg put out his major economic statement in December iron ore had surged from trading at $US51 per tonne to $US81.

Twenty-eight consecutive years of economic growth, more people finding work and fewer people on welfare had all helped underwrite the result, Mr Frydenberg said.

Government coffers received an extra $9 billion from company and resources rent taxes to hit $101.9 billion, while having more Australians in work meant a boost of $11.2 billion in the amount workers paid the taxman.

The surplus is forecast to climb to $11 billion next financial year and $17.8 billion in 2021-22.

“(This is) a $55 billion turnaround from the deficit we inherited six years ago,” Mr Frydenberg said.

Mr Frydenberg said while that adds up to $45 billion in surplus cash over the next four years, the economy will be under pressure from slowing global growth and, at home, drought and falling house prices. “And every one of us wants to see wages growing faster.”

He said the books return to the black without higher taxes, and with the tax take, as a proportion of GDP, staying under 23.9 per cent until 2029-30.

The economy is forecast to grow by 2.75 per cent in 2019-20 and will get a boost from the government’s $100 billion infrastructure spend.

Total revenue in 2019-20 is $513.8 billion, a 3.6 per cent jump. This year’s surplus equates to 0.4 per cent of gross domestic product.

SOMETHING BORROWED MAKES US ALL FEEL BLUE

Josh Frydenberg has declared war on debt, saying the interest cost alone on this year’s bill could have built more than one new school a day for a year.

Armed with a Budget in surplus, the Treasurer has set his sights on paying down the nation’s debt, which this financial year peaked at $373 billion. The interest bill on gross debt was a whopping $18 billion over the past financial year, he said.

“This is money that could have built 500 schools or a world-class hospital in each state and territory. We are reducing the debt and this interest bill,” Mr Frydenberg said.

His aim was to wipe out the sea of red in government borrowings by 2030.

“As we climb the mountain and reach our goal of eliminating Commonwealth net debt by 2030 or sooner. This matters because over the past year, the interest bill on the national (gross) debt was $18 billion,” he said.

The bill would have been bigger had interest rates been higher, coming during record low interest rates, the Treasurer said.

Net debt has almost doubled since Tony Abbott was elected prime minister in September 2013 and the interest bill on that debt has climbed from $10.84 billion to $14 billion in 2018-19.

Net debt is the amount the government owes in borrowings after accounting for assets like the Future Fund.

Net debt, while falling steadily over the forward estimates, is still huge, at $361 billion in 2019-20 and dropping to $326 billion by 2022-23.