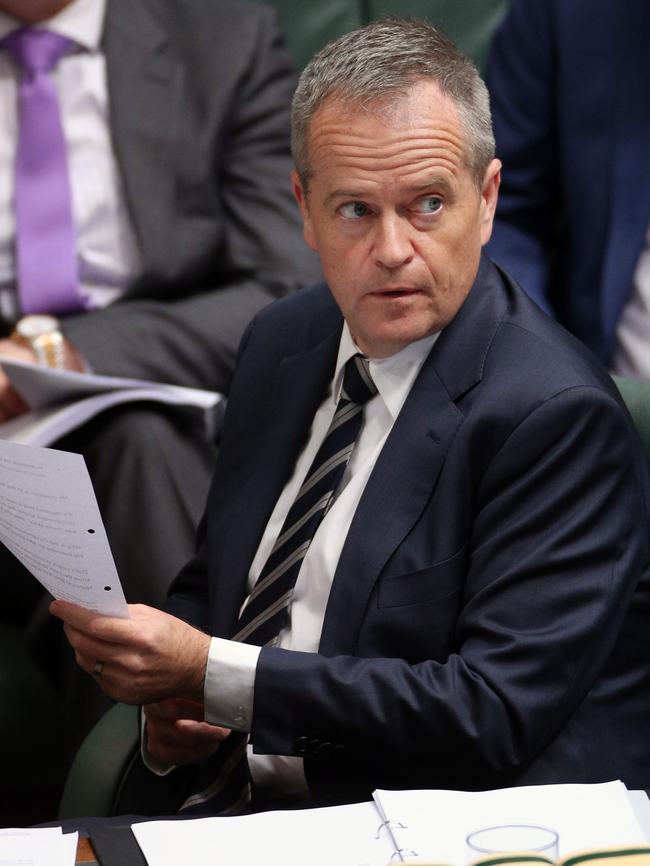

Bill Shorten to overturn Malcolm Turnbull’s tax cut plans if he wins the next election

LABOR would ramp up a $20 billion tax grab on 14,000 small and medium businesses if it wins the next Federal Election and makes good on its threat to repeal the Turnbull Coalition government’s company tax cut.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

LABOR would ramp up a $20 billion tax grab on 14,000 small and medium businesses if it wins the next Federal Election and makes good on its threat to repeal the Turnbull Coalition government’s company tax cut.

Federal Treasurer Scott Morrison last year successfully navigated a cut in the company tax rate from 30 per cent to 25 per cent for businesses turning over less than $50 million annually, but Labor leader Bill Shorten yesterday confirmed those changes would be overturned if his party came to power.

The policy has yet to make it through Shadow Cabinet, and hasn’t been put to Labor MPs, leading to some disquiet in the party while also allowing Prime Minister Malcolm Turnbull and Mr Morrison to lead attacks on Opposition Leader Mr Shorten as the “snake of envy”.

And Labor has yet to decide whether to leave the tax cuts in place for businesses turning over between $2 million and $10 million annually.

MORE:

Abbott’s threat to vote against Turnbull

Cecilia Haddad’s ex officially a murder suspect

The new video chat app parents need to know about

Mr Morrison yesterday put the extra cost on small and medium businesses at about $20 billion over a decade, with the changes expected to impact at least 14,000 companies.

“This is a snake and ladders game under Labor,” Mr Morrison said.

“It used to be the ladder of opportunity and now it’s the snake of envy under Bill Shorten.

“This is terrible news for 1.5 million Australians who work in those businesses.”

A Labor spokesman said the party had “never supported these tax cuts for big businesses — we voted against them and we haven’t changed our position.

“As Bill said, we’re considering a threshold of $2 million or $10 million turnover,” he said.

“That will be decided by the Shadow Cabinet, in the normal way.”

If the tax cut repeal was extended to the lower threshold, it would affect 94,000 businesses employing more than 3.3 million workers.

But Labor faces a Senate roadblock even if elected, with many of the key crossbenchers who supported the small business tax cut last year — part of the government’s $65 billion corporate tax plan — vowing to stand by the policy and refusing to repeal it.

The government is now attempting to pass its entire tax package, extending the cuts to larger companies, but has so far failed to secure the support of One Nation and Centre Alliance. Australian Chamber of Commerce and Industry boss James Pearson said it was a “big kick in the guts” from Labor.

“This is precisely the wrong signal to send to the Australian business community … these are not big businesses,” he said.

Business Council of Australia chief executive Jennifer Westacott said Labor’s decision was “very damaging” to business confidence.

“How do you plan your business when someone says they’re going to reverse tax cuts that have already been legislated by the Parliament … how does business do its planning,” she said.

“We have to come to terms in this country with the fact that we are falling behind the rest of the world in our competitiveness, that there are many businesses in that mid-size that really need that tax break and this announcement today is another blow to businesses to be able to plan their future.”