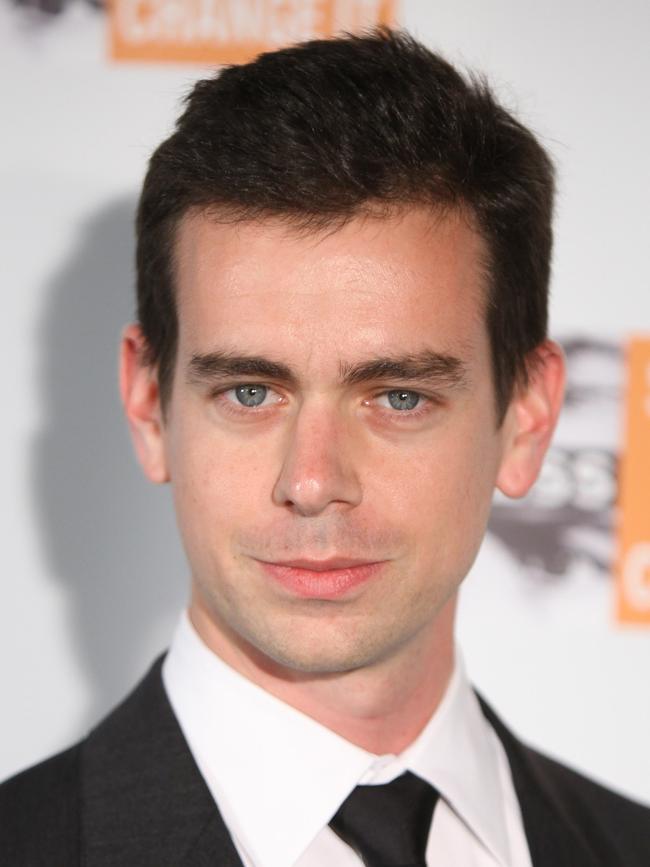

Aussies paying $140 a year in card and mobile payment surcharges that go to banks and Jack Dorsey’s Square

We are now paying $140 a year each in surcharges for the privilege of buying a coffee or sandwich using a card or mobile. It’s great for Twitter founder Jack Dorsey. Not so great for your budget.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Australians are now forking out an average of $140 a year each in surcharges when they pay with plastic or their phone.

All up, the price of leading the world in making electronic transactions can be revealed to have risen by $400 million last year to a whopping $4 billion, according to analysis by comparison service Canstar.

The bulk of that bill is hidden in sticker prices, which retailers have secretly increased to recover their growing cost of acceptance.

But more and more merchants – especially cafes and restaurants – are choosing to put a fee on top.

The proportion of food and drink businesses applying surcharges rose from 42 per cent to 47 per cent in the six months to January, new data from payment terminal provider Tyro shows.

“Hospitality is a hotspot,” said industry expert Brad Kelly, whose analysis produced the $140 estimate.

Mr Kelly, the managing director of Sydney-based consultancy Payment Services, said consumers’ surcharge costs are rising at 10 to 15 per cent a year.

This is not only because more retailers are imposing payment fees. The other factor is that the share of transactions being done electronically is growing.

According to the Reserve Bank of Australia, consumers made about 650 electronic transactions per person in 2021-22 – more than any comparable nation – and up from 300 a decade earlier.

By law, merchants are not allowed to profit from surcharges. But they can recoup their payment expenses.

Canstar group executive Steve Mickenbecker said: “The retailer either sees it as yet another inflation-induced increase to their costs that has to be recovered in the price, on top of increased wages, rent, freight and everything else.

“Alternatively, they remove it from the equation by passing on the surcharge to their customer. Ultimately, as is almost always the case, the buck stops with the consumer.”

Acceptance fees are typically charged in percentage terms, which is an added bonus for service providers during the recent period of high inflation, Mr Mickenbecker said.

Mr Kelly said: “The cost of acceptance is going up dramatically. It’s a hotspot for the RBA, which oversees the payments system.

“Who’s gouging? The banks and the people who are providing the merchant (payment) facilities.”

One of the most expensive payment service providers is Square, run by Twitter founder Jack Dorsey.

When a customer pays for a purchase via a Square terminal and the retailer has chosen to surcharge, 1.6 to 1.9 per cent is added, regardless of card or whether it is a tap transaction. Often Square is able to send that money through the EFTPOS system for less than 0.3 per cent.

Square’s Australian income rose 62 per cent in 2022 to $288m from $177m in the prior year “mainly due to a significant increase in transaction revenue”, according to company’s accounts.

Mr Kelly said applying flat rates for all card payment types was legal but not “in the spirit” of the RBA’s rules.

University professor Steve Worthington also said surcharging is “becoming more and more common” but that many retailers were failing in their duty to warn customers beforehand.

“We often don’t know when we are paying that we are being surcharged,” Prof Worthington said, even though by law we should be warned. He speculated that Australians may soon begin withdrawing more cash from ATMs to avoid the surcharge scourge.

In the EU and UK, surcharging is banned. But in Australia, the RBA has encouraged it.

The central bank has wanted consumers to know the cost of different payment options.

A person buying a seat on a Jetstar flight has the choice of paying a 0.33 per cent surcharge with a MasterCard debit card or 1.29 per cent with Visa credit card.

Large merchants have the systems to manage such complexity with ease but many smaller retailers have chosen the simplicity on offer from the likes of Square.

Some have done so after struggling to make sense of what Mr Kelly described as “overly complicated” statements from their bank telling them the separate limits they were allowed to surcharge – under the RBA’s rules – for different cards.

RBA Governor Michele Bullock has publicly put pressure on banks and other service providers to lower the cost of payment acceptance. If they don’t, the RBA may regulate.

An Australian Banking Association spokeswoman said its members weren’t gouging and fees were coming down.

A Square spokesman said: “It’s clear that sellers appreciate the flexibility, transparency, and value they get from a single blended rate”.

For Sydney business owner Franco Amitrano, the recent decision to apply the surcharge to his loyal customers was a bitter pill to swallow.

“I feel bad (having) to pass this surcharge onto my customers,” he said.

“Because the banks charge the fees and every month from my pocket I have to put in between $700 to $800 every month just for the fees. With all of the other expenses we have, that’s a lot of money every quarter, just for the bank. They’re making money, not us. The business is the one that suffers.”

It hurts the family budget

Central Coast couple Lauren McInerney, 31, and her partner Andrew Duff, 43, said hidden surcharges are unfair.

More and more businesses are imposing surcharges but not all of them are being clear about it prior to payment.

“It’s frustrating when you don’t have a choice with everything going cashless, it’s unfair,” she said.

She said she likes to use cash to minimise the risk of her accounts being breached.

“There is that issue with security and getting hacked which is why I like having cash and my physical credit card on me,” she said.

“Sounds like we are getting taken advantage of as Australians.

Mr Duff said: “I wasn’t aware of how much the surcharges add up to, I think if we’re going to go to be a cashless society, it’s just another corporation making money off us.

“I think it will get harder with the cost of living … it becomes something you have to factor in with a budget.”

John Rolfe: Why we must make a switch to cash

“So, before I pay, can you please tell me if there’s a surcharge, because if there is, I’ll use cash,” I asked at a restaurant in the Blue Mountains.

No surcharge, the waiter assured me. So I tapped my phone on the payment terminal. In an instant, 1.5 per cent was added to the bill.

Then, on the weekend, I tapped to pay for parking. The machine did not say there was a surcharge. But later I looked at my card statement and found a surcharge had been applied by the council.

In both cases, it should have been clear before payment that a fee was going to be imposed.

I can forgive the restaurant, but the council – a very large, wealthy one – should know better. I’ve asked for an official explanation. Watch this space.

The haphazard application of surcharges is just one of the problems in the system.

Another is single-rate fees, regardless of the type of card used. It costs very little to process a transaction through the EFTPOS system.

American Express and some other credit cards are much more expensive.

But, increasingly, retailers are using terminals that impose the same percentage fee.

Square is a good example. Its fee is the same for all cards, which is legal, but not the intent of the system.

Square’s costs are not the same for all cards. Square’s gross margin on processing via EFTPOS can be as much as 700 per cent.

I’ve started going to the ATM again to beat these surcharges.

I’m also using PayID more.

I recently bought plane tickets for my family’s first overseas trip since the pandemic and saved a substantial sum by avoiding the nearly one per cent fee for using my MasterCard credit card.

The RBA cannot be trusted to fix the situation. We as consumers must fight back.

Do you have a story for The Daily Telegraph? Email tips@dailytelegraph.com.au