AMP chair Catherine Brenner resigns but could still earn $440,000 from other positions

UNDER-FIRE AMP chair Catherine Brenner has resigned from her lucrative $660,000-a-year role at the embattled wealth manager but she could still take home about $440,000 this year — more than five times the average Australian’s salary.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

UNDER-FIRE AMP chair Catherine Brenner has resigned from her lucrative $660,000-a-year role at the embattled wealth manager but she could still take home ab

out $440,000 this year — more than five times the average Australian’s salary.

Ms Brenner, 47, holds several high-earning directorships as well as other pro bono positions on other boards but last night she offered to step down from her influential position on the Art Gallery of NSW Board of Trustees until the banking royal commission delivers its interim report.

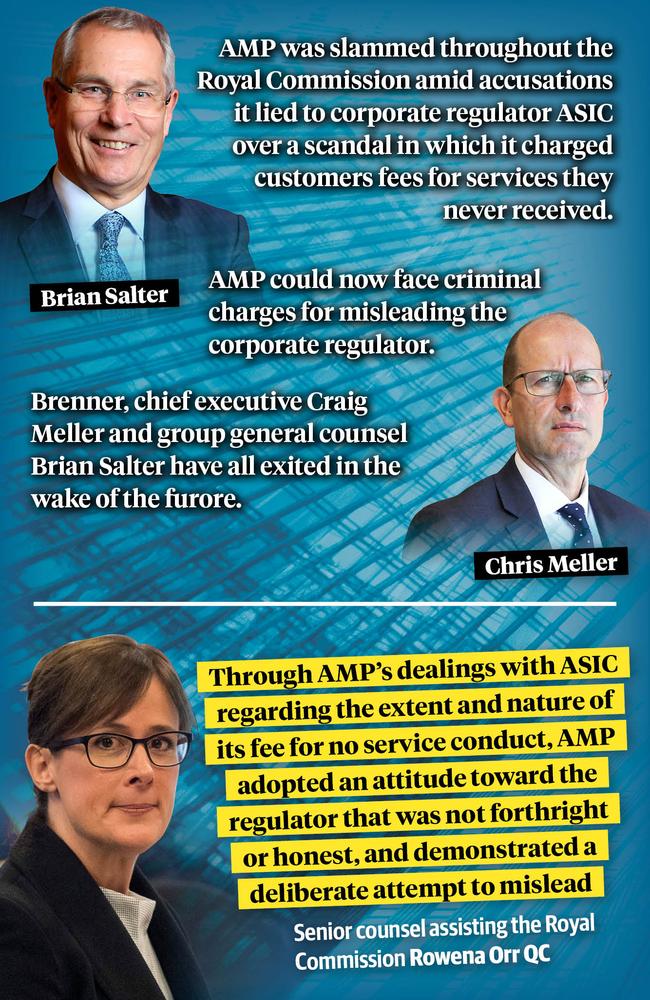

Ms Brenner, who lives in a 10-bedroom mansion overlooking Centennial Park valued at some $10 million, follows chief executive Craig Meller and dismissed chief legal counsel Brian Salter out the door at a critical time for AMP.

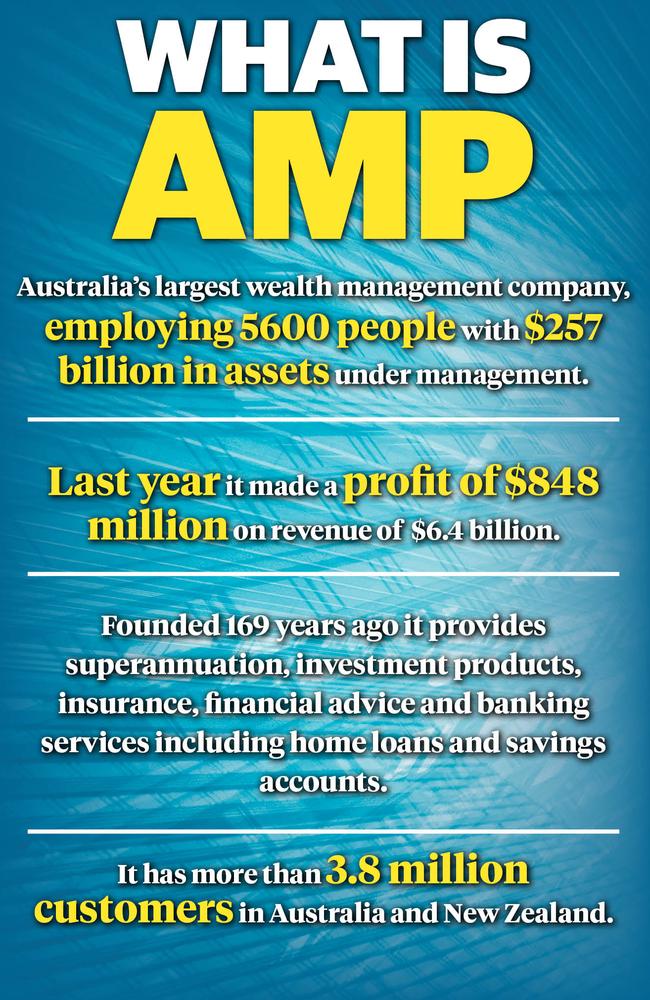

The company has lost $2.3 billion in value from its share price since the royal commission began a fortnight ago.

The once-respected wealth manager is now also facing four potential class actions from angry shareholders concerned with the company misleading investors.

But despite AMP potentially facing criminal charges for the fees-for-no-service scandal highlighted last week, corporate giants Boral and Coca-Cola Amatil are standing by Ms Brenner and refusing to sack her.

She is a non-executive director of both companies and was paid $254,388 last year by Coca-Cola Amatil and $182,300 by Boral — giving her an annual income from both of $436,688.

According to the Australian Bureau of Statistics, the average pre-tax earnings for an Australian in the year to November 2017 was $81,530 — which means Ms Brenner could take home more than five times that amount in directors’ fees alone this year.

MORE

BANKING ROYAL COMMISSION: AMP could face criminal charges

BANKING ROYAL COMMISSION: AMP chair Catherine Brenner resigns

BANKING ROYAL COMMISSION: CBA charged dead customers

BANKING ROYAL COMMISSION: NAB advisers falsified signatures

She has also earned about $220,000 this year for just four months’ work at AMP.

Ms Brenner sits on a number of boards in a pro bono capacity, including Adara Partners, SCEGGS Darlinghurst — where her three daughters go to school — and the Art Gallery of NSW.

“Catherine feels stepping aside from the board is appropriate while the royal commission continues its work,” NSW Arts Minister Don Harwin said.

“I have accepted Ms Brenner’s offer.”

At the second round of the royal commission hearings Ms Brenner’s knowledge of the failings in AMP’s financial advice business were revealed, as was her alleged role in adapting an “independent” report by law firm Clayton Utz, which was presented to corporate watchdog ASIC.

“The senior management and executives who contributed to the misleading of ASIC over the two-year period had knowledge of the extent and nature of the conduct and were warned by junior staff about it being a breach, but continued with a misleading narrative to ASIC,” counsel assisting the royal commission Rowena Orr said last week.

BRENNER RIGHT TO QUIT: TURNBULL

AMP’s statement announcing Ms Brenner’s resignation said the board was “satisfied” that Ms Brenner “did not act inappropriately in relation to the preparation of the Clayton Utz report”.

Property records show Ms Brenner lives in her palatial home on Lang Rd, which is estimated to be worth between $9.25 million and $12.7 million. She also recently sold a block of four units on Military Rd in Cremorne for a price believed to be more than $10 million.

She joined AMP in 2009 as the chairman of AMP Life — the life insurance division — and held that position for seven years until she assumed the role of AMP chairman in June 2016.

But she resigned from this position yesterday, saying she was “deeply disappointed” by the issues raised during the commission.

Prime Minister Malcolm Turnbull said it was the right move.

“All of these institutions, whether they’re financial advisers, wealth managers, banks, insurance companies, have got to put the customer first,” he said.