New laws that affect Australians from January 1, 2020

Today there are a raft of changes coming to welfare, health, education and many other living expenses. This is how it will change Australia in 2020.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

From January 1, 2020, there are a raft of changes coming to welfare, health, education and many other living expenses.

This is what’s ahead and how it will affect you and your family across Australia.

PASSPORT FEES

From January 1, annual passport fees are rising from $2-$5. A 10-year passport for persons aged 16 and over will cost $298 (up $5), a five-year passport for children under 16 years and persons aged 75 and over will be $150 (up $2), and an emergency passport overseas and/or a replacement passport will cost $187 (up $3).

A priority processing fee will now be $218 (up $3), with an adult overseas surcharge of $134 (up $2) and child overseas surcharge of $65 (up $1).

WHISTLEBLOWER LAWS

All public companies (including charities and non-profits), “large” proprietary companies and trustees of “registrable superannuation entities” must have a specific whistleblower policy in place that offers:

*protections available to a whistleblower

*how a whistleblower can make a disclosure

*how the company will support and protect a whistleblower

*how the company will investigate a disclosure, arrangements for fair treatment of employees mentioned in a disclosure

*how the policy is to be published within the company

Penalties for companies are potential imprisonment or up to 50,000 penalty units ($10.5 million) for most companies.

For individuals it is up to 5,000 penalty units ($1.05 million).

SUPERANNUATION

An employer can no longer count amounts that an employee has salary sacrificed to super to satisfy their own superannuation guarantee (SG) obligation.

Legislation changes also mean the formula has been altered to decide the amount of superannuation guarantee contributions that must be paid.

The ATO will legislatively enforce SG contributions to be paid on top of an employee’s salary sacrifice arrangements.

From January 1, eligible individuals with multiple employers can also apply to opt out of receiving SG contributions from some of their employers.

This can help them avoid going over the concessional contributions cap.

PENSIONERS

The interest rate for the Pension Loans Scheme (PLS) will reduce from 5.25 per cent per annum to 4.5 per cent. The new rate will kick in on January 1 on loans granted before and after.

NDIS

From January 1, registered NDIS providers will need to notify the NDIS Quality and Safeguards Commissioner of changes and events that substantially affect their ability to provide support and services they are registered to provide. This could include an increase in wait times, a shortfall in workers or an inability to meet payroll obligations for example.

FAMILY TAX BENEFIT

If a child gets ABSTUDY, families could keep their Family Tax Benefit (FTB) longer, and instead of stopping when the child turns 16 or until they’ve finished Year 12 or have turned 19.

Students must be means tested for the ABSTUDY Living Allowance or School Fees Allowance (Group 2) and be in full time secondary study, approved to live away from home to study or boarding to attend school.

CHILD CARE

Providers of long day care services and preschools/kindergartens must have a second early childhood teacher or a ‘suitably qualified person’ when 60 or more children preschool age or under are being educated and in care.

Services located in NSW are unaffected by these changes, given these staffing requirements have been in place for a few years.

But NSW parents will see a new star rating system introduced that childcare centres will be required to display near their entrance.

The sticker will show the star rating they have achieved when assessed in line with national standards.

Each centre is judged on criteria including educational program; children’s health and safety; physical environment; staffing; relationships with children; collaboration with families; and leadership.

FIRST HOMEBUYER DEPOSIT SCHEME

The new scheme allows first home buyers to have five per cent deposit saved up and the government will act as the guarantor for the remaining 15 per cent deposit.

It is only available to the first 10,000 applicants per year, with singles earning less than $125,000, couples less than $200,000.

Traditionally entry-level buyers need to have a 20 per cent deposit saved up otherwise they are hit with lenders’ mortgage insurance (LMI).

Under the scheme borrowers will not have to pay LMI.

The scheme can also be used alongside the government’s First Home Super Saver Scheme, which allows home buyers to withdraw voluntary superannuation contributions they have made to their super fund, and put it towards a deposit on a property.

PARENTAL LEAVE PAY & ADOPTION

If a child’s birth or adoption date is on or after January 1, the work test for Parental Leave Pay and Dad and Partner Pay will change.

The gap allowed between each work day in the work test period will increase from 8 to 12 weeks.

There will also be a new Dangerous Jobs provision for Parental Leave Pay and applies if:

*you’re pregnant or the birth mother of a newborn child

*your child’s date of birth is on or after January 1

*you stopped work because a workplace hazard was a risk to your pregnancy

*you won’t meet the work requirements in the 13 month work test period ending the day before your child’s birth.

If you meet the provision, the work test period will no longer be the 13 month period ending the day before your child’s birth. It will end the day you stopped work. You’ll still need to meet the work test in this new period to get Parental Leave Pay.

HELP FEES AT UNIVERSITY

The combined HELP loan limit begins on January 1. This is a cap on what can be borrowed from the Australian Government to cover tuition fees.

The HELP loan limit will replace the current FEE-HELP limit.

Existing FEE-HELP, VET FEE-HELP and VET Student Loan debts will be carried over and will count towards their HELP loan limit.

Any previous HECS-HELP debts will not be included in the HELP loan limit.

New HECS-HELP borrowing will count towards the limit.

For 2020, the HELP loan limit is $106,319 for most students.

The limit for students studying medicine, dentistry and veterinary science courses leading to initial registration will be $152,700.

FEE-FREE TRAINEESHIPS

The NSW Government will pay the course cost for 70,000 new traineeships – meaning trainees undertaking a government funded traineeship course no longer face a student fee of up to $1000.

ENERGY / POWER PRICES

Energy companies are set to increase Victorian power prices from January 1.

The price hikes match the 7.8 per cent rise outlined by the Essential Services Commission on Victoria’s new default power price.

The Default Offer includes a daily supply charge as well as a usage charge (per kilowatt hour).

Differences in tariffs across distribution zones reflect the unique costs of providing electricity services in each area.

Many Victorian households will be hit with electricity bill hikes averaging 5 to 7.8 per cent from this month, adding $99 to $164 to annual bills depending on retailer.

Gas prices for many residents will also climb an average 1.7 to 5.1 per cent, depending on retailer, bumping up annual costs by as much as $63 for a typical user.

For those off the electricity grid, solar panel installation costs are set to increase across Australia from January 1.

The Federal Government’s Small-Scale Renewable Energy Scheme will reduce the number of small-scale technology certificates (STC) issued, which give homeowners a rebate on the purchase of a solar system.

Changes to postcode zones have also been approved and will come into effect.

The ACT is also aiming to attain 100 per cent renewable energy on January 1.

MEDICARE

For medical practitioners working in an after-hours service, there will be a fee change from $101.60 to $91.45. The change was announced as part of the Government’s 2017-18 Mid-Year Economic and Fiscal Outlook (MYEFO) and is part of the Guaranteeing Medicare — Medicare Benefits Schedule Review. Most after-hours patients are bulk-billed, and will see little to no change.

CHEAPER DRUGS / PBS

From today, the Pharmaceutical Benefits Scheme (PBS) safety net threshold will be lowered by 12 scripts for pensioners and concession card holders – from 60 prescriptions to 48 – and the equivalent of two scripts for non-concession card holders.

Prime Minister Scott Morrison has said it will cut the cost of medicines for over 1.4 million Australians, with pensioners and families qualifying much sooner for free or further discounted PBS medicines.

Four new medicines will be added on the PBS.

These includes Verzenio® (Abemaciclib) for patients with advanced breast cancer and APO-Primidone® (Primidone) for patients with epilepsy.

NEW E-INVOICING PAYMENTS

Federal government agencies will start paying e-Invoices within five days or pay interest on any late payments.

The five-day e-Invoicing payment policy will apply to contracts valued up to $1 million, where a supplier and a Commonwealth agency both use the internationally established framework for delivering and receiving invoices in an electronic form.

CITRUS LEVY

Citrus growers will be paying for a levy to fund the industry’s share of costs to the citrus canker eradication response in the Northern Territory and Western Australia, under the Emergency Plant Pest Response (EPPR).

The levy was nil but from January 1 it will increase to $1.05 per tonne or 2.1 cents per 20kg box.

This will take effect in growers’ quarterly return, due April 28, 2020.

It means the total levy (including components for marketing for oranges, PHA and R&D) will rise from $4.25 to $5.30 per tonne for oranges in bulk; and from $3.50 to $4.55 per tonne for other citrus in bulk.

DAIRY FARMERS

The Dairy Code of Conduct comes in today to create a fairer process for negotiating contractual arrangements between dairy farmers and dairy processors. The code will improve the balance in bargaining power between dairy farmers and processors, and will replace the previous voluntary industry code. The code also includes dispute resolution and mediation processes.

This code has been developed following extensive stakeholder consultation with both dairy farmers and processors.

L & P PLATE REVIEW

The ACT Government is changing the ACT Licensing Scheme for learner and provisional drivers.

With driving hours:

*Those under 25 you must undertake a minimum of 100 supervised driving hours, including a minimum of 10 hours at night-time.

*Those 25 or older you must undertake a minimum of 50 supervised driving hours, including a minimum of 5 hours at night-time.

*A mandatory online Hazard Perception Test will be introduced prior to obtaining a provisional licence, and will be available once drivers have held a learner licence for three months.

*There will also be a two-staged red P plate. For the first 12 months (P1) with late night passenger restrictions. Exemptions will apply for employment and education purposes and for family members.

*A green P plate for the remaining two years (P2). Those 25 or older when they get a provisional licence, will be a P2 for the entire three-year provisional licence period.

*There will be a reduced demerit point threshold for learner drivers from 12 points to four points, and a removal of options for a provisional driver to increase their demerit point threshold of four points.

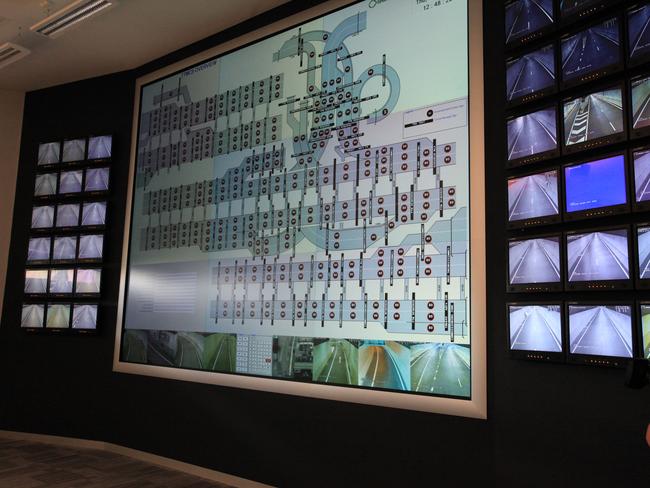

SPEED CAMERAS

From January 1, the Western Australian Government is axing speed camera location updates from the WA Police Force.

Instead, it will provide a list of 1800 locations that may or may not have a camera in place.

MORE NEWS

Surprising facts about the stars we lost

Ultimate kids’ holiday movie guide

Major cancer breakthroughs of the decade

Business scandals that shocked Australia

TRANSPORT FARES

In NSW, Busway fares for North Coast Services will change in line with maximum fares for rural and regional bus services determined by IPART.

Regional Excursion Daily (RED) tickets will still be $2.50.

Busways will be charging less than the maximum fare for:

*Adult single tickets for most fare sections within fare band 8

*Child and concession single tickets for fare sections 123 to 125

Fares changes are applicable to services in Coffs Harbour, Grafton, Great Lakes and

Port Macquarie.

In Victoria, public transport fares will increase by 1.7 per cent on average in line with the Consumer Price Index (CPI).

The increase will add 20 cents to the daily Zone 1 and Zone 1+2 metropolitan fares.

There will be no increase for those travelling within Zone 2 only.

For regional Victorians the cost of getting around town will remain unchanged, with the regional town bus fare remaining at $2.40 for a two-hour fare or $4.80 for a daily fare.

TOLL ROADS

In NSW, tolls for the Cross City Tunnel, Eastern Distributor, Hills M2 and Lane Cove Tunnel will increase anywhere from zero to 24 cents.

Cross City Tunnel

OCTOBER 2019

Cross City Tunnel $5.81 for cars, $11.62 for Trucks and Buses

Sir John Young Crescent Exit cars $2.74, trucks and buses $5.48

JANUARY 1

Cross City Tunnel $5.84 for cars, $11.68 for Trucks and Buses

Sir John Young Crescent Exit cars $2.75, trucks and buses $5.51

PRICE RISE

Cross City Tunnel: 3 cents for for cars, 6 cents for non cars

Sir John Young Crescent: 1 cent rise, 3 cent rise for non cars

EASTERN DISTRIBUTOR

OCTOBER 2019

Eastern Distributor $7.76 for cars, other $15.52

(Northbound)

JANUARY

Eastern Distributor $7.84 for cars and motorbikes, other $15.68

(Northbound)

PRICE RISE

8 cents for cars, 16 cent rise for non cars

Hills M2

OCTOBER 2019

Main Toll Plaza for cars and motorbikes $7.68, trucks and buses $23.03

Pennant Hills Road ramps for cars and motorbikes $3.84, trucks and buses, $11.52

Herring Road and Christie Road ramps for cars and motorbikes $3.84, trucks and buses $11.51

Windsor Road ramps for cars and motorbikes $2.72, trucks and buses $8.15

Lane Cove on-ramp for cars and motorbikes $2.27, trucks and buses $6.88

JANUARY 2020

Main Toll Plaza for cars and motorbikes $7.76, trucks and buses $23.27

Pennant Hills Road ramps for cars and motorbikes $3.87, trucks and buses, $11.63

Herring Road and Christie Road ramps for cars and motorbikes $3.87, trucks and buses $11.63

Windsor Road ramps for cars and motorbikes $2.74, trucks and buses $8.15

Lane Cove on-ramp for cars and motorbikes $2.29, trucks and buses $6.88

PRICE RISE

2 cents on Main Toll Plaza, 24 cents for non cars

3 cents on Pennant Hills, 11 cents for non cars

3 cents on Herring Rd, 12 cents for non cars

2 cents on Windsor Rd, same price for non cars

2 cents on Lane Cove ramp, same price for non cars

Lane Cove Tunnel

OCTOBER 2019

Cars $3.37

Heavy vehicles $10.78

Military E-Ramp

Cars $1.69

Heavy Vehicles $5.39

JANUARY

Lane Cove Tunnel

Cars $3.39

Heavy vehicles $10.89

Military Road E-Ramp

Cars $1.69

Heavy vehicles $5.45

LANE COVE TUNNEL PRICE RISE

2 cents for cars, 11 cents for non cars

MILITARY E-RAMP

Cars are the same, 11 cent rise for non cars only

THE WEST CONNEX M4

It will have a minimum toll of $1.99 for cars and motorbikes and a maximum of $8.20. Heavy vehicles will be charged a minimum of $5.96 and a maximum of $24.60.

The current toll is $7.89 for cars and motorbikes.

The current toll for heavy vehicles is $23.65.

The New M4 at Parramatta (Church Street) to Haberfield (Wattle Street and Parramatta Road) will have a $8.20 toll charge for cars and motorbikes and a heavy vehicle charge of $24.60.

The current toll is $7.89 for cars and motorbikes.

The current toll for heavy vehicles is $23.65.

The New M4 tunnels will have a toll charge of $4.44 for cars and motorbikes and a heavy vehicle charge of $13.33.

The current toll is $4.27 for cars and motorbikes.

Heavy vehicles are charged $12.81.

In Queensland, tolls on the AirportlinkM7 will increase from four cents to up to 27 cents depending on class of vehicle and route taken.

In Victoria, CityLink’s maximum charge for cars per one-way trip has risen to $9.65, up 10c.

Car trip tolls are between 3c and 10c extra. For example, a trip across the Bolte Bridge will rise 4c, to $3.22.

Victorian public transport fares increase by 1.7 per cent on average.

A daily adult full fare in Zone 1 and Zone 1+2 is now $9, up 20c.

There are no changes for those travelling within Zone 2 only, or for regional town bus fares.

POSTAGE COSTS

From January 2, Australia Posts’s ordinary small and large letter prices will increase including the Basic Postage Rate which increases from $1 to $1.10. Business letter prices will also increase.

TENANTS LAWS

In Queensland, the Residential Tenancies Authority (RTA) is going paperless. Tenants are being told to exchange an email address with their property manager /owner for all property related issues. They should also discuss receiving all documentation online.

MECHANICAL SERVICE LICENCES

New mechanical services licensing requirements will come into force in Queensland.

The new laws will apply if you contract for, supervise or personally carry out mechanical services work regardless of the value of the work.

This applies to the construction, installation, replacement, repair, alteration, maintenance, testing or commissioning of a mechanical heating or cooling system in commercial and residential buildings, for example airconditioning and refrigeration.

Mechanical services work also includes work on medical gas systems found in hospitals and other health services such as dental facilities.

*All new businesses (contractors) starting mechanical services work for the first time and apprentices finishing a relevant apprenticeship after December 31 2019 will need to hold a mechanical services licence

*All existing QBCC licensed refrigeration and airconditioning contractors will transition free of charge to the new equivalent mechanical services licence.

WhatsApp will stop working on phones as the company withdraws support for some older mobile platforms.

It will stop working on all Windows phones from December 31 — the same month that Microsoft ends support of its Windows 10 Mobile OS.

From February 1, 2020, any iPhone running iOS 8 or older will no longer be supported, along with any Android device running version 2.3.7 or older.

It will support devices running Android 4.0.3 onwards and iPhones running iOS 9 and onwards.

YOUTUBE

In January, YouTube will no longer have targeted advertising on what is being called “content made for kids.”

This applies to content that contains:

*Children or children’s characters.

*Popular children’s programming or animated characters.

*Play-acting, or stories using children’s toys.

*Child protagonists engaging in common natural play patterns such as play-acting and/or imaginative play.

*Popular children’s songs, stories or poems.

Twitter is updating its global privacy policy to give users more information about what data advertisers might receive and is launching a site to provide clarity on its data protection efforts.

The changes, which will take effect on January 1, will comply with the California Consumer Privacy Act (CCPA).

The California law requires large businesses to give consumers more transparency and control over their personal information, such as allowing them to request that their data be deleted and to opt out of having their data sold to third parties.