Global paper producer Norske Skog sells Tasmanian forest assets to an investment company

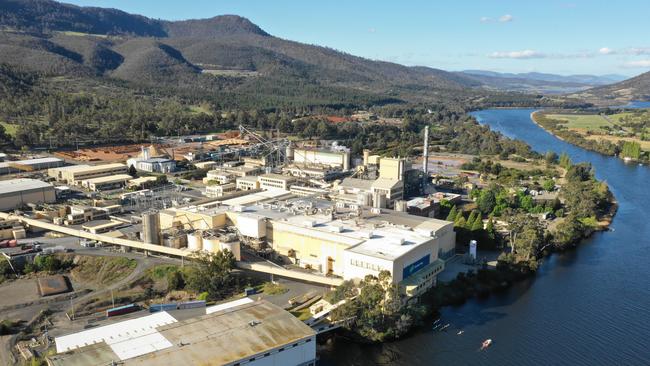

The Boyer pulpwood mill will continue production despite its owner, Norske Skog, selling all of its Tasmanian forest assets to an investment manager.

Tasmania

Don't miss out on the headlines from Tasmania. Followed categories will be added to My News.

NORSKE Skog has entered an agreement to sell its Tasmanian forest assets to Sydney-based investment manager New Forests for $62.5 million.

The 18,000ha of radiata pine was valued about $47 million in 2019.

The Norwegian paper producer owns the pulpwood mill at Boyer in the Derwent Valley, with an annual newsprint production capacity of 150,000 tons and magazine production of 135,000 tons.

Once the transaction is complete, the Boyer Mill will buy back 360,000 tonnes of pulpwood annually from New Forests.

The existing contracts related to the plantation assets such as forest harvesting and transport services will also be transferred to the buyer.

Eight Norske Skog employees in forestry management positions will be made redundant, however, publication paper production will continue as normal at Norske Skog Boyer.

The eight employees are expected to be hired by New Forests in similar roles if they choose to apply.

Federal Labor MP Brian Mitchell said jobs in the Derwent Valley were a priority for him, but he as comfortable with the news workers will be receiving any entitlements as per the Enterprise Agreement and potentially offered work with the new owners.

“Bipartisan negotiations between the companies and the unions need to be at the forefront of the sale and I will be encouraging all parties to tick that box,” he said.

Minister for Primary Industries and Water, Guy Barnett, said the Government has been informed of the sale of Norske Skog’s forest assets operations and has been assured that wood supply for the Boyer Mill will not be affected.

No further staffing changes are expected in Tasmania as Norske Skog’s Albury plant was closed about six months ago, solidifying the place of the company’s two remaining Australasian mills.

Norske Skog president and CEO Sven Ombudstvedt said the forest sale was a continuation of the company’s strategy asset review and strategy of optimising its portfolio and seeking “value enhancing transactions”.

He said released funds would enable necessary conversions, investments in new green projects and investor policy to be fulfilled.

“I am satisfied that we also have assured a long-term softwood supply agreement for the Boyer mill,” Mr Ombudstvetd said.

Completion of the forest transaction is subject to customary closing conditions including approval from the Australian Foreign Investment Review Board and is expected to take place within the end of the second quarter of 2020.

Mr Ombudstvedt said the sale and cash proceeds from the transaction will further strengthen the group’s underlying balance sheet and financial capabilities, and provide “increased robustness” for future investments in the group and attractive dividends in coming years.

The plantations included in the sale have traditionally supplied around two-thirds of Boyer’s annual pulpwood consumption of approximately 550,000 tonnes.

The Tasmanian forests being sold were valued about $47 million in 2019.

New Forests’ website says it is a “sustainable real assets investment manager offering leading-edge strategies in forestry, land management, and conservation”.

The company’s assets include sustainable timber plantations, rural land, and conservation investments related to ecosystem restoration and protection.

“New Forests focuses on managing our clients’ assets for a future in which landscapes will encompass both production and conservation values,” the website says.

New Forests manages more than 950,000 hectares of land and forests and is headquartered in Sydney with offices in San Francisco, Singapore, and New Zealand.

Originally published as Global paper producer Norske Skog sells Tasmanian forest assets to an investment company