Fake signatures and bogus caveats: Multimillion-dollar allegations against finance broker Nathan Daly

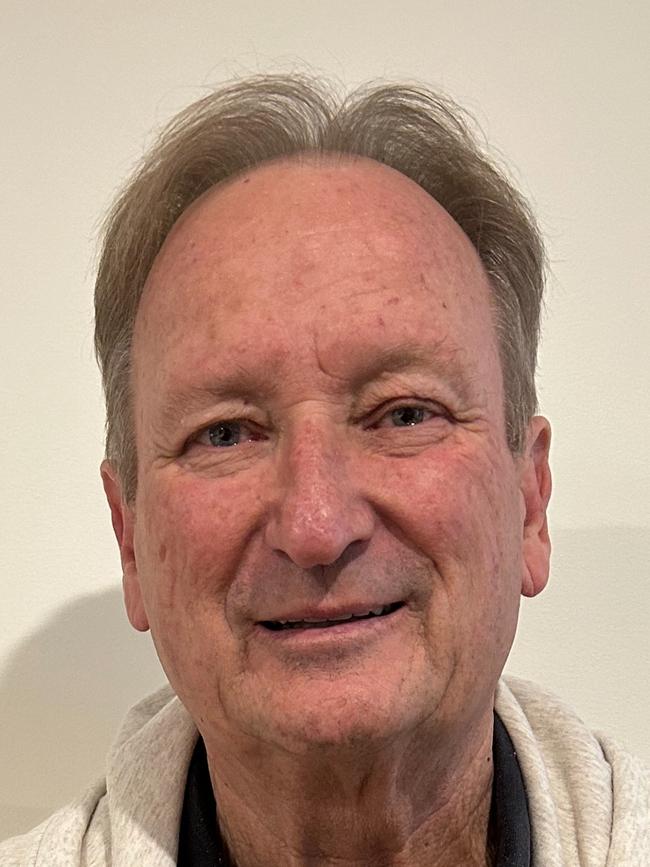

Finance broker Nathan Daly denies doing anything wrong – and has slammed his “purported victims”. See the accusations against him.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Finance broker Nathan Daly has been accused of charging business people across Australia million-dollar fees he wasn’t entitled to and failing to deliver on big loans he claimed to be able to organise.

Mr Daly’s company, Acumen Finance, has been accused in court of wrongly registering security over companies and caveats over land and refusing to take them off unless additional fees totalling tens of thousand of dollars were paid.

The personal property security registrations and caveats make it very difficult to sell property or borrow money from elsewhere, meaning business owners may opt to either pay Mr Daly to take them off or pursue legal action.

Acumen has also relied on documents that bore fake signatures, a court has found.

Mr Daly denied any wrongdoing on his part and lashed out at his “purported victims”, saying that “they have cost me my business and my health and I have had many death threats”.

His activities have resulted in a series of court judgments against Acumen across Australia’s eastern seaboard involving business people who made inquiries with him including Queensland cattle baron Peter Camm and Melbourne builder and property developer Ross Pelligra.

Private eye Danny Mikati, of Precision Integrity Services, who has been investigating Mr Daly, said that he had identified a total of nine court cases.

West Australian investor Rod Carter, who sued Acumen and Mr Daly over a disastrous loan deal, said his ordeal showed that regulators need to do more to stop bogus security and caveat registrations.

“This system is broken, mate,” he said.

He said someone could “just go online, put a PPSR (personal property security registration) on and then you can’t sell it for three months or a year”.

Mr Carter spoke to Acumen in December, when he was looking for a loan of about $25m to help fund the purchase for $30m of land near Newcastle, in NSW, that he planned to develop into 620 housing lots.

Acumen initially offered a loan and charged Mr Carter more than $100,000 in fees, but then withdrew the offer.

Despite this, Acumen registered security interests over Mr Carter’s companies and slapped a caveat on the Newcastle land.

Acumen demanded $50,000 to remove the registrations and caveats, of which Mr Carter paid $25,000.

But it didn’t remove them, so Mr Carter took Acumen and Mr Daly to the Federal Court.

Acumen claimed in court Mr Carter signed an agreement and owed it $1.7m in engagement fees.

But in April Justice Ian Jackman threw out Acumen’s claim, saying he accepted Mr Carter’s evidence that he never signed the document.

The judge ordered Acumen to repay Mr Carter and remove the securities and caveats.

In a separate case, the Federal Court also rejected Acumen’s allegations that Mr Camm signed an application for finance.

Mr Camm spoke to Mr Daly in 2020 because he wanted to rearrange his financial affairs so that he could leave one of his cattle stations to his daughter.

But he told the court he never signed the Acumen document and didn’t go ahead with the deal because Mr Daly wanted a fee upfront.

Nonetheless, Acumen registered securities over Mr Camm’s companies and sent him an invoice for $1.2m, plus GST.

Justice Kylie Downes threw out Acumen’s claim in December 2021, finding there was no valid agreement.

Acumen sued Mr Pelligra and his companies in the Victorian County Court in 2021, trying to stop Mr Pelligra from removing security interests related to property developments.

In a counterclaim, Mr Pelligra said his companies didn’t owe Acumen a cent and the securities should be removed.

The court ordered in favour of Mr Pelligra in June last year.