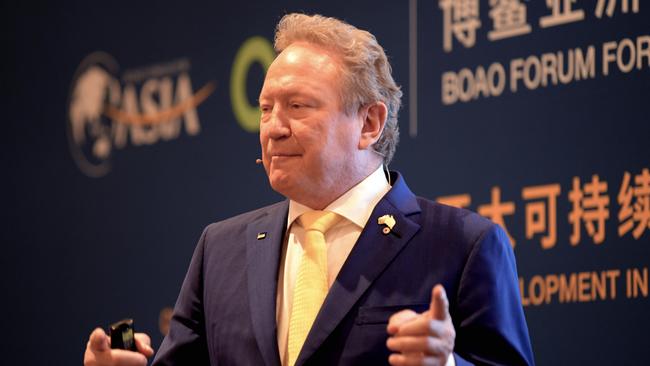

Market wrap: FMG shares plunge amid executive exodus

The mining company of Andrew ‘Twiggy’ Forrest has taken a hit on the share market after its third executive within a week called it quits.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

The Australian share market closed down on Friday, as yet another executive quit on mining billionaire Andrew Forrest, causing shares in his flagship company to take a hit.

The S&P/ASX200 closed down 26.40 points, or 0.36 per cent, to finish the trading week on 7278.90.

The turmoil in Mr Forrest’s organisation continued on Friday when it was announced Guy Debelle had quit the board of Fortescue Metals Group’s green arm, Fortescue Future Industries.

Mr Debelle is the third high-profile name to leave the organisation within a week, and the 11th this year, although it’s understood the former Reserve Bank deputy governor quit weeks ago.

The news came just hours after chief finance officer Christine Morris’ departure was announced after the close of trading on Thursday.

FMG shares opened lower at $20.90 on Friday and finished the day at $20.30 – down 5.272 per cent.

Market analyst at eToro Farhan Badami says the biggest surprise for FMG was when chief executive Fiona Hick resigned earlier this week, just six months into the role.

“Fortescue reshuffled its leadership and board structure by fast-tracking Dino Otranto’s appointment as CEO and bringing on board Dr Larry Marshall as a non-Executive Director for guiding technology strategies,” Mr Badami says.

“[Ms] Hick was initially entrusted with the responsibility of guiding Fortescue to mine battery minerals for decarbonisation.

“She was also tasked with expanding mining operations in Africa and ensuring the group’s cash cow, Pilbara mines, thrives.”

In trade on Friday, there were gains for energy stocks, offsetting losses in other markets.

Rio Tinto finished up 1.3 per cent on $114.23, but fellow mining giant BHP dipped 0.24 per cent to $44.74 off the back of general weakness in the materials sector.

Healthcare was the big loser of the day, with Mayne Pharma dropping another 8.2 per cent to $3.37 after posting poor earnings earlier in the week.

Whitehaven Coal enjoyed a 4.35 per cent rise, as did Paladin Energy, Santos and Woodside.

Meanwhile, CommSec has hinted that the Australian economy could be in for a “soft landing” as the business reporting season comes to a close.

CommSec economist Craig James says it’s due to dividends and profit results mostly meeting expectations.

“In terms of earnings multiples, analysts generally believe that the S&P/ASX 200 index is on track for 1.8 per cent earnings growth over financial year 2023, on a per-share basis,” Mr James says.

“For financial year 2024, the consensus of forecasters imply an earnings per share (EPS) retreat of 5.4 per cent, versus a contraction of 1.6 per cent heading into results season.”

Originally published as Market wrap: FMG shares plunge amid executive exodus