Domino’s big win on Australian share market despite profit loss

An investor favourite has won big on the ASX this Wednesday while another company saw its share price plummet to new lows.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

Domino’s Pizza has managed to reverse its fortunes in a busy day of trading in the Australian share market, which also saw grocer Woolworths report a big increase in profits.

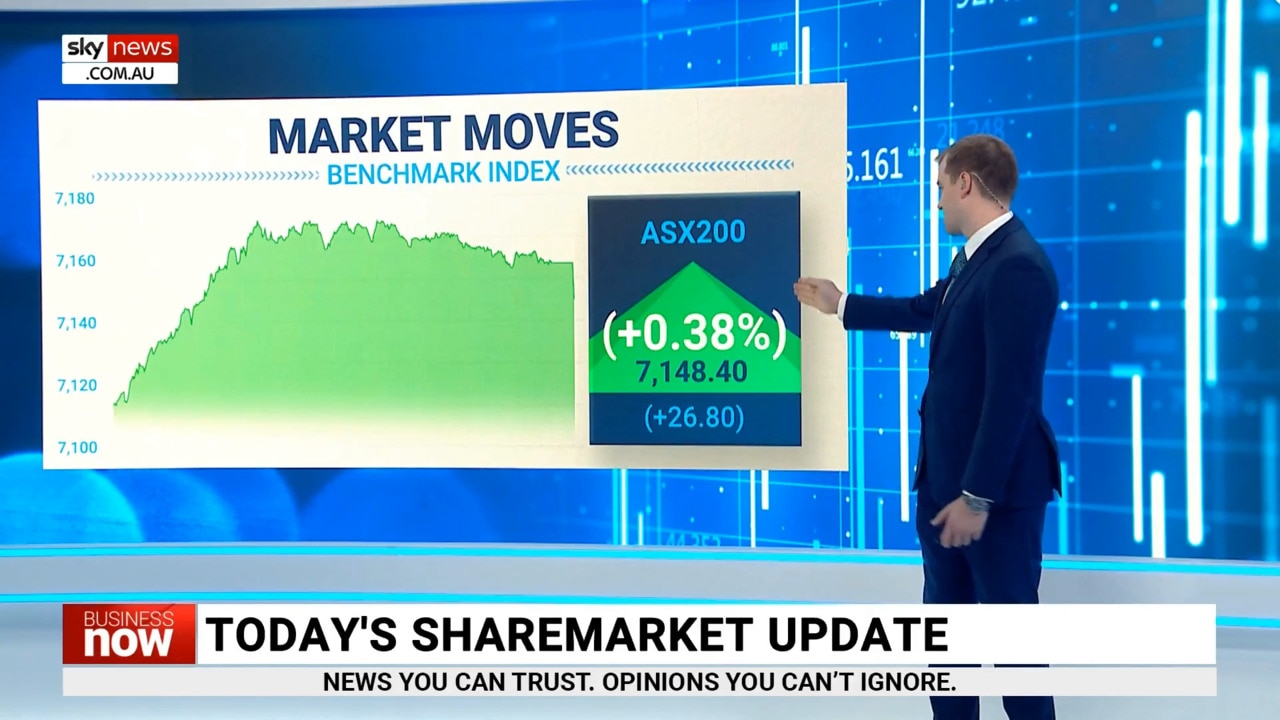

The S&P/ASX200 closed up Wednesday, gaining 26.80 points or 0.38% to 7,148.40 after setting a new 20-day low.

Domino’s Pizza took home the crown on Wednesday, up 11.81 per cent to $53.70 per share after its share price has fallen steadily since 2021.

Market analyst Tony Sycamore said that Domino’s success had “caught his eye”.

“In the context of the Domino’s Pizza story, it’s fallen about 75 per cent since 2020-21 and it feels like we had seen some type of significant low back there in June which was around that $40 level,” he said.

“My gut feel there is the market’s short and the evidence of that is the fact that we had such a stunning rebound today.

“It smells like traders were short and were looking for that $40 level to be retested and, lo and behold, here we are closer to $54.”

Australia’s largest supermarket retailer, Woolworths, has posted a $1.62bn after-tax profit for its continued operations in the 12 months to June, up 4.6 per cent.

But the results also revealed a 79.6 per cent drop in full-year profits to $1.6bn. The loss follows the sale of Endeavour Group, the company’s drinks and hospitality arm, which inflated the FY2022 profit result to $6.2bn.

The after-tax result fell just short of analysts’ forecasts for a $1.7bn profit.

On Tuesday, Woolies’ major competitor Coles recorded a $1.1bn net profit for the 12 months to June 2023, up 4.8 per cent on its 2021-22 profit result.

While Domino’s saw its fortunes take a turn for the better, it was not the same story for the IT sector, which fell by 5.26 per cent on Wednesday after making roaring gains the day before.

Mr Sycamore said the IT sector had lost “all of it and more” after software company WiseTech’s earnings fell short of estimates.

Its shares fell by a whopping 19.62 per cent to $69.60, a major loss when considering that contemporaries Altium and Megaport saw their share prices lift by 25.30 per cent and 14.9 per cent respectively on Tuesday.

“Back where we started really, pre-yesterday’s reports from Megaport and Ultrium, so that one from WiseTech was very, very harshly dealt with,” Mr Sycamore said.

Santos is the latest energy company to fall victim to reporting season, its share price dropping 1.02 per cent to $7.73 after it reported a 32 per cent fall in first-half profit, which it blamed on softer production and lower oil and gas prices.

Despite the results, Moody’s vice president of investing service Matthew Moore said he expected the company would manage shareholder returns and growth spending well.

“Santos’ results for the first half of 2023 are in line with our expectations and largely reflect the company’s solid operational performance and good cost control amid inflationary pressures and weaker oil and gas prices,” he said.

Woodside continued to slide, dropping another 1.21 per cent to $37.60 while Origin ended the day up 0.23 per cent to $8.68.

While the energy companies were mixed, the miners enjoyed a bonza day led by Fortescue which saw its price rise 2.54 per cent to $21.02.

Rio Tinto grew by 2.39 per cent to $107.74 while BHP was up 1.90 to $44.03 per share.

The banks also ended Wednesday on a high with Westpac up 1.25 per cent to $21.14 and CBA up 0.79 per cent to $99.45.

ANZ saw its share price rise by 0.62 to $24.45 and NAB jumped 0.39 to $28.04

More Coverage

Originally published as Domino’s big win on Australian share market despite profit loss