‘Decades long boom’: WA iron ore keeps the state streaks ahead of the rest

One Australian state enjoys the highest average wages and low unemployment, with the economic “powerhouse” driven largely by one thing.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

Staggering amounts of Australia’s wealth comes from the plains of Western Australia, and the mining capital of Australia is leading its east coast cousins in a bevy of key economic indicators.

Commonwealth Bank data released last month shows the Sandgropers out west lead the country in unemployment, private sector growth and internal economic activity; the latter doesn’t even take into account the resources exports.

But export they certainly do.

WA accounts for two-thirds of Australia’s resources exports. Chamber of Minerals and Energy of WA members paid 20 per cent of the country’s corporate tax bill last year, the chamber said.

There are more listed companies in WA than any other state or territory, but only 10 per cent of Australia’s population live there.

Iron ore pays one-quarter of the state government’s income, and 88 per cent of royalties come from iron ore.

China’s demand for the mineral started WA’s golden age. The boom has gotten a second wind from the energy transition that requires rare earth minerals in far greater quantities, University of Western Australia Business School professor Ray da Silva Rosa told NewsWire.

“The iron ore price, driven by demand from China, has stayed at far higher levels than anyone has been able to predict,” Professor da Silva Rosa said.

“This now decades-long boom is a function of three WA-specific factors: Firstly, the state’s geological make-up provides high concentrations of varying metals so that if any or two go off the boil then the slack is likely to be picked up by demand for another metal.”

The mining companies have over decades worked out how to extract their resources in very remote locations.

“This is why many (mainly small) mining companies with operations in Africa, Asia and even Europe have their headquarters in Perth,” Professor da Silva Rosa said.

The third key prong is high safety standards and technical expertise.

“The mining industry is far more technologically sophisticated than many Australians appreciate,” he said.

“It’s not a matter of grabbing a couple of shovels and digging the stuff out of the ground.”

A double edge for these immense money-making ventures is the resources sector’s success has left little to no room for processing onshore.

“It’s a version of Dutch disease,” Professor da Silva Rosa said.

“That is, the crowding out of development of other sectors when one sector is immensely profitable.”

The state could be processing more to add value, but the motivation to make that hugely expensive further investment is missing.

“The problem we have is that all our resources are at full capacity in extracting the resources, and the profits are so good, it is prohibitively expensive to develop the infrastructure and expertise for further processing,” Professor da Silva Rosa said.

CommBank’s latest quarterly economic report, released in June, said people were choosing to move overseas and interstate to Western Australia.

“The strongest state economy in the country continues to be WA with economic opportunities luring interstate and overseas migrants to the state,” it says in the report.

“West Australian consumers are also seeing the highest level of spending growth in the country.”

Wages are rising 4.2 per cent above the national average.

“WA is the only state in the country with the private sector contributing more than 50 per cent of annual economic growth,” the report noted.

But again, there’s a flip side. While cheaper than Melbourne, Sydney and Canberra, WA house prices are climbing.

A healthy rental vacancy rate is about 3 per cent. Perth’s vacancy rate is a measly 0.4 per cent.

A squeeze that tight sends rent prices higher than the BHP, Rio Tinto and South32 buildings that tower over the Perth skyline.

The oligopolies of the big players puts the state in a strong position when negotiating with China though.

Professor da Silva Rosa said BHP, Rio Tinto and FMG had such dominant market shares, and the Chinese buyers were far more fragmented.

“So that whilst Chinese interests may try very hard to organise themselves as a bloc to counter the producers, they find it very difficult to sustain any pressure on the producers,” he said.

“What this means is that a large part of the value is captured by the producers.”

The rollback of Chinese tariffs on wine and lobster helped the state economy too.

Chamber of Minerals and Energy of WA chief executive Rebecca Tomkinson knows the state is a force.

“WA’s role as a strategic part of the global energy future and our position as an economic powerhouse for Australia is not lost on our trading partners, as evidenced by recent visits by key international diplomats to Perth,” Ms Tomkinson said.

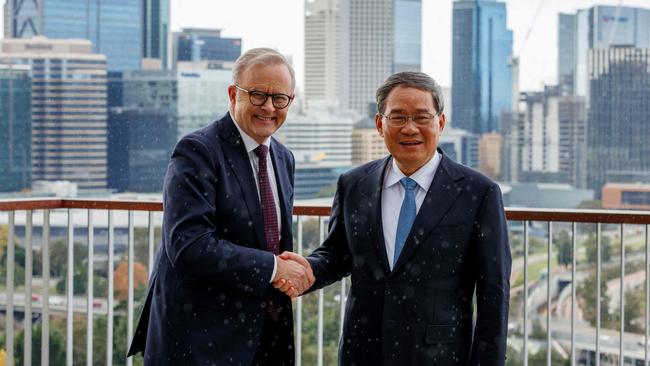

The Chinese Premier visited Australia in June.

He went around the nation, but the handshake photo op with Anthony Albanese in Perth was of course at King’s Park, with an expansive view of the dominant BHP, Rio and South32 buildings.

Replacement projects are adding incremental tonnes, as WA’s iron ore take is expected to climb to 893 million tonnes in the coming three years.

“WA enjoys a stable economy and the ongoing economic and social contribution of our resources sector plays a huge role in that,” Ms Tomkinson said.

Originally published as ‘Decades long boom’: WA iron ore keeps the state streaks ahead of the rest