Financial literacy course for high school kids to be rolled out across NSW

Research showing almost half of young Australians are at risk of falling into a debt spiral by the age of 25 have prompted calls for NSW high schools to teach a course in money management.

Education

Don't miss out on the headlines from Education. Followed categories will be added to My News.

NSW high schools are being urged to take up new lessons in money management amid fears nearly half of all young Australians are already at risk of falling into a debt spiral by the age of 25.

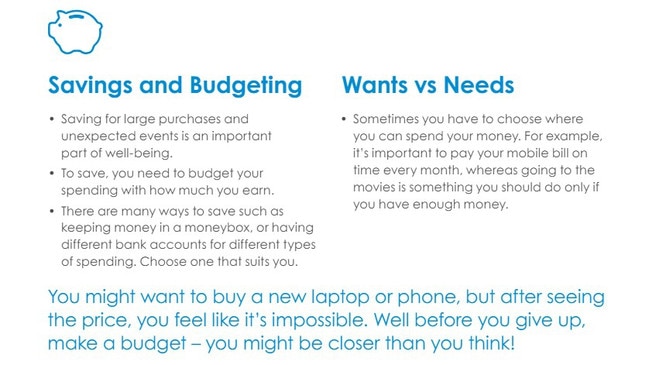

A University of Newcastle-designed financial literacy course, which covers the fundamentals of saving, budgeting and banking over four lessons, is being rolled out for free to Year 9 and 10 teachers right across the state, after being trialled by over 4400 students in 100 local schools.

The project, a collaboration between the University of Newcastle and Greater Bank, comes after research by the uni found an alarming 43 per cent of young people aged 18 to 24 years old are unable to meet their personal debt obligations.

Program co-ordinator Dr Adrian Melia said the figure was “startling”, and highlighted the need to make sure high school students understood the consequences of taking on debt.

“That’s a pretty stark statistic, and if it’s starting that early, it means we need to address it even earlier,” he said.

The advent of buy now, pay later products represented “an increased vulnerability for students”, Dr Melia said, making familiarising teens with the terminology of financial products critical.

“This program is about building of awareness, and building of confidence. Financial literacy can be quite confronting when you’re new to it.”

Under the current mainstream maths curriculum, “financial mathematics” gets a passing introduction, with students taught how to add and subtract GST or in-store discounts, or prepare a simple budget in early high school.

However, detailed education in money matters may be reaching as few as one in four students, with only 23 per cent of Year 10s enrolling in the elective commerce course last year according to NSW Education Standards Authority figures.

Core lessons in the university-designed course, meanwhile, cover differences between managing physical and digital money, introduce saving strategies, and even explain how credit ratings work.

Hunter Christian School teacher and “pathways” co-ordinator Kristin Clulow has started running the course with her Year 9 students this term, and said it was never too early to start teaching kids how to manage their own money.

“We recognised that financial literacy isn’t something that’s traditionally taught in schools, or you have to wait until you’re an adult to learn,” she said.

“I came from a financial background — my dad’s an accountant, and I swear my first word was ‘budget’.

“It’s why I’m so passionate about kids knowing not only how to budget and how to save, but how to think outside the box and be innovative.”

Classmates Amelia Jensen and Elias Sarraf said the program had given them tools that they previously weren’t aware of to help them budget and build the “lifestyle” they wanted.

“I’ve recently got my first job and am looking forward to earning and saving,” 15-year-old Amelia said.

“I don’t want debt because it’s not going to give me the best lifestyle for the future,” her classmate Maryam Khaido added.

Newcastle Grammar Head of Global Studies Daniel Locking has been running the program with Year 9 commerce students for several years and said he “absolutely” recommended all schools take it up, noting there “isn’t a whole lot of opportunities” to explore financial literacy outside of the elective subject.

The course contents are “really timely”, he said, given how many of his pupils were taking on their first jobs.

“These kids have so much access to … money and their own accounts, compared to when I was at school,” he said.

“I don’t know if the students realise they need (financial literacy), until it’s actually presented to them

“It opens students’ eyes to concepts like superannuation — something the typical 14-year-old isn’t thinking about, but when you enter the working world suddenly it all becomes relevant.”

Schools and teachers interested in the program can contact the Finance Academy via FinanceAcademy@newcastle.edu.au or 02 4913 8537.

Do you have a story for The Daily Telegraph? Message 0481 056 618 or email tips@dailytelegraph.com.au