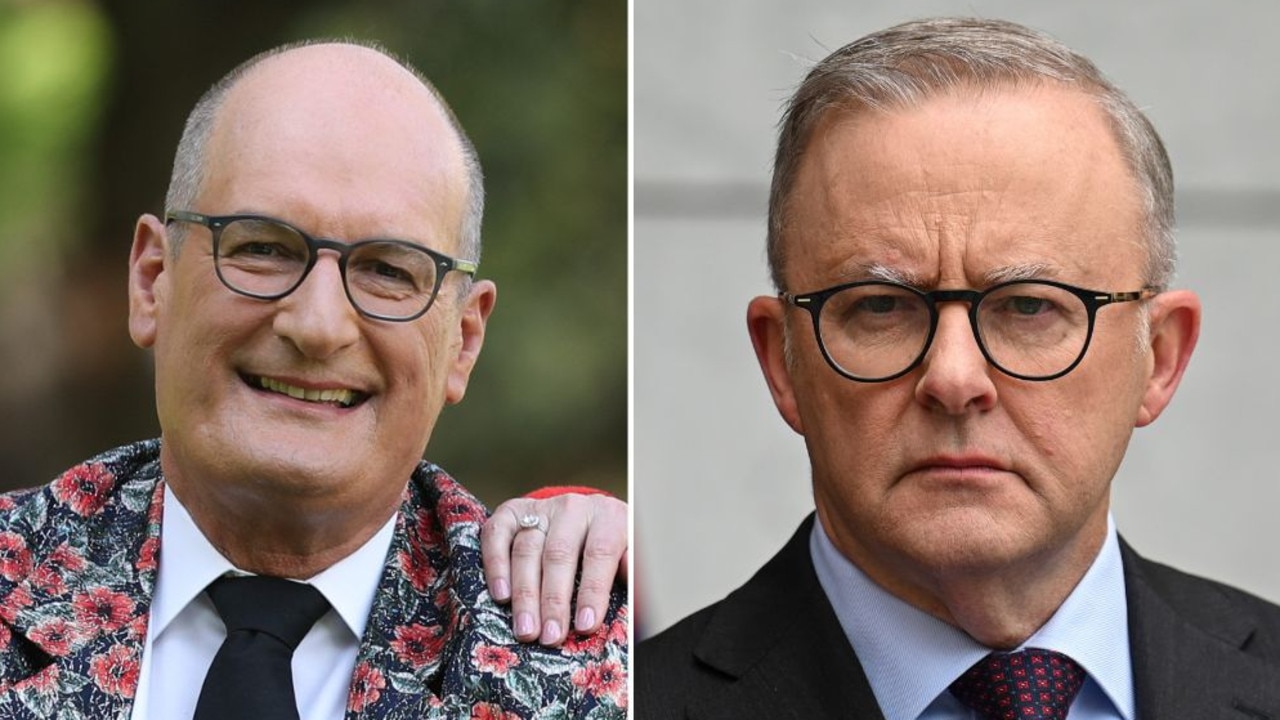

Kochie’s take on the 2019 Federal Budget

Financial expert David Koch says this budget is all about trying to restore the PM’s political fortunes. But the average Aussie is finding it tougher than ever. Here’s what it means for you.

This is Prime Minister Scott Morrison’s resurrection budget to restore his political fortunes from the ashes.

And the major beneficiaries are average Australians. This is good old fashioned pork-barrelling to buy votes at next month’s Federal election.

It also reflects the great shape of the economy that the Government has the financial fire power to splash the cash. The last year has seen strong tax revenues flow into Treasury coffers from solid company profits plus high coal and iron ore prices.

BUDGET 2019: WHAT IT MEANS FOR YOU

‘SECRET’ FUNDING TO STOP CYBER SPIES

But while the economy has been solid and it hasn’t been in recession for 27 years, the average Australian feels under financial pressure. A combination of tiny (if any) wage rises, falling property values and rising cost of living is squeezing us all.

That’s been the frustration. The economy and our bosses are doing better but we’re finding it just as tough as ever.

So what is this federal budget predicting for your financial wellbeing over the next 12 months?

YOUR JOB

Despite record jobs growth and low unemployment, wage rises are going to stay low. So get used to stingy bosses.

It’s a phenomenon which is baffling the Government and the Reserve Bank. Logic tells you that unemployment below 5 per cent should indicate a tight employment market where bosses need to pay more to attract staff.

Many point to the “casualisation” of the workplace subduing wage rises and the large number of people who are classed as “employed” but want to work more hours.

Last year’s federal budget predicted wage growth this financial year of 2.75 per cent … it is currently well below at 2.3 per cent. It was also predicting 3.25 per cent next financial year and 3.5 per cent in 2020/21.

In last night’s budget those forecasts have been revised down to 2.75 per cent and an optimistic 3.25 per cent respectively. But unemployment will stay at 5 per cent.

Next financial year’s average wages will rise in real terms (wage rise less CPI rise) by just 0.5 per cent.

YOUR FAMILY BUDGET

While wage rises have stayed low, so has inflation. Yes, power bills have been skyrocketing but the price of clothes, cars, electronics, travel and technology have been dropping significantly.

The budget is predicting the Consumer Price Index rise will stay low at 2.25 per cent … but is splashing the cash to help the household budget.

The average Australian 2 income family will receive $2160 next financial on the back of tax cuts brought forward and $1080 for singles. Plus the handouts to offset rising power bills for pensioners, carers and low income families.

Effectively this financial bonus equates to a pay rise of around 1.77 per cent on an average annual wage of $61,000.

YOUR HOME

I’ve said before that Australians have been asset rich (through rising property and superannuation values) but cash poor (because of slow wage rises).

Over the last year our property asset values have plunged further than expected and aren’t stopping. Sydney prices are down 13.9 per cent from their July 2017 peak and Melbourne down 10.7 per cent from its November 2017 peak. Nationally property prices have dropped 7.4 per cent.

It’s the worst property fall since the 1989-91 recession. The market falls have been triggered by an over supply of new property when immigration is being cut, foreign investors restricted and loans harder to get as financiers tighten lending in the fallout from the Banking Royal Commission.

Subdued economic growth (of 2.75 per cent), a further cut back in immigration and the continuing credit squeeze are likely to see even more falls in property to come.

So for homeowners, with a mortgage, interest rates could go even lower.

YOUR SUPERANNUATION

The Budget changes are aimed at allowing older Australians close to, or winding down to, retirement the ability to boost their superannuation contributions.

Flexibility is the key here with 65 and 66 year olds able to make voluntary contributions without meeting the “work test” which also includes adopting “bring forward” arrangements which allow them to make 3 years worth of voluntary contributions up to a cap of $100,000.

YOUR BOSS

Will be a little more nervous depending on the industry you’re in. The economy is quite slow, retail is under pressure from online shopping and high rents, while business confidence has fallen.

But the Government is extending, and increasing, the popular instant tax write-off of equipment purchases valued up to $30,000 per item.