The secret fee list your doctor doesn’t want you to see

THE secret fee list that Australian doctors didn’t want you to see can be revealed for the first time. It affects millions of us. Use our exclusive online calculator to see if you are paying too much.

Health

Don't miss out on the headlines from Health. Followed categories will be added to My News.

IT’S the document doctors don’t want you to see.

The secret fee bible that recommends specialists charge up to three times more than the Medicare fee for thousands of hospital procedures can be revealed for the first time.

News Corp has obtained the Australian Medical Association’s “List of Services and Fees”, used by doctors to set their rates for more than 8700 common procedures.

And their greed is plain to see — some are charging 10 times more than what it recommends, contributing to the more than $1.6 billion a year in gap payments not covered by patients’ health fund or Medicare.

The peak doctors group has for years refused to make the fee list public and in doing so has made it impossible for patients to understand whether their doctor’s fees were reasonable.

Today we lift the lid on a massive overcharging scandal by showing that many doctors are charging even in excess of these higher AMA fees.

And we give consumers the power to find out if their doctor is overcharging via a new online tool (below) that lets them compare the fees they have been quoted to those recommended by Medicare and the AMA.

For ACT residents, the recommended AMA and Medicare fees are the same as NSW, but gap fees may vary.

RENDEZVIEW: Why the Medicare rebate is based on a lie

PREGNANCY: Cost of having a baby rises 1000 times inflation rate

HEALTH INSURANCE: Thousands of Australians dump their cover

WORST OFFENDERS

Our investigation has found more than 15,000 patients have had to draw down more than $290 million in superannuation to fund these exorbitant medical bills and other out of pocket expenses.

Industry data shows money-hungry surgeons are stripping pensioners of their retirement nest eggs charging them massive out of pocket fees of over $20,000 for deep brain stimulation for Parkinson’s disease and $10,000 for hip and knee replacements.

Plastic surgeons are among the worst offenders with some charging fees of $25,000, ten times the AMA rate for breast reductions.

Cancer patients are being preyed on by doctors charging gaps of $12,000 for breast reconstructions or over $10,000 for robotic prostatectomies.

Almost four in ten privately insured women are deciding to have their babies in public hospitals because they can’t afford the $13,000 in out of pocket fees charged by private obstetricians.

The highest out of pocket costs are for hip and knee surgery, urology and ear nose and throat surgery.

Worse even than this, News Corp has been told some doctors are breaking the health fund rules by charging patients secret gap fees they tell their patients to keep hidden from their health fund.

This “shadow billing” occurs because patients of doctors who charge high fees that exceed health fund limits can’t access the health funds gap scheme payments.

To maximise the patient’s rebates the doctor gives them two bills — one for the health fund that fits within its gap fee limits and a second secret bill for thousands of dollars worth of gap fees to be hidden from the fund that the patient must pay out of their own pocket.

AFFORDABILITY CRISIS

News Corp was able to source a list of AMA fees for many common hospital procedures from health fund Bupa which believes patients need better information so they can shop around to get the best value health care.

“The number one concern we hear from our customers is the affordability of healthcare and their anger when they have an unexpected out-of-pocket cost,” says Bupa Managing Director Dwayne Crombie.

Mr Crombie acknowledges exorbitant doctor fees undermine the value of health insurance.

“While what out of pocket fees a doctor charges for a procedure doesn’t directly contribute to higher health insurance premiums, it does undermine the perceived value insurance provides,” says Mr Crombie.

“If customers have to pay out of pocket gaps because a fee is high, then people question what benefit insurance provides them, without realising where the cost is coming from and why they are having to pay it.”

Australian Medical Association President Dr Michael Gannon says overwhelmingly doctors don’t actually charge their patients the AMA fee, “the vast majority use the insurers list of fees”.

And he explained the reason the AMA fees were up to three times higher than the Medicare fee was that they are indexed to inflation and wages growth but the Medicare fee was indexed at a much lower rate and has been frozen at 2014 levels for four years.

“If a doctor charges more than the AMA fee they need to explain to their patients why that is the case,” he said.

Dr John Quinn of the Royal Australasian College of Surgeons said his organisation “believes that extortionate or manifestly excessive fees which bear little if any relationship to utilisation of skills, time or resources, are exploitative and unethical”.

“As such, they are in breach of RACS’ Code of Conduct and will be dealt with by RACS,” he said.

FINANCIAL PAIN

Breast Cancer Network Australia chief Kirsten Pilatti says people wouldn’t buy a car without shopping around but they often don’t get a second opinion on their health care.

“We do know there are enormous variations in fees and we want full disclosure not just of surgeons fees but of all the other costs including the anaesthetist and the assistant surgeon,” she said.

Consumers Health Forum chief Leanne Wells is conducting a survey of out of pocket expenses and said too many medical specialists and surgeons were charging excessive fees that leave already vulnerable patients distraught and struggling to pay.

“It appears increasingly questionable whether the taxpayer should be subsidising to the tune of $6 billion a year a private health system in which doctors are able to charge exorbitant fees at will, often leaving patients in financial strife,” she said.

Private Healthcare Australia chief Rachel David says where doctors are charging gap fees they are rising at a rate faster than inflation.

Health funds are working on ways to reduce the financial pain for members, trying to get permission to cover out of hospital gaps like pregnancy management fees.

They are also providing feedback to clinicians about how their fees and the quality of their care compares to their peers to drive improvement, she said.

The Prostate Cancer Foundation says many of the people it represents face gap fees of over $10,000, not just because of surgeons high fees but because ancillary health care gets no rebates.

There is growing government concern about medical gap fees. Late last year, Health Minister Greg Hunt asked the Chief Medical Officer Brendan Murphy to investigate the problem.

One of the solutions proposed is a requiring doctors to list the fees they charge on a public website so consumers can shop around for the best deal.

Taxation statistics show doctors make up five of the top ten highest earning occupations in the country, with surgeons listed as the nation’s highest earners on an average income of $377,044. Anaesthetists come second earning $341,041 on average each year.

‘THE WHOLE SYSTEM SUCKS’

LEONIE Havnen’s retirement dreams have been decimated because she had to raid her superannuation and her savings to pay medical bills of more than $70,000.

Diagnosed with breast cancer in 2011 the now-57-year-old has had 13 major surgeries including a double mastectomy and hysterectomy and her doctors repeatedly charged much more than her health fund or Medicare would cover.

“I remember my doctor laughing and saying ‘I think you paid for my extension’,” the former Defence force employee who lives in Queanbeyan, New South Wales, said.

Ms Havnen contracted a serious staph infection through a catheter in hospital that caused kidney failure and saw her hospitalised for three weeks and nearly killed but she still had to pay for her treatment.

“I needed dialysis and a blood transfusion and nearly didn’t make it,” she said.

“I got an infection in hospital and I was still lumbered with paying for it, it wasn’t my fault, it should have been the hospital paying for it,” she said.

The staph infection left her body so damaged she has had to have multiple follow-up corrective surgeries that she has also had to fund herself.

Her financial pain began when she required a double mastectomy to treat breast cancer.

While her breast surgeon charged no out of pockets the plastic surgeon who did the reconstruction and the anaesthetist left her with expenses of over $20,000 and she had to raid her superannuation to pay the bill.

She needed to take more money from her superannuation to cover out of pocket medical bills for the three week hospitalisation related to the staph infection.

More recently the last bout of corrective surgery saw her charged $4000 by the surgeon but receive back just $125 from her health fund and $300 from Medicare.

The anaesthetist charged $1500 but she got back just $900 in rebates.

Ms Havnen says she is very happy with her doctor and the work he did but says she doesn’t think doctors take into account the effect of their gap fees on their patients.

“I don’t think they do realise how it all adds up but they charge you anyway,” she said.

She’s angry her health fund did not cover more of the bills.

Because she had to raid her superannuation to pay for her health care she has $3000 a year less in retirement income and has to work part-time.

“The whole system sucks,” she says.

‘IT’S DISGUSTING ... IT’S PREDATORY’

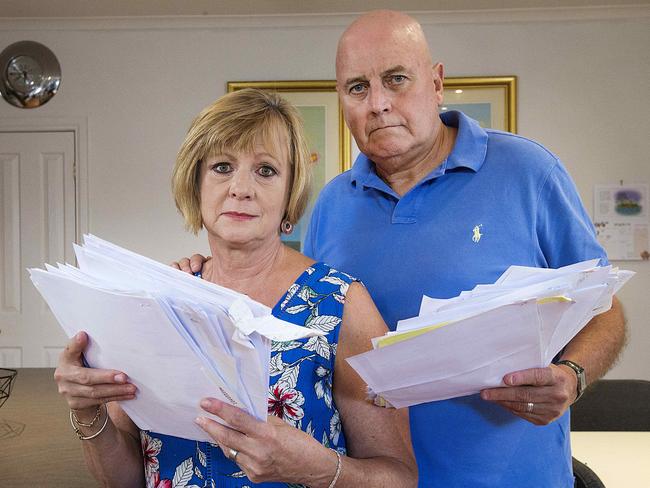

BETWEEN them Victoria’s Karen and John Cowley have undergone 11 surgeries and the out-of-pocket fees levied by high-charging doctors have had a serious financial impact.

Karen Cowley, aged 60, was diagnosed with breast cancer in 2006 and faced out of pocket expenses then.

Years later when both her legs suffered fractures as a result of side effects from her medication she had to pay her surgeon and her anaesthetist $600 each in fees not covered by Medicare or her health fund.

She needed lifesaving medication Kadcyla to keep her breast cancer under control and at one stage was spending $5000 a year on medication costs.

More recently she had a reprieve from medical fees for brain cancer surgery.

“I don’t have out of pockets now because my oncologist doesn’t charge people with advanced cancer because they have already gone through the mill,” she says.

Her neurosurgeon also did not charge her gap fees for recent surgery either, says the South Morang mother of two.

For her husband John aged 63 it’s a different story. The keen footballer has had eight surgeries to correct sporting injuries including three arthroscopes, knee surgery, spinal surgery, a laminectomy and arthroscope of the left shoulder and a hip replacement.

Most of these procedures have seen the couple lumbered with hefty out of pocket expenses.

John’s most recent hip replacement surgery in 2016 resulted in gap fees of $3000 for the surgeon and anaesthetist.

“The health industry should thank us for keeping them afloat,” Mrs Cowley said.

She did not lose her breasts due to cancer but she feels for other women she knows who have who suffered extreme financial pain as a result of exorbitant medical bills for breast reconstructions.

“It’s disgusting, they are exploiting women at a time when they are very vulnerable and they are in the mode of I’m going to beat this thing, it’s predatory,” she said.

‘PAYING MONEY FOR NOTHING’

DEBORAH Morrison has had to use most of her $60,000 in superannuation to cover the massive medical bills she faced for deep brain stimulation surgery to treat her Parkinson’s disease.

The 61-year-old mother of four who lives near Ipswich in Queensland had surgery in late 2016 to try and control the tremors caused by her illness.

A few months later she had to have further surgery because the initial procedure had left her feeling “weird and angry and silly”.

Bupa data shows some doctors in Queensland are charging patients gap fees of well over $10,000 for the surgery and that is in excess of the AMA fees.

The anaesthetist charged over $18,000 for her 2016 operation and Deborah says only around $5,000 of that bill was covered by Medicare and her health fund.

“I had to use nearly all of my super, I had $60,000 and I paid out about $38,000-$40,000 of that,” she said. “Using you super is lousy.

“I thought my super was going to be there for me but look at my finances now.”

Mrs Morrison said she had been a member of a health fund for almost 30 years and had top cover at the time of her surgery but this provided little help for her hefty surgical bills.

“I think a lot of health funds have you paying money for nothing,” she said.

Her financial pain is ongoing as she has to attend regular follow up treatments with psychiatrists, psychologists and her specialist every few months.

Each of these visits can cost between $120 and $180 and she gets only around $70 back from Medicare.

Despite spending so much money on the surgery she doesn’t think it was worth it.

She feels horrible every time doctors turn the battery up on the device and has to have it running on low and she is now back on medication to treat her disease.

“It has helped the tremor but not very much and there are cognitive effects of the surgery that seem to be a by-product that are not very good either,” she said.