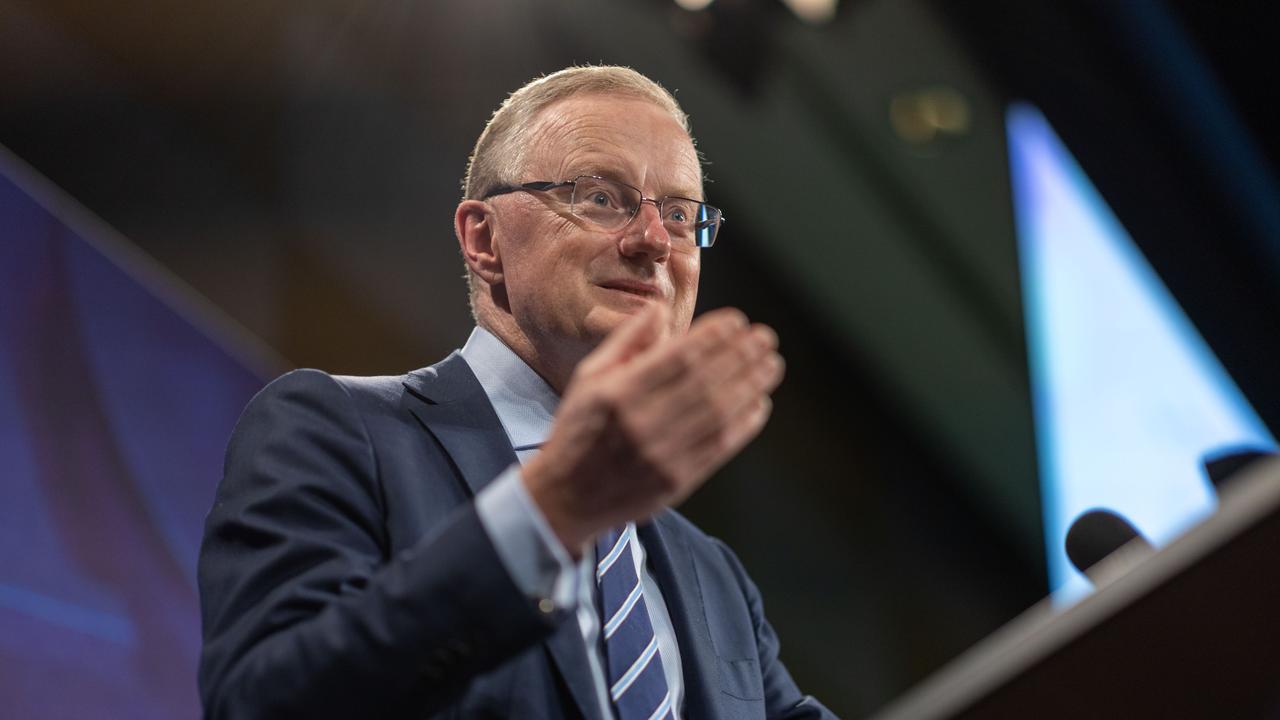

Philip Lowe announced RBA is changing and reveals how it will affect interest rates

The Reserve Bank will have its most significant shake up to the way it operates in decades, governor Phil Lowe has confirmed.

The Reserve Bank will cut the number of times it meets in a year to set interest rates but make the meetings longer, as the central bank begins the process of implementing recommendations of a wide-ranging review.

From 2024, the board will meet eight times a year, rather than 11, governor Philip Lowe told the Australian Conference of Economists in Brisbane on Wednesday.

Reflecting on the 51 recommendations handed down in the RBA review released earlier this year, Dr Lowe said having less frequent but longer meetings would provide more time for the board to examine issues in detail, and to have “deeper discussions on monetary policy strategy, alternative policy options and risks, as well as on communication”.

Dr Lowe said while the review had found Australia’s current monetary policy framework was fit for purpose, “as times change, we too need to change”.

“The world we face is increasingly complex and it is right to re-examine how we make and communicate monetary policy decisions and how the RBA is managed. The board and the bank’s staff have supported the review, and we have been working constructively on the recommendations,” he said.

Dr Lowe said at recent meetings, the board had spent time discussing the recommendations, and had – in addition to changing the number of meetings – agreed to make the eight meetings longer.

Meetings will now typically start on Monday afternoon and continue on to the Tuesday morning, before the decisions are made public at 2.30pm on Tuesday.

The post-meeting statements will now be issued by the board, not from the governor as is currently the case.

The governor will hold a press conference after each board meeting to explain the decision; and the quarterly “statement on monetary policy” will be released at the outcome of the February, May, August and November board meetings.

Dr Lowe said the board would work with the Treasury to undertake five-yearly open and transparent reviews of the monetary policy framework.

He said the 10 changes announced on Wednesday were “significant” and represented a “substantial response” to the review’s recommendations.

“The changes I have laid out are a significant step in this directing and the new board will have the opportunity to consider the merits of further steps,” he said.

The review was launched in part because of concerns about the bank’s handling of monetary policy before the pandemic and recommended splitting the central bank into two boards to separately deal with interest rates and currency issuance.

Dr Lowe backed in the structure of the central bank, which he said was unique and differed significantly from central banks elsewhere.

“In almost every other central bank, most of the decision-makers are insiders – that is, they spend the bulk of their time inside the central bank. In our case, only two of nine board members are insiders,” he said.

“The other seven spend the bulk of their time outside the RBA and this will remain the case … The Australian model has the advantage of ensuring there is diversity of thought and it helps bring a wider perspective to monetary policy decisions.

“However, it does have implications for the way those decisions are communicated and the appropriate accountability mechanisms. In my view, it is right to allow the new board to consider these issues and make its own decisions after due deliberations.”

Dr Lowe confirmed the RBA would later this year begin recruiting a chief operating officer, as the review recommended. He said the bank would also establish a separate communications department to “elevate” the bank’s communications functions.

He suggested more recommendations would be adopted by the bank “in due course”.

Lowe’s future in doubt

Wednesday’s speech is widely expected to be the last Dr Lowe makes before federal cabinet makes decision about his future ahead of his term expiring in September.

Dr Lowe, who has served in the top job at Australia’s central bank for seven years, is expected to be replaced.

While the government has the option to extend his tenure out to 10 years – as was the case with his two predecessors – it’s widely anticipated someone else will be appointed to the role.

Current frontrunners are the finance department secretary Jenny Wilkinson, Treasury secretary Steven Kennedy and RBA deputy governor Michele Bullock.

There have been mounting calls for Dr Lowe to be replaced because of his comments – as late as late 2021 – that interest rates would remain at record lows of 0.1 per cent until at least 2024. Interest rates have risen to 4.1 per cent since last May.

Treasurer Jim Chalmers, who will make the announcement later this month, said he would take his recommendations to cabinet “soon”.

“This is a decision for the cabinet to take on my recommendation, and I take the role of the cabinet and the opinions of my colleagues very seriously,” Dr Chalmers said.

“This is one of the biggest appointments the government will make. It is a big job … and I am approaching it in a methodical and measured and considered and consultative way, which represents the magnitude of the decision that the government will take about the governor of the Reserve Bank.”

Dr Chalmers said he’d had a preliminary discussion with shadow treasurer Angus Taylor about the decision.

“We had one preliminary conversation and I’m up for another one if he and his colleagues would like to have one,” he said.

“We will appoint someone who has the necessary experience and expertise who can help bed down the recommendations of that really important RBA review.

“Whether it is a Reserve Bank review or the appointment of the governor, our interest here is in ensuring we get the best possible central bank to take the country forward during really uncertain times for the global economy.”

Dr Chalmers and Dr Lowe will fly together to India this weekend for a G20 meeting of finance ministers and central bank governors.

“He and I will work closely together to represent Australia’s interests in that forum and also to make our contribution to the big global conversation about how we safeguard our economies from inflation and some of the other typical pressures that we have, that we are all confronting in one form or another around the world,” Dr Chalmers said.

“What happens overseas has consequences here in Australia, and there are opportunities as well and the approach we have taken as a government is that we are always better engaging with the world on these big economic challenges we confront together.”

Originally published as Philip Lowe announced RBA is changing and reveals how it will affect interest rates