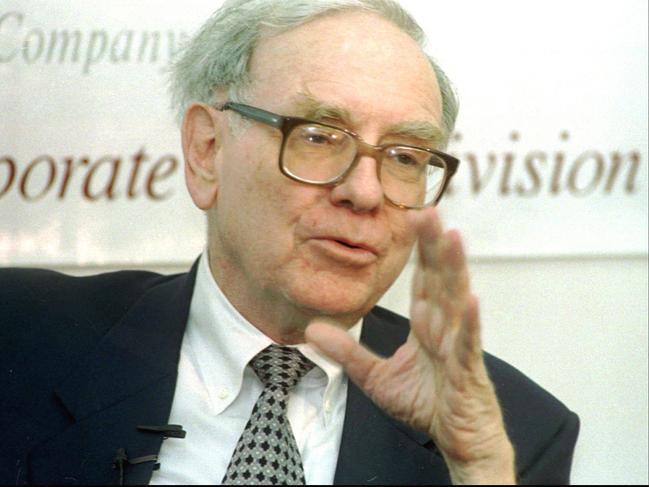

Billionaire Warren Buffett steps down from Berkshire Hathaway

Legendary investor Warren Buffett, the fifth richest person on earth, has made a major announcement about his future after a thinly veiled attack on Donald Trump.

Leaders

Don't miss out on the headlines from Leaders. Followed categories will be added to My News.

Legendary investor Warren Buffett, the fifth richest person on earth with a fortune worth $162 billion ($948 billion), has announced he will retire as CEO of Berkshire Hathaway later this year.

Buffett, 94, told his annual shareholder meeting, dubbed the Woodstock for Capitalists, that he would ask the board to hand over the reins to his hand-picked successor Greg Abel, 62.

The ‘Oracle of Omaha’ appeared to suggest Abel had been kept in the dark about the timing of his retirement plans until the final minutes of the marathon Q&A session.

The death of his longtime friend and business partner Charlie Munger two years ago had led to increasing speculation about when Buffett might finally call it a day as CEO.

“Tomorrow, we’re having a board meeting of Berkshire, and we have 11 directors. Two of the directors, who are my children, Howie and Susie, know of what I’m going to talk about there,” Buffett said.

“The rest of them, this will come as news to, but I think the time has arrived where Greg should become the chief executive officer of the company at year end,” he added.

“I would still hang around and could conceivably be useful in a few cases. But the final word would be what Greg said, in operations, in capital deployment, whatever it might be.”

The death of his longtime friend and business partner Charlie Munger two years ago had led to increasing speculation about when Buffett might finally call it a day as CEO.

Canadian national Abel, who currently serves as a vice-chairman, has been Buffett’s heir apparent since 2021. He helped build Berkshire Hathaway’s energy unit into a major US power provider.

His appointment will end Buffett’s 55-year tenure as the company’s chief executive, the longest of any S&P-listed firm, which he transformed from a failing textile maker into a global investment juggernaut.

JPMorgan CEO Jamie Dimon described how he had been inspired by the Berkshire Hathaway boss during his career as one of America’s top bankers.

“Warren Buffett represents everything that is good about American capitalism and America itself — investing in the growth of our nation and its businesses with integrity, optimism, and common sense,” Dimon said. “I’ve learned so much from him to this very day, and I am honoured to call him a friend.”

Reacting to the news, Goldman Sachs CEO David Solomon said: “Warren’s reputation as an investor is unrivalled, and his accomplishments as a CEO have influenced a generation of leaders who have benefited from his unusual common sense and long-term approach.”

Buffett also used his final annual shareholder shindig to make a thinly-veiled attack on President Donald Trump’s use of tariffs to renegotiate America’s trading relationship with dozens of countries.

“Trade should not be a weapon,” the billionaire investor said, breaking his months-long silence on the topic and without mentioning the commander-in-chief by name.

He ripped Trump’s protectionist policy, telling a packed audience of 40,000 investors that the United States “should be looking to trade with the rest of the world. We should do what we do best, and they should do what they do best.”

Buffett, however, insisted the stock market’s recent turmoil, which generated headlines after Trump’s tariff announcement last month, “is really nothing.”

He dismissed the recent drop in the market because he’s seen three periods in the last 60 years of managing Berkshire when his company’s stock was halved.

A student of Columbia University’s legendary professor Benjamin Graham, the author of the stock-picking bible, “The Intelligent Investor,” Buffett once outlined in his widely-read letter to his Berkshire shareholders how patiently holding onto stocks bought at bargain-basement prices was “the corner of our investment policy.”

“Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results,” he wrote in the 1974 missive.

Berkshire Hathaway owns more than 60 companies, including insurer Geico, battery-maker Duracell, and restaurant chain Dairy Queen.The company also has major stakes in some of this country’s biggest corporate titans: its recent quarterly report said its five largest investments are in American Express, Apple, Bank of America Corporation, Coca-Cola and energy giant Chevron.

Born in Omaha, Nebraska in 1930, Buffett shunned the trappings of his vast wealth for his entire life and still lives in the same modest house he purchased in 1958 for $31,500.

He has been in the process of offloading his fortune since 2006 as part of his pledge to transfer 99 per cent of his estate to philanthropic causes before his death.

This article was originally published in the New York Post