Boss of collapsed $2.3 million company sends unusual text message to former worker

An ex-employee has alleged that his CEO attempted to keep the dying business afloat by paying staff using his personal savings.

At Work

Don't miss out on the headlines from At Work. Followed categories will be added to My News.

EXCLUSIVE

An Australian technology company has become the latest casualty in the country’s struggling start-up sector after it collapsed earlier this month.

Sydney-based FirmGuard Pty Ltd, which taught other companies risk management and compliance requirements and issued $2.3 million worth of private shares, went into liquidation on August 1.

The firm allegedly didn’t pay staff members their full wages or superannuation in the months leading up to its demise and an employee was in the process of taking legal action when the company went bust.

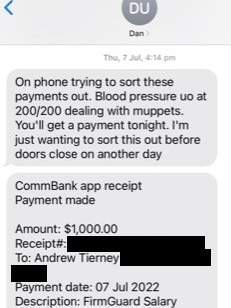

A former staff member has alleged that a damning SMS text message showed that the company’s founder and chief executive, Dan Ussher, attempted to keep his business afloat by manually paying the worker using his own funds.

Ex-employee Andrew Tierney, who worked as FirmGuard’s general manager for 18 months, claims he is owed $150,000 in unpaid wages and remuneration, which he says stopped being paid from April this year.

Mr Tierney, 55, begged for his salary to be paid and eventually engaged a solicitor.

Then he received an unusual text message from his boss, Mr Ussher, who sent him a receipt which showed $1000 had been sent to him.

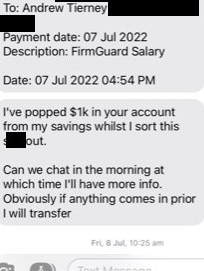

“I’ve popped $1k into your account from my savings while I sort this sh*t out,” Mr Ussher wrote in the text message, seen by news.com.au.

However, this money never arrived in Mr Tierney’s bank statement.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“(The money) didn’t come through,” Mr Tierney told news.com.au. “[The situation] was raising the hairs on the back of my neck.”

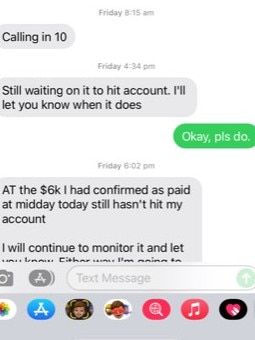

In the text message thread, Mr Ussher sent him a manual receipt and in subsequent messages, assured him the money was coming.

Another $1500 was transferred in the same manner, and this time it did reach Mr Tierney’s account.

“That was the last thing I really heard from him (Mr Ussher).”

Mr Tierney claims he was then terminated from the company on July 28 and just three days later, FirmGuard appointed liquidators.

Mr Ussher told news.com.au he would not be commenting on the matter.

Do you know more or have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

Mr Tierney alleged he stopped receiving his full pay from April and between May and July this year he received none of his wages.

“I used up all of my savings because I wasn’t being paid,” Mr Tierney said.

“I’m sitting there thinking ‘I’m going to be kicked out of the house, I won’t be able to put food on the table for my son.’”

Around the same time, a number of other “red flags” emerged.

He says he knew of a contractor who had not been paid either, and a company that cut ties with FirmGuard, both of which appeared on the liquidator’s list of creditors.

Then he received an email from a US debt collection agency representing a tech company called ZoomInfo, which claimed FirmGuard owed them $18,000.

Mr Tierney wanted to quit but was hesitant because he had invested $50,000 into FirmGuard and claims he was also owed around $50,000 from retained earnings – which is where he took a lesser salary on the basis that he would receive two large payouts each year.

“On the lead-up to July 28, I was thinking, ‘Should I go, should I stay?’” he said.

“I was in a very difficult position. There was investment money, there was another $50,000 of retained earnings, it’s not just a few months of earnings.

“I felt a little trapped. If it was one or two weeks (of unpaid wages) you could find another job and move on, but when it was around 150-odd grand, it stressed me out.”

Mr Tierney said it has impacted his health and in late June he was rushed to hospital via ambulance with fears he was having a heart attack.

Doctors concluded it must have been a panic attack because of the stress he was under and subsequently put him on a mental health plan.

Mr Tierney also sent an email to investors and stakeholders informing them that he was owed money.

However, after sending the email, he was fired.

“It has been bought [sic] to our attention that on Wednesday, 20th Jul 2022 at 11:06am you sent an email from your FirmGuard email account titled ‘Investor Notification’ to the FirmGuard Advisory Board and Investors, advising of grievances and allegations toward FirmGuard Pty Ltd,” the termination letter read.

“In this email communication, and the follow-up phone calls I am aware of, you made or attempted to make various disparaging statements and false allegations.”

Mr Tierney was shocked by the email, but days later, when the company went bust, he believes it was because FirmGuard couldn’t afford to keep staff on.

The sacked employee has made a workers compensation claim, with the results of investigation expected in October.

He has also contacted the Fair Work Ombudsman over his unpaid wages and the Australian Taxation Office for superannuation he was owed, as well as looking to pursue action over unfair dismissal.

However, these government organisations cannot help after a company goes into liquidation.

According to a liquidator’s report on FirmGuard’s collapse released on August 14, $2.3 million worth of share capital was issued to investors but only $113,000 of that was paid back.

The majority of those shares were from Mr Ussher, who invested $2.2 million into his company. Mr Tierney was the second-largest shareholder.

FirmGuard has 16 creditors chasing it for at least $320,000 they claim is owed to them.

However, that number is expected to be a lot higher because the $150,000 Mr Tierney claims he is owed was not included in the report. It simply says he is owed an “unknown” amount.

Two other creditors – the Fair Work Commission and iCare – have also been listed as “unknown” in terms of the amount owed.

The Australian Tax office is owed $150,000.

News.com.au has contacted the liquidator, Christian Sprowles of HoganSprowles, for comment, however emails and phone calls went unanswered for several days.

Industry in crisis

Tech companies are struggling across Australia as investors have been left spooked by dramatic plunges in valuations making funding harder to find.

The latest tech outfit to be impacted was a Melbourne-based e-sports company called Order, which raised $5.3 million in funding last year, but collapsed last week with liquidators seeking to sell the business urgently.

Then there was an Australian tech company called Metigy, which left staff “shell-shocked” by its sudden collapse earlier this month, after it planned to raise money with a valuation of $1 billion.

Last month, Australia’s first ever neobank founded in 2017, Volt Bank, went under with 140 staff losing their jobs, while 6000 customers were told to urgently withdraw their funds.

Other failed businesses include grocery delivery service Send, which went into liquidation at the end of May, after the company spent $11 million in eight months to stay afloat.

A Victorian food delivery company called Delivr that styled itself as a rival to UberEats and Deliveroo also collapsed in July as it became unprofitable, despite making more than $6 million worth of deliveries since it launched in 2017 and had 18,000 customers.

Last month, news.com.au raised questions about another Sydney-based tech firm, D365 Group, which builds software for health, real estate and accounting services.

Staff claim they haven’t been properly paid for months and a contractor has taken the company to court saying his debts were not paid. D365 Group is due in court at the end of August.

Originally published as Boss of collapsed $2.3 million company sends unusual text message to former worker