Woodside, Santos in $80bn merger talks

Australia’s two biggest energy companies are in talks on a blockbuster merger that would create a global oil and gas giant.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Woodside Energy and Santos have opened talks on a blockbuster $80bn merger in a deal that would create a global oil and gas giant, as fossil fuel producers bulk up as part of a wave of consolidation across the industry.

The combination of Australia’s two biggest producers would transform the country’s energy sector and follows Woodside’s previous buyout of BHP’s petroleum arm and Santos acquiring the Papua New Guinea-focused Oil Search.

The Australian’s DataRoom column reported on November 30 the two local resources giants were back in focus surrounding a potential buyout, stoking speculation the pair may combine for a merger.

Woodside confirmed on Thursday it was in talks over the merger.

“In response to recent media speculation, Woodside confirms it is in discussions regarding a potential merger with Santos Ltd. Discussions remain confidential and incomplete, and there is no certainty that the discussions will lead to a transaction,” Woodside said in a statement.

“As a global energy company, Woodside continuously assesses a range of opportunities to create and deliver value for shareholders. Woodside will continue to update the market in accordance with its continuous disclosure obligations.”

Santos said it was assessing a range of alternative structural options with a view to unlocking value.

“Santos confirms it has engaged in preliminary discussions with Woodside regarding a potential merger. Santos continuously reviews opportunities to create and deliver value for shareholders,” Santos said.

“The consideration of any merger is at an early stage and there is no agreement between the parties. There is no certainty that any transaction will eventuate from these discussions.

Santos will continue to update the market in accordance with its continuous disclosure obligations.”

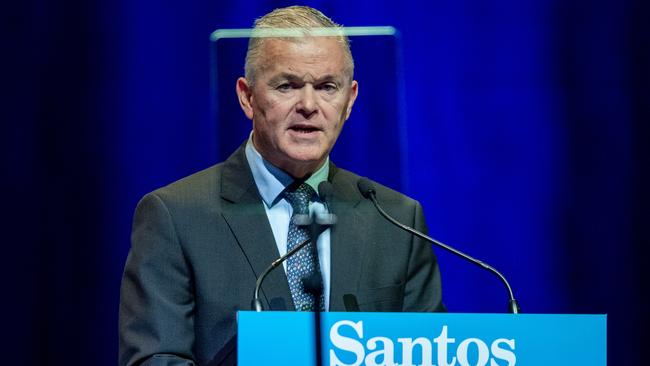

Santos boss Kevin Gallagher received an unusual $6m “once-off growth projects incentive” in 2021 to deliver the oil and gas giant’s major projects to 2025, in a move that proved successful in keeping him out of winning Woodside’s top job, now held by Meg O’Neill.

One source told The Australian that Woodside admired Santos’ Papua New Guinea LNG assets, but was wary of the South Australian producer’s coal seam gas and high emissions intensity Barossa and Cooper Basin assets.

Woodside was foiled in 2015 after it lobbed a $12bn deal for Oil Search, now owned by Santos, with the WA company eager to grab a share of its exposure to PNG.

It’s thought that merger talks could involve a break-up of Santos with the GLNG gas export project in Queensland potentially being snapped up by Gina Rinehart’s Senex Energy,

while fellow Adelaide producer Beach Energy could snap up Santos’ Cooper Basin and West Australian assets.

The source also said another major issue was that many Santos shareholders believe the company is undervalued compared with Woodside and will seek a premium, potentially making a deal difficult to get over the line.

Australia’s energy sector is undergoing its most profound restructuring in a generation as companies look to bulk up through consolidation with local companies including Woodside and Santos in the crosshairs of investors who are piling pressure on their emission records.

Confirmation of the talks comes only 18 months after Woodside closed its acquisition of BHP’s petroleum assets, which catapulted the homegrown gas producer into a player on the global scene.

The all scrip merger saw BHP shareholders receive 1 Woodside share for each 5.54 BHP shares they controlled, in a deal that was designed to deliver future value to Woodside by allowing it to compete on the global stage while ridding BHP of the liabilities of its fossil fuel portfolio.

Woodside shares have traded as high as $39.03 in the wake of its acquisition of BHP’s oil and gas assets, but closed on Thursday at $29.97 – only marginally ahead of the $29.76 at which they traded when the deal was officially completed in 2022.

Like Woodside, Santos shares are up only marginally since the company completed its own mega merger with Oil Search in late 2021, closing at $6.83 on Thursday, from about $6.46 when the deal completed.

Santos has been under more pressure from shareholders than Woodside, however, with activist investors including L1 Capital, Wilson Asset Management and Tribeca pushing the company to split its LNG and conventional gas business.

But the equation for Woodside is less clear. Santos holds quality assets in PNG. But its WA assets service the domestic market, and doubt remains over whether the company’s massive investment in coal seam gas in Queensland was worth the money spent.

Woodside – already under fire from climate activists – would also inherit some of Australia’s most contentious fossil fuel projects in any merger with Santos, including the company’s long stalled Barossa gas project that still faces significant court challenges.

Santos’ $3.5bn Narrabri gas project has also been beset by delays and challenges.

While Santos has said it would be willing to speed up development of the company’s long delayed Narrabri development to meet soaring demand, the development is unlikely to hit the market until later this decade.

Originally published as Woodside, Santos in $80bn merger talks