Women to wait until 2025 to see $14,500 super benefit

The government is making moves to address a billion dollar problem impacting Australians but there is still a delay.

A billion dollar problem that largely impacts Australian women is finally being addressed by the government, but they will continue to be financially punished for another year as they wait for the new measure to be introduced.

The Albanese government revealed in the Federal Budget that it will pay superannuation on government-funded parental leave from July 2025.

Yet it’s an issue that has cost Australian women for over a decade with an estimated $2.8 billion in super savings lost since the Commonwealth paid parental leave was introduced in 2011, according to figures from super fund Hesta.

It’s also an issue that news.com.au campaigned on before the federal election in May 2022 – calling on the party elected to introduce the measure to address the gender imbalance.

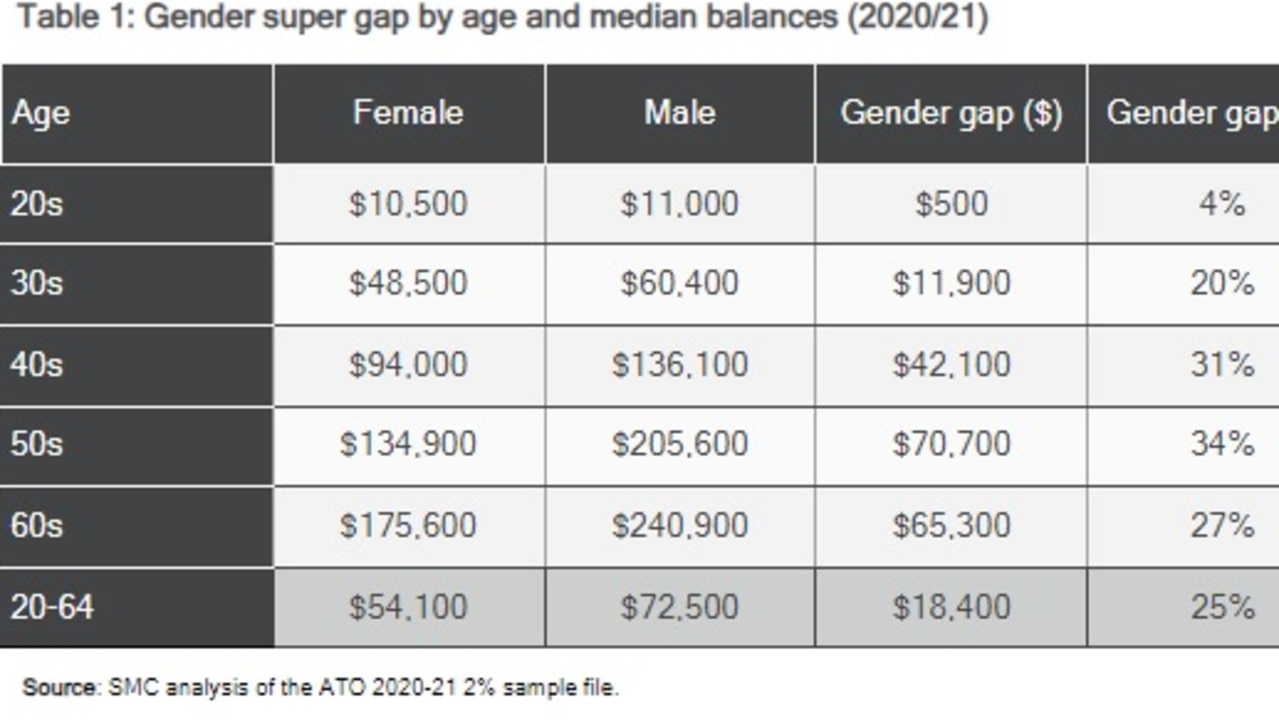

The reality is that women retire with a median superannuation balance of $146,900, compared to men who walk away with $204,107 at retirement when aged 60 to 64 years, data from KPMG found.

The measure will add an extra $5100 into the super balance of a mum according to the Association of Superannuation Funds of Australia (AFSA), while Hesta calculates an extra $7000 per child would be added at the time of retirement.

The funding for paying super on paid parental leave – which would cost $1.1 billion over four years – was “long-awaited”, said Hesta CEO Debby Blakey.

“This is a great investment in the financial future of women across Australia that will narrow the gender super gap, all the while sending a clear message that unpaid caring work is valued,” she said.

For a woman who received paid parental leave at age 28 for a first child and at age 30 for a second child, the increase in superannuation balance would be at least $10,700 in today’s dollars, ASFA’s research showed.

“Future generations of Australian women stand to add thousands to their super balances thanks to this change in policy. This is a crucial and long-overdue step in improving their financial security in retirement,” said ASFA CEO Mary Delahunty.

Around 180,000 Australian families will benefit from the new policy each year, with super on paid parental leave boosting the savings of a mother-of-two by about $14,500 by retirement, said Super Members Council CEO Misha Schubert.

“The historic announcement to pay super on parental leave takes Australia another major stride closer to ending the financial motherhood penalty many women face when they have children,” she said.

“It’s a watershed reform that will powerfully strengthen retirement savings for Australian mums and help to narrow the gender gap at retirement.”

The anticipated pay rises for the highly feminised early childhood education and aged care

workforces are also key changes to help close the retirement savings gap for Australian women, she added.

“These are big steps on the road to gender equity – and the Government has signalled it intends to continue that work. Australia cannot rest until all women have a financially secure retirement.”

Super Consumers Australia director Xavier O’Halloran also welcomed the government’s move.

“This is a positive step in addressing the gender inequality in super balances. The gender pay gap, alongside the disproportionate caring responsibilities women carry, means they often retire earlier and with less,” he said.

“This measure will go some way to addressing this inequality.”

But Ms Blakey said tax changes brought into focus the need for the more equitable targeting of superannuation tax concessions to help boost retirement savings for women and lower-income earners.

She explained that increasing the maximum income eligibility for the Low-Income Super Tax Offset (LISTO) from $37,000 per annum and aligning the offset with the super guarantee was a non-inflationary measure that would help make a difference to the retirement savings of women and low-income earners.

“It’s unfair low-income earners, many of whom are women, continue to pay more tax on their super contributions than their wages. That’s why we want to see the LISTO updated to reflect current tax and super settings,” she added.

Originally published as Women to wait until 2025 to see $14,500 super benefit