Why investing in Bitcoin is like taking a gamble

IF YOU invested $1000 in Bitcoin seven years ago, you’d be a multi-millionaire today. But before you rush out to buy shares, Barefoot Investor has this sobering advice.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

QUESTION: if you’d bought $1000 worth of Bitcoin in July 2010, how much would it be worth today?

(a) $1,430

(b) $143,000

(c) $1,430,000

(d) $14,300,000

(e) $143,000,000

The answer? ... ‘(e)’

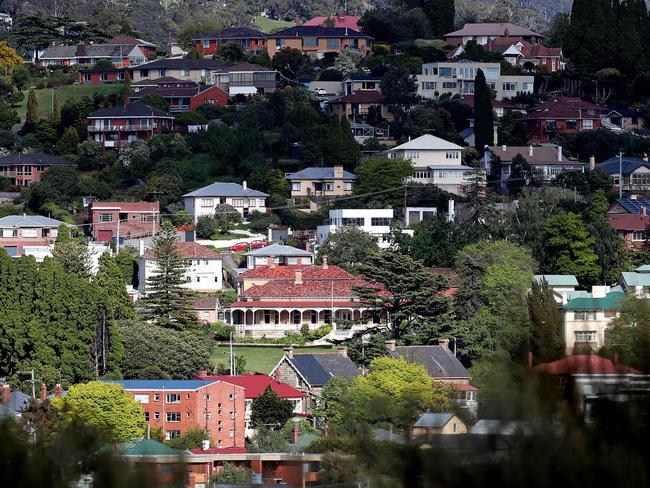

Yep, $143 million (that’s nearly enough money to buy a decent three-bedder in Toorak).

Staggering figures, but true — it was trading at 6 cents a share back then, and now it’s $8580 … oh hang on, in the time I’ve driven home, read the kids a story, put them to bed (twice) and come back to my computer, a Bitcoin is worth $9051!

That means our $1000 is now worth $150.8 million.

In other words, we’ve made $7 million bucks while I was frigging around reading Bob the Builder. (“Can we build it?” — Bob, with seven million large, “yes we can!” … just not in Toorak).

MORE BAREFOOT:

HOW TO SAVE YOUR ASSETS IN A HOUSE FIRE

DUMP THE BUMP WHEN SAVING FOR KIDS

CHILDREN LOSE OUT WHEN BANKS WIN

WOULD YOU LET AMAZON INTO YOUR HOME?

Now, let’s be honest, you wouldn’t be a dinki-di, red-blooded, chop-eating Aussie if my little quiz didn’t get your … err … bitcoins going, right?

After all, we’re the biggest punters on the planet.

The Economist magazine says:

“Australia is the most lucrative gambling market in the world: according to H2 Gambling Capital (H2G), a consultancy, betting losses per resident adult in Australia amounted to $990 last year … some 40% higher than Singapore, the runner-up, and around double the average in other Western countries.”

And that’s why there are plenty of stock-jockeys trying to get you to ‘invest’. Case in point, here are a few headlines from investment newsletters talking up ‘cryptocurrencies’ (like Bitcoin):

“$642,245 for every $10,000 invested?”

“This could turn $500 into $42k.”

“A potential 629% gain if you buy on tomorrow’s opening.”

(Note the artful disclaimers in each headline: the question mark, ‘could’, and ‘potential’).

Fair dinkum, these claims would make Tom Waterhouse blush.

Don’t get me wrong — at this time of the year I love a day at the races. (In fact, a few years ago I scored a selfie with Brynne in the Birdcage, while her old man stood off to the side giving me the stink eye.) But at the racetrack, everyone knows it’s a punt.

Bottom line? Don’t confuse cryptocurrencies with investing — they, too, are just a punt.

Tread Your Own Path!

CAN I TRUST MY PARENTS-IN-LAW?

ABBIE ASKS:

My parents-in-law (both in their 60s and retired) have put a proposition to my boyfriend, and I am very uncomfortable about it. He is in serious debt, with credit cards and personal loans. In two months they will lose their cheap rental home (they’re renting from a friend, who is now selling the place).

So they want my boyfriend to buy a home in his name for them to live in. They say they will pay him $5000 a month and cover all other costs. For income they have four pensions — two for themselves and two ‘carer payments’ they receive for having two people in their 80s living with them. They say it will not cost him a cent, so he can pay his debts and, when they all die, he will have a house. They all think it’s an amazing idea, but alarm bells are ringing for me!

BAREFOOT REPLIES:

Ding! Ding! Ding!

I’m hearing the same alarm bells!

I could be wrong, but it sounds like your parents-in-law have been moved on from mooching off their mate … so they’re looking around for their next meal ticket, which just happens to be your boyfriend.

Make no mistake, they’re looking out for themselves — not for their son.

So, at the risk of being the party-pooper, let me poop all over this plan:

First, retired pensioners can’t underwrite a mortgage — especially when part of their income is supplemented by carer payments which may go to God at any stage.

Second, it sounds like your boyfriend would have trouble qualifying for a mortgage, given you say he is in ‘serious debt, with credit cards and personal loans’. And even if he can score a loan, it doesn’t mean he should.

What could end up happening is your deeply-in-debt boyfriend becomes your deeply-in-debt husband, and you both end up on the hook providing a home for his deeply dependent parents for the next 30 years.

Ding ... Dong … don’t do it.

RIPPING OFF A PENSIONER?

CHANTELLE ASKS:

My mother received around $300,000 as an inheritance. Being financially illiterate (after a lifetime of illness and living on disability pension), she went to a NAB financial planner, who put her money into a superannuation account with MLC. The good part is she is still eligible for her Disability Pension. The bad part is that NAB charges around $2500 per year for their ‘advice’, and MLC charges around $3000. Is it a rip-off?

BAREFOOT REPLIES:

There is no way anyone on a disability support pension should be paying $2500 a year ongoing for advice. (Besides, if your mum is under the Age Pension age, whatever she has in super is exempt from the asset test). What she should do is go and see a free Centrelink Financial Information Services Officer (FISO), who will help her maximise her pension — for free.

As far as the cost of her super goes, it’s about average: over the next decade, she’ll end up paying over $50,000 in fees. (If people paid their super investment bill the same way they do their quarterly power bill, it’d be a bloody outrage, but it’s all out of sight, out of mind.) If she can ‘fight the power’, I’d suggest she switch to an ultra-low-cost industry fund.

MILLION D OLLAR PAYDAY

MAX ASKS:

I am 24 years old and I earn $40,000 a year working part time. Today I received a lump sum of $1,000,000 (after costs) due to being run over by a car seven years ago. I need to pay around $5000 a year in ongoing medical costs. How should I invest this money, and is it worth setting up a trust and a ‘bucket company’ that reinvests in itself?

BAREFOOT REPLIES:

First up, you won’t have to pay tax on the payout itself, but you will pay tax on any investment earnings you earn on it. Now, would I invest the money in a trust and then distribute the investment income to a company?

Possibly. The trust will give you asset protection benefits, and the company acts as a ‘bucket’ to theoretically cap your tax rate at the company tax rate of 30 per cent. But know this: it’ll also gobble up a few thousand dollars a year in fees to your accountant.

However, let’s not put the cart before the horse.

If I were in your shoes, I’d keep it simple:

I’d buy a nice little unit for cash (say $500,000).

I’d put $15,000 into Mojo (high-interest online saver account).

I’d put $25,000 into term deposits with different maturities to cover any medical costs within the next five years.

I’d also kick $25,000 into your super.

Then I’d invest the rest ($435,000 or thereabouts) into good-quality Aussie shares (either via a trust, or in your own name), tick the ‘Dividend Reinvestment Plan’ option (so your dividend earnings are automatically reinvested rather into more shares), and let your money compound.

10 YEARS WITHOUT MONEY

DOUG ASKS:

Ten years I have been a monk and therefore ten years without money. Now, at age 52, I am leaving the monastic life and coming back into the regular world. (Scott, I notice you are a bit older, wiser and chubbier than when I last saw you on TV all those years ago.) I am earning $52,000 a year but have no assets or savings. I am not sure I will ever have the chance to buy a home, but I would really welcome your advice on how to build up some wealth. The world has changed a lot, I see.

BAREFOOT REPLIES:

My wife calls me her ‘Barefoot Buddha’ (mental note, when your wife and your work are commenting on your chubbiness, it’s time to hit the gym).

Anyway, you’ve got a couple of good things going for you:

First, you don’t have a wife, or children, so you can focus 100 per cent on yourself.

Second, you’ve spent the last decade without an iPhone, a butler’s pantry, or KFC. In other words, you’ve broken the chains of materialism!

Having said that, you still need financial security, so your priority should be to increase your income so you can sock away three months of living expenses in a Mojo account.

And the house? Well, if you’re willing to move to a rural area, you could eventually afford a cheap home, too.

(They’re cheap in Manangatang, and if you can stick it out in monastery, you’ll be a shoo-in for Manangatang.)

Remember, you’ve got at least 20 years of full-time work ahead of you. Repeated studies have shown that, once you earn over $75,000 a year, money doesn’t make you any happier. But you’re only earning $52,000, so you have $23,000 worth of happiness to gain

The Barefoot Investor holds an Australian Financial Services Licence (302081).

This is general advice only. It should not replace individual, independent, personal financial advice

Originally published as Why investing in Bitcoin is like taking a gamble