Wealthy Australians bringing home money amid US volatility will look to property instead of shares and gold

Trump-based hazards have caused a number of Australia’s wealthiest families to bring their money back home, which could have some flow-on effects to areas like property.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The sharp fall in the NASDAQ index during the lead-up to Easter ushered in a sudden realisation in global markets that the challenges US and world enterprises face go deeper than normal trade fluctuations.

And those Trump-based hazards have caused a number of Australia’s most wealthy families to bring their money back home, which is contributing to the rise in the Australian dollar.

Longer term the biggest challenge to the NASDAQ, and therefore US momentum, is that its high-growth Silicon Valley based leaders face an unprecedented technology challenge from China.

I set out the potential world-changing battle looming between photon and silicon technology earlier this week under the heading “Silicon Valley faces wrath from China”.

And that challenge from Chinese technology could gain momentum because of China’s dominance in global trade and the much lower energy requirement of its photon technology.

Adding to the technology sector’s concerns, Federal Reserve chair Jerome Powell said President Donald Trump’s tariffs could pose a challenge for the central bank because levies could drive up inflation in the near-term and are “likely to move us further away from our goals”.

In other words, just because the US bond market is forecasting lower interest rates does not lock in lower official Federal Reserve rates. Trump was elected on a mandate to exchange income and other taxes for tariffs, and a reduction in government spending.

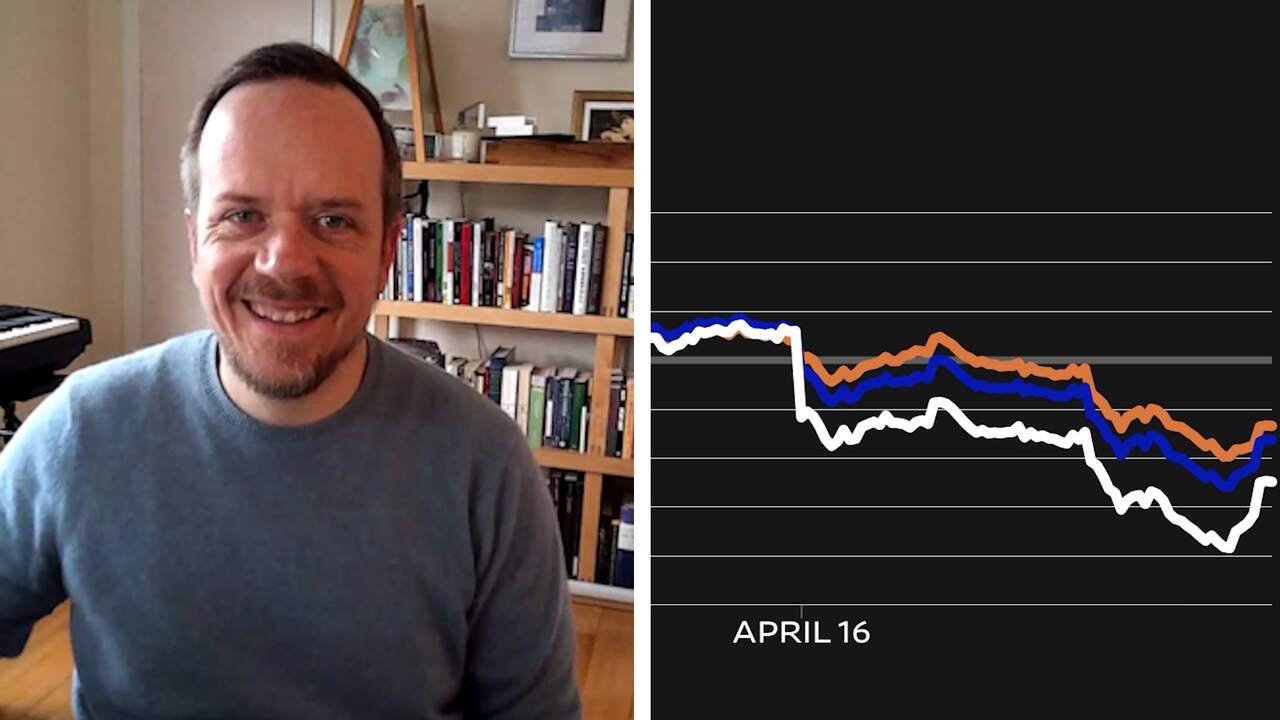

Along with Powell, the markets were not prepared for a massive exercise in tariff-based bluff games with uncertain outcomes. Whereas some Australians are bringing their money back home, around the world safe-haven money is moving to gold, which on April 16 jumped about 3 per cent as the NASDAQ fell by a similar amount.

Given the demand problems in China, one would normally have expected the Australian dollar to be put under pressure. But traditionally it is linked to the gold price, so that helps the currency, along with the “coming back home” movement.

Bitcoin will get some of the safe-haven money, but its support comes partly from the technology-oriented sector, whereas the rise in the price of gold is coming from the traditional investors who feel safer in gold than Bitcoin.

Their gold buying is the global equivalent of the Australian families who feel it’s time to bring their money home.

From what I can tell, the money coming back to Australia is not racing into the local sharemarket because the dramatic gyrations on Wall Street have been duplicated in the Australian market.

These gyrations are causing a nervousness about basing long-term wealth on the sharemarket.

Shares have always fluctuated, but the markets are now being dominated by short-term traders who gain their rewards by outperforming the index and moving money around at a rapid rate.

Investors who go for the long term are seeing the savings base moving dramatically up and down, and it causes nervousness.

Global and Australian institutions that are investing the savings of ordinary citizens need to be able to invest in successful businesses.

Accordingly, the sharemarket swings are increasing investment in non-listed equities which carry the challenges of valuation and liquidity.

The nervousness in the sharemarket will also help government and corporate bond markets, but it has the potential to help the property sector in areas where there is long-term demand that justifies building new developments or renovating existing property.

In the residential sector, outside the government-subsidised residential rental market, the only area that can be economically developed into major projects is larger units for people who want to downsize in relative luxury.

But there are also areas in the commercial sector.

What Trump is trying to do has been well documented, but the means by which he is embarking on the journey to boost the trading position of the US is having repercussions that he likely did not envisage.

Meanwhile, the silicon-based technology companies on NASDAQ need to concentrate on their technology base and the developments they can engineer rather than giving their attention to Trump’s next move.

Originally published as Wealthy Australians bringing home money amid US volatility will look to property instead of shares and gold