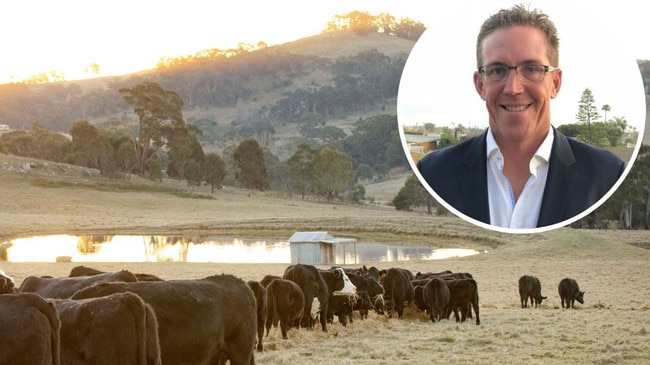

WealthCheck’s agricultural land dealmaker Sam Mitchell bites dust after ATO intervention

The Bondi-based high-flyer behind $500m of agricultural deals – Sam Mitchell from WealthCheck – has crash landed after his main companies were put into liquidation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The man behind more than $500m of agricultural deals who boasts having blue ribbon farming connections, a former job at Harvard University and a private plane – Sam Mitchell from WealthCheck – has crash landed after his main companies were put into liquidation.

Bondi-based Mr Mitchell said he had “no” comment about his WealthCheck and The Edge firms being placed in the hands of duelling receivers after banks and the Tax Office called in outstanding loans.

In the past few years the Sydneysider has either announced or closed on more than $500m worth of transactions with big names including Brett Blundy, Harold Mitchell and Eddie Listorti. Wealthy cattle barons, citrus and avocado farmers, carbon advisers, truckers and self-employed cattle counters are among those alleged to be owed money by companies associated with Mr Mitchell.

Carbon Neutral chief executive Philip Ireland said his firm had been “contracted to provide services to entities that Mr Mitchell was associated with and we are yet to be paid in full”.

It is understood issues with Mr Mitchell have been raised with the corporate regulator, but sources could not indicate the status of investigations by the Australian Securities and Investments Commission.

The final blow to Mr Mitchell came after the Tax Office hit WealthCheck with a $4m demand, moving to wind up the company on Tuesday, after liquidators moved in on other arms of his operations. Court records show the ATO served WealthCheck with its demands in February at Mr Mitchell’s luxury North Bondi apartment.

This came after WealthCheck failed to make repeated business activity statement payments to the ATO as well as superannuation payments.

The matter will go to court on June 14.

The ATO is also seeking to wind his businesses because he owes millions in unpaid super, suppliers’ fees and wages.

“We’ve been waiting for this day to come,” said a husband and wife couple that previously worked for Mr Mitchell and struggled to be paid either wages or superannuation.

The biggest bank exposure to Mr Mitchell’s companies appears to be Rabobank, with private credit provider ADM Capital the firm that called in the administrators.

According to allegations from a number of farmers and private fund operators – who would not be named for this article because they are seeking to recover funds from Mr Mitchell – his methods appear to be similar for most transactions.

Mr Mitchell has referenced working for the Harvard Endowment Foundation, boasted of impeccable farming connections, and in some cases has been working directly with the well known agricultural real estate agent Danny Thomas from LAWD.

The two were co-directors of a company called Mitchell River Cattle Company that was involved in the purchase of the Maryfield and Limbunya stations in the Northern Territory – through WealthCheck – for $38.2m and $65.2m from Colin Ross’s North Star Pastoral.

Mr Mitchell has subsequently listed the 521,883ha Limbunya Station and the 147,300ha Maryfield Station for sale through Mr Thomas with new carbon projects attached to the properties, expected to generate a combined 10.4 million Australian Carbon Credit Units (ACCUs) during a 25-year crediting period, with a 100-year permanency period. Several carbon projects have been registered by companies associated with Mr Mitchell, offering regeneration of native forests across swathes of inland Northern Territory.

But many local landowners dispute the likelihood of the properties being about to generate that much in carbon credits, a view shared by industry figures who expressed scepticism that many of the properties purchased by Mr Mitchell would perform.

“No one’s generating ACCUs for at least 24 months while this thing burns its head off with interest,” one source said.

One cattle property owner, who would not be named but is owed what he alleges to be millions of dollars by companies associated with Mr Mitchell said he was approached to sell his NT station even though it was not on the market by Mr Thomas, who is considered the best known agent in multimillion-dollar properties.

Research by The Australian shows that companies controlled by Mr Mitchell have purchased at least 21 properties in recent years.

Some, such as Ceres Sustainable Avocados, have subsequently been placed in the hands of administrators.

In other situations, such as the Conway Station, which he purchased in a joint venture for $14.5m and Benmara Station which he purchased for $40m last year in a joint venture with Hartree, indirectly owned by Brookfield, his joint venture partners have had to take action against Mr Mitchell and take full control of the properties themselves.

In those instances, it’s understood that Mr Mitchell has pitched to his co-investors that he will find the land – usually with the help of Mr Thomas – and that he will run the property, find tenants and in many instances build out carbon storage opportunities.

In 2022 retail billionaire Brett Blundy sold his massive cattle property Walhallow to Mr Mitchell’s WealthCheck for $250m – the biggest ever deal in agriculture at the time – but the deal fell over, with Mr Blundy saying it was “disappointing” that WealthCheck “couldn’t perform.”

The circa $50m sale of Moroak and Goondooloo stations, also in the Northern Territory, also fell through last year after WealthCheck strung the family owners of the properties out over 12 months and got them to change the carbon project they already had running to better suit his needs and then failed to pay a cent. In that time live cattle prices halved.

More Coverage

Originally published as WealthCheck’s agricultural land dealmaker Sam Mitchell bites dust after ATO intervention