There’s a lot to be optimistic about in 2025: Citi Australia

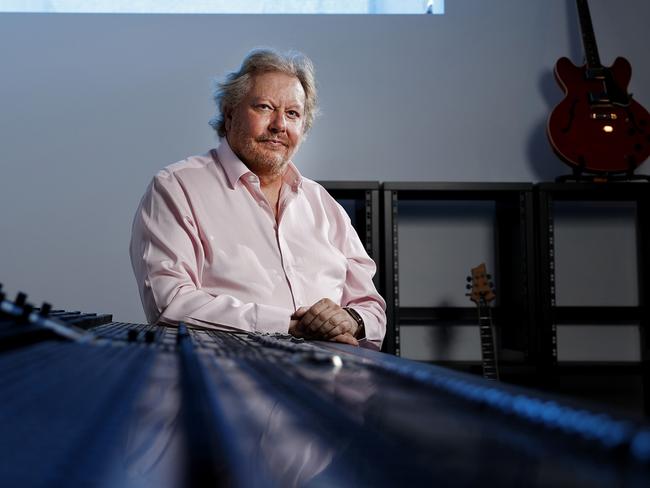

Mark Woodruff, the local boss of US banking giant Citi, says market conditions are turning positive for the coming year.

Mark Woodruff, the local boss of US banking giant Citi, says market conditions are turning positive for the coming year.

The board of pandemic market darling VIP Gloves has laid out a plan to resurrect the company, which crashed from huge profits to huge losses in a short period.

Guests have flocked to the inaugural 2024 Melbourne Local Business Gala Awards, held by Precedent Productions, at The Langham this week. See the winners of each category.

An underperforming cloud services provider one third-owned by NextDC has found itself the target of competing takeover bids.

The billionaire founder of WiseTech Global, Richard White, has the backing of his board but there are active discussions about the chief executive taking leave from the tech major.

Richard Dammery will talk to large investors and proxy advisers next week, following recent revelations about the private life of WiseTech founder Richard White.

SkyCity will be on the hook for as much as $38.4m after losing a dispute with the South Australian government over the taxation of loyalty points.

The New York giant was dabbling with some sheds with ‘some power on the side’ but two lessons paved the way for its bumper acquisition.

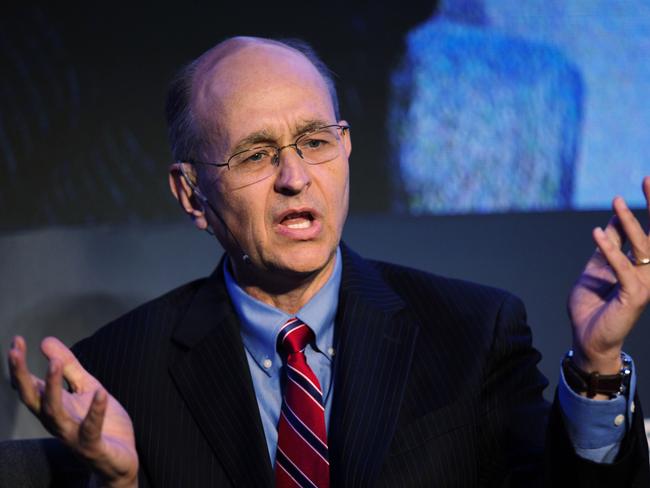

For Citi’s New York-based global economist, Nathan Sheets, the difference between a recovery and global recession are finely balanced.

A top Reserve Bank official gives a strong indication the central bank could be preparing the way for an interest rate cut.

Late payments by businesses are at their highest level since the depths of Covid-19, and it’s the hospitality and construction sectors faring worst.

Hundreds of millions of dollars on the books of one of GFG Alliance’s Australian subsidiaries could be sheeted home to prop up the ailing parent company, which owes $950m to creditors.

Investment bank Macquarie wants to build another AirTrunk, and the infrastructure supporting the tech revolution sits at the heart of its plans.

The former hardware boss believes Lendlease can get its glory back. This involves ‘the right kind’ of risk.

Original URL: https://www.dailytelegraph.com.au/business/victoria-business/page/24