UBS survey says consumers ready to ramp up spending

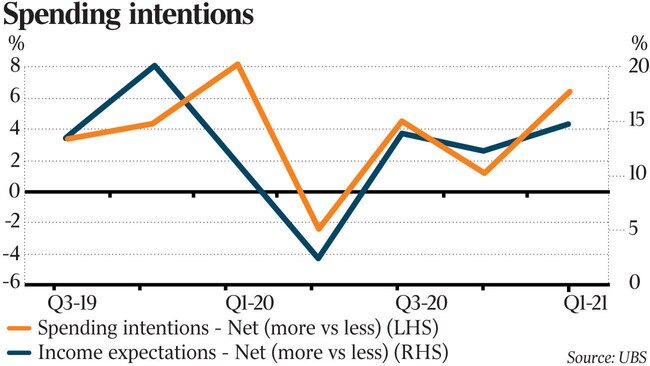

Spending intentions are strong ahead of JobKeeper coming to an end, in particular among high-income earners, according to survey by UBS.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Spending intentions are strong ahead of JobKeeper coming to an end, in particular among high-income earners who expect to “significantly increase” their spending in the coming year, according to UBS.

JobKeeper recipients also expect a rebound in their income once the subsidy is pulled, suggesting a positive employment outlook, the investment bank found in its latest consumer survey.

While nearly half of those on JobKeeper said they owned a property, the majority — 88 per cent — are looking to sell, with 68 per cent hoping to sell within the next 12 months, the survey found.

Despite this, the outlook for the property market remains high, with 38 per cent of those surveyed on the hunt for a new home.

“The COVID impact on employment is fading with the net share of consumers expecting a reduction in their working hours and wages due to COVID falling in the first quarter,” UBS said.

“Concerns about job losses held steady, despite JobKeeper ending (in late) March.”

The government support, which has cushioned those worst affected by the COVID pandemic and economic shutdowns, will be cut off on March 28.

Close to 4 million people received JobKeeper at some point over the past year, with this figure dropping to 960,000 by the end of January, ahead of the survey.

“A continuation in strong spending intentions and household financial outlook is supportive for all discretionary retail estimates this half,” UBS said in a note to clients.

“In particular, results are positive for apparel (Premier Investments) and hardware. We prefer Adairs (strong housing) and Super Retail (lagged, despite strong earnings per share revisions).”

Handing down its half-year result on Wednesday, Premier posted an 89 per cent jump in earnings to $188.2m, on a 72 per cent increase in sales to $784.6m.

Online sales stood at 20 per cent of the group total and in the first seven weeks of the year like-for-like sales were up 32 per cent.

The retailer received close to $20m in JobKeeper payments.

While the outlook is positive for discretionary retail and housing, it is negative for new car purchases, UBS found.

Car purchasing intentions fell from 39 per cent to 32 per cent, driven by a 6 per cent drop in new car demand

This suggests “the COVID-related tailwinds for autos could be fading”, the broker warned.

UBS still likes cyclicals over defensives amid the improving economic signposts.

Amid the companies UBS likes are Nine, Seven West Media, Premier Investments, Transurban and Qantas. On the negative side, the fall in new car purchase intentions is negative for auto names such as Eagers Automotive and AutoSports Group, it cautioned.

Originally published as UBS survey says consumers ready to ramp up spending