The 10 Australian billionaires to watch in 2023

Australia’s rich lost a lot of money in 2022 and it could get worse for some billionaires this year, but others could buck the trend. Here are the ones with the most at stake.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The rich might be getting poorer as markets fall around the world, but our wealthy elite will still have a strong influence over what happens in Australian business this year. Billionaires are at the helm of the country’s biggest miners, property firms, retail behemoths and technology giants and dominate the top ranks of The List – Australia’s Richest 250.

Many have steered their companies through downturns before, from the credit crunch of the 1970s through to the Global Financial Crisis of 2008, and then the recent Covid-19 pandemic.

But as profits fall and interest rates rise, their ability to chart troubled waters will be tested. It is a big year for many of them, who could either see long-term strategies continue to pay off or hundreds of millions of dollars wiped from their fortunes.

Here are the billionaires to watch in Australia in 2023.

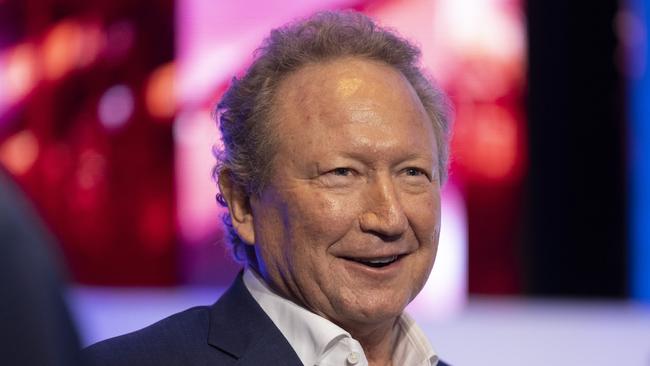

ANDREW FORREST

This is the year that the iron ore magnate needs to start delivering on his green energy dream. Forrest has been outspoken for the best part of two years now about his Fortescue Future Industries, the subsidiary of Fortescue Metals Group that he wants to turn into one of the world’s biggest energy producers. FFI plans to spend billions on turning green hydrogen into a major commodity, and after hearing Forrest’s big promises, Fortescue shareholders will want to see some tangible evidence of FFI’s progress.

Forrest, who has moved back into an executive chairman role, will also need for the leadership merry-go-round at Fortescue and its subsidiary – which has been marked by several executive arrivals and departures – to slow down.

MELANIE PERKINS and CLIFF OBRECHT

Now is the time when venture capital firms such as Square Peg Capital and Blackbird are deciding whether another re-rating on start-up darling Canva is needed. The online graphics business started and headed by Perkins and Obrecht has been a huge success, but was caught up in the technology downturn of 2022, with shareholders Square Peg and Blackbird slashing their valuation of Canva by 36 per cent in their June 30 portfolios. Another valuation is due for the six months to December, meaning it won’t be long until it emerges if Canva, worth a record-breaking $US40bn in 2021, has its valuation cut again.

SCOTT FARQUHAR and MIKE

CANNON-BROOKES

The Atlassian co-founders have plenty of money to splash given their gradual selldown of small portions of stock in their NASDAQ-listed software firm.

That has bought Cannon-Brookes influence over AGL’s energy transition via his major shareholding, and Farquhar has also contemplated a tilt at Genex Power before pulling his bid in late December.

While the pair pursue their renewable energy strategies, they are also buying plenty of Sydney property. Farqhuar is shelling out a record $130m for a Point Piper mansion, and between them the pair have more than $500m invested in Sydney housing.

It is all happening as Atlassian’s share price has slid more than 60 per cent in a year, amid the end of the tech boom. Arresting that decline will be the biggest, if least glamorous, job for Cannon-Brookes and Farquhar this year.

JUSTIN HEMMES

Pubs have been the hottest play in property and Hemmes has been at the forefront of the boom in recent years, rapidly expanding his Merivale hospitality empire across Sydney and NSW.

Next comes a foray down into Victoria, where food-savvy locals will test Hemmes’ first venue in the state, Totti’s, in beachside Lorne later this summer.

Later in the year there will likely be a Cantonese-themed restaurant in a Melbourne laneway. They are big moves for Hemmes, whose signature upscale dining locations could be tested during an economic slowdown.

WILL VICARS

It was a horror year for Vicars in 2022, who will be hoping the big bets his Caledonia investment house has taken on global stocks bounce back this year. Caledonia had a huge 2021, making massive profits for Vicars, the Nelson family and other co-investors such as Gretel Packer. But Caledonia crashed last year, with its flagship fund ending down more than 50 per cent.

There has been better news of late for some of its portfolio, with global wagering giant Flutter (the owner of Sportsbet in Australia) rising in the past six months.

The jury is still out on the home delivery sector, though, which Caledonia has exposure to via stocks such as Just Eats. Its most recent play is German caravan maker Knaus Tabbert, which is up more than 30 per cent since Caledonia emerged with a 5 per cent stake in October.

JAMES PACKER

He has one of the most famous names in Australian business and though he is mostly out of the spotlight these days, what Packer does next will be intriguing.

Packer received about $3.3bn from the sale of his Crown Resorts shares when the casino group was privatised by Blackstone last year, and has since formed an investment committee at his private Consolidated Press Holdings to invest his fortune.

Magellan Financial Group co-founder Hamish Douglass sits on the committee alongside longstanding CPH executive Guy Jalland and technology entrepreneur Daniel Nadler. Packer already has several technology-themed investments, which could be a hint of what he next puts his money into.

HARRY TRIGUBOFF

If there is someone who can defy the doom and gloom pronunciations for the property sector, it is most likely Triguboff. Though he is turning 90 in March, the Meriton owner shows little signs of slowing down. Meriton has vast reach across property, including the nation’s biggest number of hotel rooms via its serviced apartment business, more than 14,000 investment apartments and close to 12,000 units in development. It means that Meriton is exposed to a slowdown in apartment sales, which is happening as Triguboff gets increasingly frustrated with the slow pace of government approvals for his projects in Sydney.

He is building more in Queensland and Melbourne, and expanding his serviced apartment business as consumer travel increases. Meriton made a $450m pre-tax profit last year, and spreading his risk across many facets of the property industry means Triguboff is a good chance of matching it in 2023.

CHRIS ELLISON

Perth’s latest iron ore billionaire has a lot going on at his Mineral Resources.

There are questions as to whether he will spin out and float the company’s lithium assets in Western Australia, as well as a takeover tilt Ellison has launched for Perth Basin gas play Norwest. MinRes wants to use its growing position in the WA gas industry to power its mines and equipment, and has also flagged using the gas from the Lockyer Deep project in the Perth Basin to move into downstream manufacturing of fertilisers such as urea and ammonia rather than sell surplus gas into overseas markets.

MORRY FRAID and

ZAC FRIED

One of the quietest, yet biggest, success stories in Australian business celebrates its 50th anniversary later this year. Fraid and Fried’s Spotlight haberdashery chain should hold up in what looms as a general retail slowdown amid an uncertain economy, given a customer’s average spend is less than $100 per store visit.

But a property slowdown will hit sales of items like bed linen and curtains, which do well when home renovations are happening or residential subdivisions get built. The Spotlight owners also have $2bn worth of property on their books and are rolling out plans for mixed-use projects that include apartments, hotels and office space across the eastern seaboard.

JACK GANCE and MARIO VERROCCHI

It would be the biggest ASX float for close to a decade should Gance and Verrocchi’s plans to take Chemist Warehouse public get dusted off later this year. It will take a turnaround in market sentiment for initial public offerings, as well as a restructure of the corporate entity underpinning the retail giant, for it to happen, but it would be big news. Gance and Verrocchi have built a business powerhouse, which could be worth more than $5bn as a listed entity.

Originally published as The 10 Australian billionaires to watch in 2023